If you're looking to invest in Reddit stock, there's good news. Your day has finally come. After a long wait, Reddit went public on March 21, 2024, allowing anyone to buy its stock.

New IPOs often attract attention on Wall Street, and Reddit is no different -- especially since its debut comes at a time when the IPO window has largely closed following the tech bear market in 2022.

However, Reddit is a unique property in the social media sector, as users operate entirely anonymously and post in forums known as subreddits where topics and comments appear in threads.

Reddit also believes it is a valuable asset in the age of AI, as its content can be used for training large language models.

If you're interested in buying Reddit stock, keep reading below. We'll discuss the steps to take to buy it, whether it's a good idea to invest in it, and other key details about the stock, such as whether it's profitable.

How to buy

How to buy Reddit stock

Now that Reddit has gone public, buying the stock is as easy as buying shares of any other publicly traded company.

Step 1: Open a brokerage account

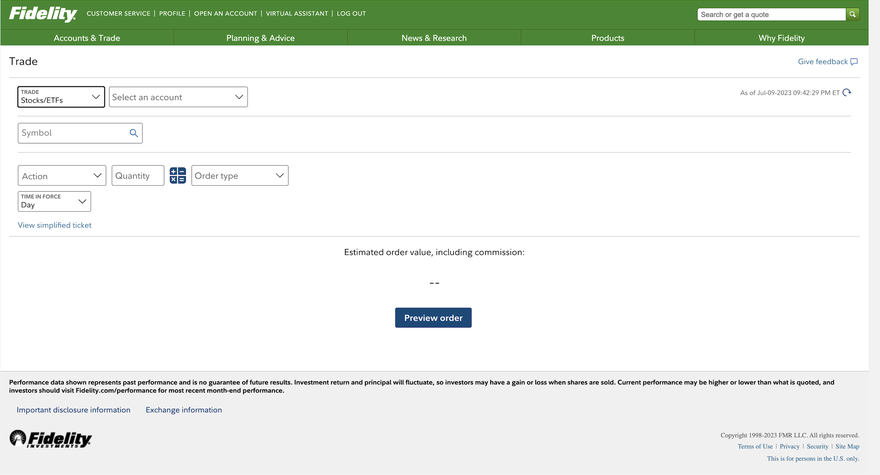

If you don't already own a brokerage account, the first thing you'll have to do to buy Reddit stock is open one up. There are a number of different investment firms you can choose from to start a brokerage account, including Charles Schwab, Fidelity, ETrade, and Robinhood. They'll all allow you to buy and sell stocks, though each one has its strengths and weaknesses, so it's worth doing some research to find the trading platform that works best for you.

Step 2: Figure out your budget

Once you have a brokerage account ready to invest in, you'll want to decide how much you want to invest. This will depend on your personal savings, your risk tolerance, the size of your portfolio, and how confident you are that Reddit stock is a good investment.

Typically, a good rule of thumb is not to invest more than 10% of your total portfolio value in a single stock. That way, you can be adequately diversified.

Step 3: Do your research

Before you buy any stock, it's a good idea to do your research, especially with an IPO like Reddit. IPO stocks tend to be volatile. You'll want to make sure you understand the business model, the competitive landscape, and the company's growth prospects, risks, and valuation.

You should also outline your thesis for the stock -- why you think the stock will go up. Finally, it's also worth considering what changes would lead you to sell the stock, so you'll have a plan if the investment goes bad.

Step 4: Place an order

Once you've decided that buying Reddit stock is right for you, you'll want to place an order. There are two principal types of orders to buy a stock.

First, you can place a market order, which will execute at the current market price of the stock. If you want to buy the stock immediately, this is the best choice for you.

On the other hand, if you're more sensitive about the price you'll pay, you'll want to use a limit order. With a limit order, you set the maximum price you're willing to pay to buy the stock, and the order will execute only if the stock is at or below that price.

You'll also choose how long your order is in effect. If you want it to expire at the end of the day, for example, you can choose that option.

Stock

Should I invest?

Should I invest in Reddit stock?

Whether you should invest in Reddit stock will depend in part on personal characteristics such as your risk tolerance.

IPO stocks like Reddit tend to be volatile, so any Reddit investor should be prepared for significant swings.

Reddit has pitched itself partly as a play on the artificial intelligence (AI) boom, as companies like OpenAI are already using Reddit's content to train large language models and other AI algorithms. In CEO Steve Huffman's prospectus letter, he said, "We expect our data advantage and intellectual property to continue to be a key element in the training of future LLMs."

Most of Reddit's revenue currently comes from advertising, a business model that has worked well for larger social media companies like Meta Platforms. However, the company also envisions expanding further into commerce, as users have developed marketplaces in areas like selling watches, commissioning art, and requesting photo edits.

