Boeing (BA 0.25%) stock has attracted many investors over the years. That’s not surprising, considering that the company plays a central role in the aerospace and defense industries. Airplanes, helicopters, missiles, rockets, satellites, spacecraft -- Boeing makes them all.

In this article, we’ll explain how to invest in Boeing. You’ll also learn what factors to consider to determine if Boeing is a good pick for your investment portfolio.

How to buy

How to buy Boeing stock

There are four key steps involved in buying a stock -- and they are as applicable to Boeing as they are to any other stock.

Step 1: Open a brokerage account

Before you can do anything else, you’ll need to open a brokerage account. Most brokerages these days support quick and easy online trading.

You’ll find that most brokerages offer similar services. There are a few factors, though, that could help you differentiate between the brokerages you consider, including:

- Commissions (some online brokerages have completely eliminated trading commissions)

- Ease of use of the brokerage’s platform

- Support for buying fractional shares of companies

- Other resources, including educational information

Step 2: Figure out your budget

If you haven’t already created a budget, doing so is an important next step. List all of your sources of income and all of your recurring expenses. This will help you determine how much money you can afford to invest.

Step 3: Do your research

It’s always important to research any stock you buy. That’s true even for well-known stocks such as Boeing.

For example, Boeing has four reportable business segments:

- Commercial airplanes

- Defense, space, and security

- Global services

- Boeing Capital

You’ll want to investigate how each of these segments is performing. Determine their competitive advantages and identify their potential challenges.

The management team of any company is also important, especially the top executive. David Calhoun has served as Boeing’s CEO since January 2020. Although his background isn’t focused on the aerospace and defense industries, Calhoun has been a member of Boeing’s board of directors since 2009 and was chairman prior to taking the helm as CEO.

No matter how great a business might be, you’ll also need to check out the valuation of the stock before buying. Look at Boeing’s forward price-to-earnings ratio compared to its historical levels and to the forward earnings multiples of its rivals. The price you pay upfront is usually a major determinant of how big your investment returns will be.

Step 4: Place an order

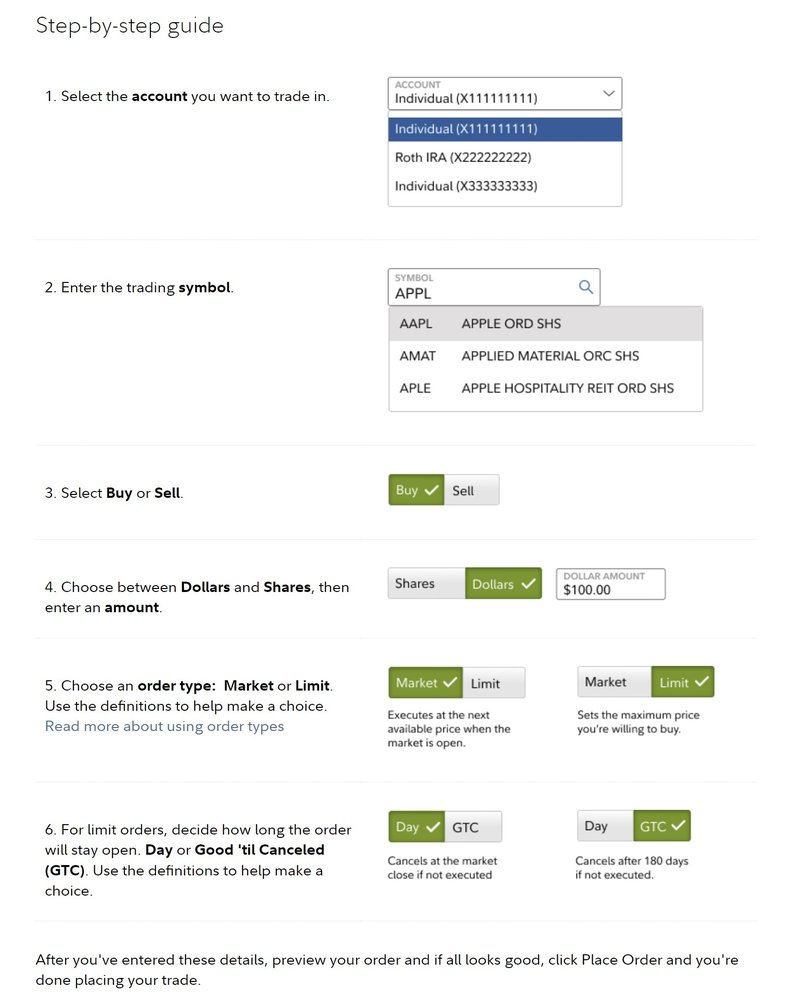

Different online brokerages will have slightly different formats for placing an order. However, the overall process will be similar from one brokerage to the next. The following screenshot explains how to plan an order to buy a stock using one of the top online brokerages, Fidelity:

The trading symbol (or stock ticker) for Boeing is BA. You’ll need to enter the number of shares of Boeing that you want to buy or (if you’re buying a fractional share) the specific dollar amount you’re investing.

Note that you’ll need to specify which order type to use -- market order or limit order. If you use a market order, the stock will be purchased immediately at the current market price. If you use a limit order, the purchase will be executed only when the stock is at or below the share price specified. The Motley Fool recommends using market orders in most cases because they ensure your stock purchase will be executed immediately.

