Verizon (VZ 1.17%) is one of the largest telecommunications companies in the country. The company provides consumers and businesses with voice, data, and video services and solutions. It's one of the largest wireless service providers, with a coast-to-coast network.

Verizon has invested heavily in recent years to upgrade its wireless network to faster 5G (fifth-generation) technology. Those investments should enable the telecom company to grow its revenue by providing consumers and businesses with faster mobile data services.

You might be one of the millions of consumers who rely on Verizon as a customer. That could have piqued your interest in learning how to invest in its stock. Here's a step-by-step guide to investing in the communications stock and some factors to consider before adding it to your portfolio.

Stock

How to buy

How to buy Verizon stock

It's fairly easy to buy shares of Verizon. Here's a step-by-step guide on how to add the telecom company to your portfolio.

1. Open a brokerage account

You'll need to open and fund a brokerage account before buying shares of any company. If you don't have one yet, here are some of the best-rated brokers and trading platforms. Take your time to research the brokers to find the best one for you.

2. Figure out your budget

Before making your first trade, you'll need to determine how much money you want to invest. You'll then want to figure out how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks that you plan to hold for at least five years. You don't have to get there all at once. For example, if you have $1,000 available to start investing, you might want to begin by allocating that money equally across at least 10 stocks and then grow from there.

3. Do your research

It's essential to thoroughly research a company before buying its shares. You should learn about how it makes money, its competitors, its balance sheet, and other factors to make sure you have a solid grasp on whether the company can grow value for its shareholders over the long term. Continue reading to learn more about some crucial factors to consider before investing in Verizon stock.

4. Place an order

Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (VZ for Verizon).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at the market price.

Here's a screenshot of an order page from five-star-rated Fidelity Investment's trading platform:

Once you complete the order page, click to submit your trade and become a Verizon shareholder.

Should I invest?

Should I invest in Verizon?

It's important to spend time researching a stock before adding it to your portfolio. This process should help confirm your thesis that it's a worthwhile investment. However, it could help you uncover something you didn't know about the company that changes your mind about buying shares.

To assist you with your research, here are some reasons you might want to invest in Verizon:

- You're a Verizon customer and want to buy shares in a company you rely on.

- You're retired or nearing retirement and want to own stocks that generate dividend income.

- You want to invest in companies that generate stable and growing cash flow.

- You're looking for higher-yielding dividend stocks.

- You're seeking stocks that steadily increase their dividends.

- You think Verizon's investments in 5G will cause its growth rate to increase in the coming years.

- You believe Verizon will turn things around and become a market-beating stock over the next three to five years.

- You're seeking to invest in value stocks (Verizon traded at a forward P/E ratio of less than 8 and roughly 11.5 times its free cash flow in late 2023).

- Buying Verizon would help diversify your portfolio.

On the other hand, here are some reasons you might not want to buy Verizon stock:

- You're not a fan of Verizon or use a rival's service.

- You're not interested in stocks that produce dividend income.

- You're looking for companies growing faster than Verizon.

- You think Verizon will continue to underperform the market.

- You already own shares of another communications company.

Profitability

Is Verizon profitable?

One important part of investment research is taking a closer look at a company's profitability. Ideally, you'll want to see that a company is profitable (or at least on its way toward becoming profitable) and has a plan to grow its earnings in the future. Profits are important because earnings growth tends to be the main driver of a stock's price over the long term.

Verizon is a very profitable company. The telecom giant reported $98.8 billion in revenue during the first nine months of 2023 and $14.7 billion of net income, both down less than 3% from the prior-year period. Meanwhile, it's a cash flow machine. Verizon produced $28.8 billion of cash flow from operations through the third quarter of 2023 (up 2% from the prior year), easily covering its capital expenses ($14.2 billion) and dividend payments ($8.2 billion). That enabled it to produce excess free cash to strengthen its balance sheet.

Verizon has been making heavy capital investments in recent years to build out infrastructure to support its faster 5G network. The company expects its investments in 5G will grow its revenue, earnings, and operating cash flow in the future. Meanwhile, the company launched a cost-cutting plan in late 2022 that it expects will save $2 billion to $3 billion annually by 2025. These initiatives to grow its revenue and cut costs position Verizon to increase its profits in the coming years.

Dividends

Does Verizon pay a dividend?