Reddit is delivering solid growth, with revenue up 21% in 2023 to $804 million, but the company is still unprofitable, and shares look pricey following a surge after its IPO.

Reddit's a unique company, and the stock could pay off for long-term investors, especially if its ambitions in data licensing with AI and e-commerce pay off, but it carries a significant level of risk, given its lack of profits and that it's a newly public company.

Is Reddit profitable?

Is Reddit profitable?

Reddit is not currently profitable and has never been profitable for a full year in its nearly 20-year history. In 2023, the company reported a generally accepted accounting principles (GAAP) loss of $90.8 million on $804 million in revenue. Even on the basis of adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), which tends to make it easier to show a profit, the company reported a loss of $69.3 million. It also lost $84.8 million in free cash flow.

Reddit's margins did improve from 2022 to 2023, and its losses narrowed as the company limited growth in expenses like sales and marketing. The company also reported a profit in the second half of 2023 with net income of $10.2 million on $557 million in revenue.

Historically, social media companies are most profitable during the fourth quarter, when advertising demand rises because of the holiday season, and Reddit benefits from that pattern as well. Responding to criticism about the company's lack of profitability, CEO Steve Huffman pointed to the company's second-half profitability and said that revenue was growing significantly faster than expenses. He also noted that gross margins were in the high 80s, showing that it costs relatively little to run the core business.

Management has yet to give guidance or set a goal for full-year profitability, but Huffman's comments seem to imply that profitability could be closer than investors think.

Does Reddit pay a dividend?

Does Reddit pay a dividend?

Reddit doesn't currently pay a dividend and is unlikely to pay one for the foreseeable future. Dividend-paying companies generally need to be profitable, as dividends are essentially a share of profits paid out to shareholders. In order to pay a dividend, companies must use profits or cash on hand.

Growth stocks like Reddit also don't typically pay a dividend until they reach a certain level of maturity. Facebook parent Meta Platforms, for example, just declared its first dividend in early 2024.

Investors shouldn't expect Reddit to pay a dividend for at least several years.

Social Media

ETFs with exposure to Reddit

ETFs with exposure to Reddit

Having just had an IPO, Reddit stock isn't owned by any ETFs at the time of writing, but the stock is likely to be included in some ETFs that focus on IPOs since it's one of the more high-profile stocks to go public recently.

One of those ETFs is the Renaissance IPO ETF, which tracks the Renaissance IPO index, an index that holds mostly new listings. On average, its holdings have been public for just 2.2 years. That means the ETF has almost no overlap with the S&P 500, which makes it appealing to some investors as a means of diversifying away from the broad-market index and getting exposure to new listings.

If Reddit starts to be included in ETFs, the first ones are likely to be IPO-focused funds like the Renaissance IPO ETF.

Will Reddit stock split?

Will Reddit stock split?

Reddit stock is unlikely to split anytime soon. Stock splits typically occur after a company's share price has run up substantially, and that typically takes several years.

During the dot-com boom, stock splits for new issues were common as prices raced higher, but it has been rare to see IPO stocks split since that era.

It's possible that Reddit's stock will eventually split, but investors shouldn't expect a split for years. The company set an IPO price of $34, giving it plenty of room for gains until a stock split would make sense.

The bottom line

The bottom line on Reddit stock

IPOs tend to excite investors, and Reddit is a unique company. While it is a social media platform, it functions differently from its peers, and the company's utility for training AI models also separates it from other social media platforms.

In order for Reddit stock to be successful, the company will have to become profitable, something it hasn't been able to do over a full-year period in its history. However, Reddit could be closer to profitability than it seems, as the company was profitable in the second half of 2023. There will be more scrutiny on the bottom line now that the company is public, which could encourage management to better manage costs.

If it can turn profitable and capture the opportunity in front of it in AI and beyond, the stock should be a winner, but it faces a number of risks and challenges on the way to that goal.

Investing in Reddit FAQs

What will Reddit's stock price be?

Reddit set its IPO price at $34 per share. That means that institutional investors and others who were able to buy the stock before it started trading paid $34 for it. The stock closed at $50.44 on its opening day.

From here on, its price will fluctuate from day to day just like any other stock's.

What is Reddit's stock symbol?

Reddit's ticker is RDDT. It trades on the New York Stock Exchange (NYSE).

When is Reddit's IPO?

Reddit's IPO was on March 21, 2024. Reddit is now a publicly traded stock.

What is Reddit's IPO valuation?

Reddit was valued at $6.4 billion in its IPO, though the stock soared nearly 50% on its first trading day, indicating the stock's first buyers thought it was worth significantly more than that.