Boston Dynamics is a global leader in developing highly mobile robots. It has developed three dynamically stable, legged robots (Spot, Stretch, and Atlas) that can perform a variety of tasks. It has deployed thousands of its robots in commercial and academic settings, giving it more real-world experience than any other robot developer.

The company is still in the early stages of developing deployable robots that can help companies automate more tasks. It has tremendous growth potential as robots become more mainstream.

Boston Dynamics' growth potential likely has many people wondering how they can invest in its stock if it completes an initial public offering (IPO). This guide will show you how to invest in Boston Dynamics and other robotics stocks.

Stock

Publicly traded?

Is Boston Dynamics publicly traded?

Boston Dynamics wasn't a publicly traded company in early 2024. It was a private company majority-owned by Hyundai (HYMTF 3.97%). The South Korean automaker acquired an 80% controlling interest in Boston Dynamics from Softbank in 2021. The deal valued the robotics company at $1.1 billion. Softbank retained the remaining 20% in Boston Dynamics.

When will it IPO?

When will Boston Dynamics IPO?

Boston Dynamics didn't have an IPO on the calendar in early 2024. And the company likely won't go public anytime soon. Hyundai acquired a controlling stake in the robotics company in 2021 to advance its robotics strategy.

The South Korean automaker saw the acquisition as an opportunity to establish a leading presence in the robotics industry and continue its transformation into a smart mobility solutions provider. Given the strategic importance of Boston Dynamics to Hyundai, it likely won't complete an IPO of the majority-owned entity anytime soon.

IPO

How to buy

How to buy Boston Dynamics stock

Although Boston Dynamics isn't a publicly traded company, you can still invest in the robotics developer through Hyundai. In addition, you can consider investing in one of its publicly traded competitors while you watch for its IPO. This four-step guide will show you how to add Hyundai to your portfolio (or one of Boston Dynamics' competitors in the robotics industry).

Step 1: Open a brokerage account

You'll have to open and fund a brokerage account before buying shares of any company. If you need to open one, here are some of the best-rated brokers and trading platforms. Take your time researching the brokers to find the best one for you.

Step 2: Figure out your budget

Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to figure out how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years.

You don't have to get there on the first day, though. For example, if you have $1,000 available to start investing, you might want to begin by allocating that money equally across at least 10 stocks and then grow from there.

Step 3: Do your research

It's essential to thoroughly research a company before buying its shares. You should learn about its competitors, review its balance sheet, find out how it makes money, and consider other factors to make sure you have a solid grasp on whether the company can grow value for its shareholders over the long term.

An integral part of investment research is looking at a company's competitors. Here are three publicly traded robotics stocks that investors should also research before investing in Hyundai's stock (or Boston Dynamics' IPO).

Intuitive Surgical

Intuitive Surgical (ISRG -0.28%) pioneered robotic-assisted, minimally invasive surgery. The medical technology company develops and manufactures the da Vinci surgical system. It won approval for its fifth-generation robotic system (da Vinci 5) in early 2024.

ABB

ABB (ABBN.Y 0.82%) is a large European industrial company that makes robots and robotic equipment. The company is a global leader in electrification and automation. Its robotics platform, ABB Robotics, is one of the world's leading robotics and machine automation suppliers.

iRobot

iRobot (IRBT 8.03%) is a leading global consumer robot company. It created the first home cleaning robot (Roomba) in 2002 and has sold more than 50 million robots worldwide. Global e-commerce giant Amazon (AMZN 0.59%) tried to buy iRobot for $1.7 billion in 2022 to expand its robotics platform. However, Amazon terminated the deal in 2024 due to regulatory concerns about competition in the sector.

Step 4: Place an order

Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (HYMTF for Hyundai or ISRG for Intuitive Surgical, ABBNY for ABB, or IRBT for iRobot).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at market price.

Here's a screenshot of how to buy a stock with the five-star-rated platform Fidelity (which offers a video tutorial and a step-by-step guide):

Once you complete the order page, click to submit your trade and become a shareholder of Boston Dynamics' owner, Hyundai, or one of its competitors in the robotics sector.

Profitability

Is Boston Dynamics profitable?

It's vital to take the time to research a company's profitability before buying its stock. That's because profits tend to drive a stock's long-term performance. Given that dynamic, you'll want to see that the company is growing its income or on the road to making money.

As a private company, Boston Dynamics doesn't publicly report its profitability. However, its publicly traded majority owner, Hyundai, does report its profitability (although it doesn't break out the robotics company's results).

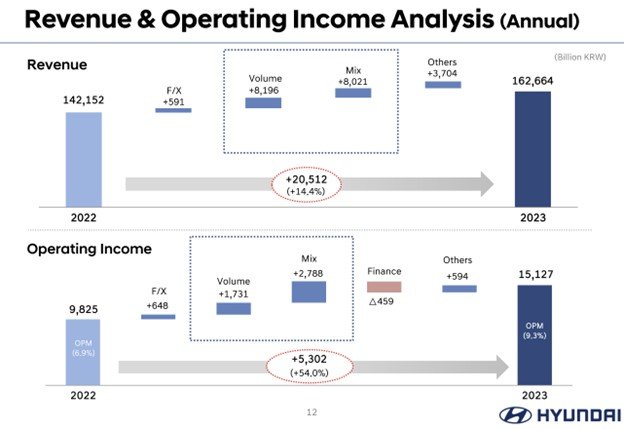

In 2023, the South Korean automaker was solidly profitable:

As that slide shows, the company's revenue rose 14.4% in 2023, while its operating income surged 54%. However, it makes most of its money from selling cars and providing financing.

Boston Dynamics is likely a minimal contributor to its revenue (the company only had a few hundred robots operating when Hyundai acquired its majority stake in 2021). The robotics company also likely isn't yet profitable due to its substantial investments in smart mobility solutions, like autonomous driving, artificial intelligence (AI), smart factories, and robots.

Should I invest?

Should I invest in Boston Dynamics?

While you can't invest in Boston Dynamics yet since it hasn't completed an IPO, you can invest in its majority owner, Hyundai. Here are some reasons you might want to invest in the South Korean automaker to gain exposure to Boston Dynamics:

- You want immediate exposure to Boston Dynamics while you await its potential future IPO.

- You like Hyundai's smart mobility solutions strategy and believe it will be a significant value creator for investors.

- You understand the risks of investing in Hyundai, including that most of its revenue comes from selling cars not robots.

- You believe Hyundai is a lower-risk way to invest in the robotics and AI trends than other pure-play robotics and automation companies.

On the other hand, here are some reasons you might opt against investing in Boston Dynamics through Hyundai:

- You want direct exposure to a robotics company.

- You're not sure Boston Dynamics will be a needle-moving investment for Hyundai stock.

- You'd rather not invest in companies headquartered outside the U.S.

- You already invest in another car stock.

ETF options

ETFs with exposure to Boston Dynamics

Many people would prefer to invest passively rather than pick a portfolio of stocks they need to actively manage. Anyone can be a passive investor with exchange-traded funds (ETFs). They enable you to gain passive exposure to a company, theme, or the broader market.

Although Boston Dynamics is a private company (and not held by ETFs), its parent, Hyundai, is a publicly traded company. Several ETFs own shares of Hyundai, including:

- iShares MSCI South Korea ETF (EWY 1.04%): The fund provides exposure to large and mid-sized companies headquartered in Korea. It held shares of 100 companies in early 2024, including Hyundai (fourth-largest holding, at 2.7% of the fund's assets). The ETF provided broad exposure to Korean companies for an ETF expense ratio of 0.59%.

Meanwhile, an alternative option is to invest in an ETF focused on the robotics sector. Notable robotics ETFs include:

- Global X Robotics & Artificial Intelligence ETF (BOTZ 0.79%): The ETF focuses on companies that stand to benefit from the growing adoption and utilization of robotics and AI. It held 43 stocks in early 2023, including Intuitive Surgical and ABB (its second- and third-largest holdings). The fund had a 0.68% expense ratio.

- ROBO Global Robotics & Automation Index ETF (ROBO 1.02%): The fund focuses on robotics, automation, and AI. It had 77 holdings in early 2024, including Intuitive Surgical (the second-largest). The ETF had a rather high expense ratio of 0.95%.

Related investing topics

The bottom line on Boston Dynamics

Boston Dynamics is an innovative robotics company. It has developed three robots that can help companies automate more tasks. While it's still very early in its development, many investors eagerly await its IPO.

However, they might have to be patient because Hyundai acquired a majority stake in the company to drive its smart mobility solutions strategy. As a result, investors might have to either invest in the automotive company or a competing robotics company since Boston Dynamics might never go public.

FAQ

Investing in Boston Dynamics FAQ

Can Boston Dynamics have stocks?

Boston Dynamics doesn't have its own stock. It's a private company owned by Hyundai (80%) and Softbank (20%), so you can't invest directly in its stock. However, you can buy shares of its majority owner, Hyundai. The South Korean automaker trades under the stock ticker HYMTF.

Can anyone buy a Boston Dynamics robot?

Boston Dynamics sells two of its robots commercially (Spot and Stretch) and has a third research and development robot (Atlas) that's not currently available for commercial sale. Its products are for the commercial, industrial, enterprise, and university research markets.

So, while anyone can buy a Boston Dynamics robot, they're intended for commercial use. They're also expensive (with Spot reportedly starting at around $75,000).

What is the stock symbol for Boston Dynamics?

Boston Dynamics doesn't have its own stock symbol because it's not a publicly traded company. However, its majority owner, Hyundai, is publicly traded. Its stock symbol is HYMTF.

Is Boston Dynamics going to IPO?

Boston Dynamics didn't have plans to complete an IPO in early 2024. It likely won't go public anytime soon. South Korean automaker Hyundai bought an 80% stake in the robotics company in 2021 to help drive its strategic transformation into a smart mobility solution provider. Because of its strategic importance to Hyundai, the automaker likely won't look to separate the entity through an IPO.