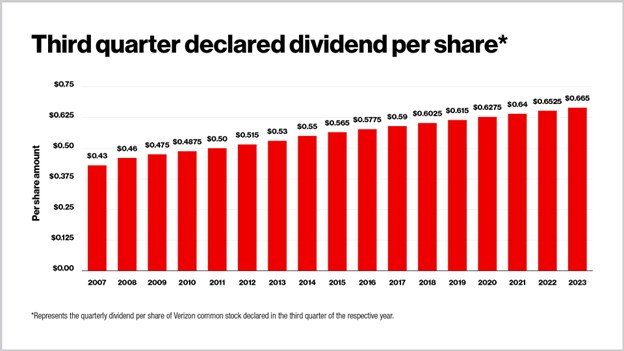

Verizon makes quarterly dividend payments to its investors. The telecom giant has a long history of increasing its dividend:

2023 was Verizon's 17th straight year of increasing its dividend. That was the longest current streak in the U.S. telecom sector.

Verizon stands out for its high dividend yield. It was more than 7% in late 2023. That put its yield in the top 5% of stocks in the S&P 500 index (which had a 1.5% dividend yield).

ETF options

ETFs with exposure to Verizon

Not all investors want to actively invest in stocks they need to manage. Many would rather be passive investors. An easy way to be a passive investor is to own exchange-traded funds (ETFs).

Exchange-Traded Fund (ETF)

Many ETFs offer passive exposure to Verizon stock. According to ETF.com, 314 ETFs held more than 445.7 million shares of Verizon in late 2023.

The Schwab U.S. Dividend Equity ETF (SCHD -0.1%) was the biggest holder at 57.8 million shares. This ETF focuses on companies with high-quality and sustainable dividends. Verizon was its second-largest holding in late 2023 at 4.5% of its assets. This fund had an ultralow 0.06% ETF expense ratio. It's an ideal ETF for investors seeking steadily rising dividend income.

Meanwhile, investors seeking greater exposure to Verizon stock could consider the iShares U.S. Telecommunications ETF (IYZ 0.29%). Verizon was its third-largest holding in late 2023 at 13.7% of its net assets. This ETF focuses on companies in the U.S. telecommunications sector. It had a 0.4% expense ratio.

Stock splits

Will Verizon stock split?

Verizon didn't have an upcoming stock split in the works as of late 2023. Verizon has not completed a stock split since its formation in 2000, when Bell Atlantic and GTE merged to create the telecom giant.

Verizon likely won't split its stock anytime soon. Shares currently trade well below a peak that topped $60 a share, which they hit around the time of the Bell Atlantic/GTE merger in 2000 and again a few years ago. Verizon stock would need to surpass its former peak before it would be likely to consider a stock split.

The bottom line on Verizon

Verizon is one of the largest telecommunications companies in the country. It generates billions of dollars in free cash flow each year, giving it the cash to pay a very attractive and steadily rising dividend, making Verizon a great stock for people seeking stable income.

FAQs

Investing in Verizon FAQs

Can you buy Verizon stock directly?

You can buy shares of Verizon directly in any regular brokerage account. The telecom company trades publicly on the New York Stock Exchange under the stock ticker VZ.

Is Verizon stock a good buy?

Verizon has many qualities that make it a good buy for certain investors. It generates lots of stable and growing cash flow, enabling it to invest in its growth while paying a high-yielding and steadily rising dividend. Verizon also has a strong investment-grade balance sheet. The company is also a leader in 5G technology, which should drive its growth in the coming years. These features make Verizon stock a good buy for investors seeking stable and rising dividend income.

However, while Verizon is growing, it's not growing very fast. As a result, its stock has underperformed the market over the last several years. So it's not a good stock to buy if you're seeking a company with outsize stock price appreciation potential.

Where will Verizon stock be in five years?

Verizon reached an inflection point in early 2023. It completed the first major investment phase of its 5G network build-out. That investment should drive steady revenue and cash-flow growth in the coming years. Meanwhile, with investment spending past its peak, Verizon will generate more excess free cash flow over the coming years.

Verizon plans to initially use those funds to continue modestly increasing its dividend and repay debt. Its long-term target is to get its leverage ratio down to a range of 1.75 to 2.0 times (it was 2.8 times at the beginning of 2022). However, the company anticipates that once leverage reaches 2.25 times, it will have the flexibility to return additional cash to shareholders by repurchasing shares (its leverage ratio was 2.6 times in late 2023). This combination of revenue and earnings growth, deleveraging, and eventual share repurchases should steadily drive Verizon's stock higher over the next few years.

How much does it cost to buy stock in Verizon?

It cost around $37.50 to buy one share of Verizon stock in late 2023. However, it's possible to invest even less money into Verizon stock. Many brokerage accounts and stock trading platforms allow investors to trade fractional shares. Some enable you to invest as little as $1 into a fractional stock purchase.