Should you invest?

Should you invest in Boeing?

Only you will be able to decide if investing in Boeing is the right choice for your financial goals. However, there are several factors to consider.

On the plus side, aerospace stocks such as Boeing should have strong long-term growth potential thanks to increasing demand for air travel and space exploration. Boeing believes that the demand for its products and services “continues to be incredibly strong.”

The competitive landscape also works in Boeing’s favor. It’s one of the biggest defense companies in the world. The aerospace and defense industries are dominated by a handful of large players. Barriers to entry are very high.

Defense contracts, in particular, tend to last a long time. Governments spend a lot of money every year on defense, which presents a great opportunity for Boeing. This also gives investors more insight into future earnings for defense stocks such as Boeing than they have with most other types of stocks.

Investing in Boeing has some downsides, though. For example, the company’s capital expenditures are very high. Pouring significant amounts of money into research and development as well as facilities and equipment for producing new products can weigh on Boeing’s profits and cash flow at times.

Aerospace and defense are also cyclical industries. Boeing can swing from boom to bust, relatively speaking, depending on which part of the cycle it’s in.

Boeing faces the risk of safety problems involving its products. As a case in point, the company’s Boeing 737 Max was grounded worldwide for more than 20 months in 2019 and 2020. These groundings came after two crashes of 737 Max jets that killed 346 people.

There’s also a possibility that the governments could cut back on defense spending. For example, concerns about soaring national debt in the U.S. could lead to significant defense cuts in the future that may hurt Boeing.

Is it profitable?

Is Boeing profitable?

Unfortunately, Boeing isn’t profitable right now. The company has posted net losses of $4.2 billion or more in each of its last three fiscal years.

Boeing does foresee better days ahead, though. Brian West, the company's chief financial officer, has said the company expects to generate positive profit margins in 2024. West indicated that the commercial airplanes segment, which has experienced low margins for quite a while, should see considerable improvement.

Does it pay a dividend?

Does Boeing pay a dividend?

No, Boeing doesn’t currently pay a dividend. The company did pay a dividend throughout much of its history. However, it suspended the dividend program in 2020 due to the major impact on its business from the COVID-19 pandemic. It’s possible that Boeing could reinstate the dividend in the future, but no plans to do so anytime soon have been announced.

Exchange-Traded Fund (ETF)

ETFs with exposure

ETFs with exposure to Boeing

Over 130 exchange-traded funds (ETFs) own positions in Boeing. They include the largest three ETFs based on assets under management:

- SPDR S&P 500 ETF Trust (SPY 0.95%)

- iShares Core S&P 500 ETF (IVV 0.98%)

- Vanguard S&P 500 ETF (VOO 1.0%)

In addition to being a component of the S&P 500 index, Boeing is in the Dow Jones Industrial Average. As a result, the stock is included in the SPDR Dow Jones Industrial Average ETF Trust (DIA 0.36%), the only ETF that tracks the Dow Jones Industrial Average.

Boeing is an especially large holding for four aerospace and defense ETFs:

- iShares U.S. Aerospace & Defense ETF (ITA 0.4%)

- First Trust Indxx Aerospace & Defense ETF (NYSEMKT:MISL)

- Invesco Aerospace & Defense ETF (PPA 0.56%)

- Gabelli Commercial Aerospace and Defense ETF (NYSEMKT:GCAD)

Other ETFs for which Boeing is a major holding include:

- Natixis Loomis Sayles Focused Growth ETF (NYSEMKT:LSGR)

- SPDR S&P Kensho Final Frontiers ETF (ROKT 1.47%)

- God Bless America ETF (NYSEMKT:YALL)

- Vesper US Large Cap Short-Term Reversal Strategy ETF (NYSEMKT:UTRN)

Will it split?

Will Boeing stock split?

While there are several notable companies that have recently conducted stock splits, Boeing isn’t one of them. The big aerospace and defense company doesn’t appear to have any plans for a stock split anytime soon.

However, Boeing has conducted seven stock splits in its history. The most recent was in June 1997.

The bottom line

The bottom line on Boeing

Boeing ranks as a key player in the aerospace and defense industries. There are both pros and cons associated with investing in the stock.

Income investors won’t find Boeing appealing, since the company no longer pays a dividend. Growth-oriented investors might be reluctant to buy the stock as well, considering its dismal performance in recent years.

However, Boeing could be a good fit for investors who like potential comeback stories. The company’s long-term prospects should be better than its recent past.

Investing in Boeing FAQs

Is Boeing a good investment?

Perhaps the best answer to this question is: It depends on what your investing style is. Boeing isn’t a good pick for income investors since it doesn’t currently offer a dividend. The company’s revenue growth hasn’t been especially impressive in recent years, so the stock probably won’t be appealing to growth investors. Boeing could be a good pick, though, for investors who like to find potential turnaround plays.

Is Boeing a high-risk stock?

In some respects, Boeing is a high-risk stock. Its beta of 1.52 is high, reflecting significant volatility. The company also faces several major risks, notably including the cyclical nature of the aerospace and defense industries.

Who are the top investors in Boeing?

More than 60% of Boeing’s shares are owned by institutional investors. The top holders of the stock include: