Airbnb (ABNB 0.75%) has been one of the most disruptive companies in the world over the last generation. The home-sharing platform has changed the way we travel, essentially inventing a new hospitality asset class that now competes with hotels and other types of accommodations.

In the process, Airbnb has also become a way for millions of hosts around the world to earn supplemental or even primary income by hosting guests at their homes or at other properties they own.

Airbnb has also established itself as a promising stock, delivering solid revenue and profit growth since its December 2020 initial public offering (IPO).

In this deep dive into investing in Airbnb, we'll explore how to buy Airbnb stock, whether it deserves your investment dollars, if the company is profitable, whether it pays a dividend, how to invest in the stock through an exchange-traded fund (ETF), and whether Airbnb will split its stock.

How to buy

How to buy Airbnb stock

Airbnb is publicly traded, so the process of buying it is pretty much the same for any U.S.-listed stock. You can follow the step-by-step guide below to see how to buy Airbnb stock.

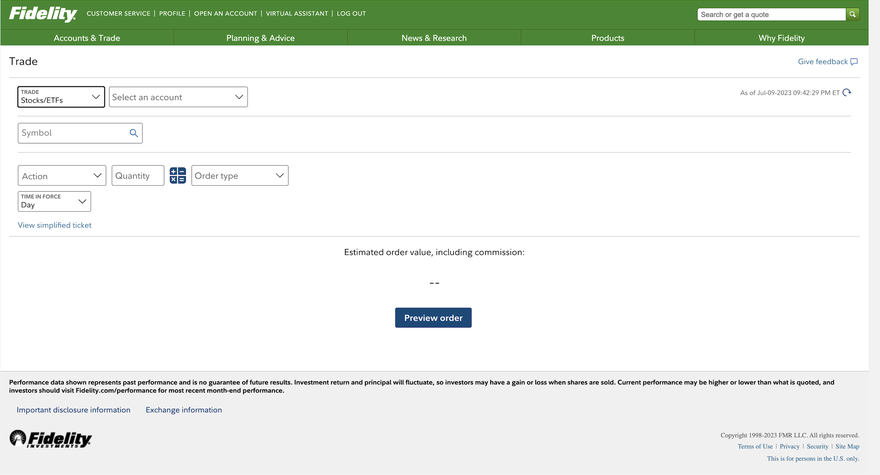

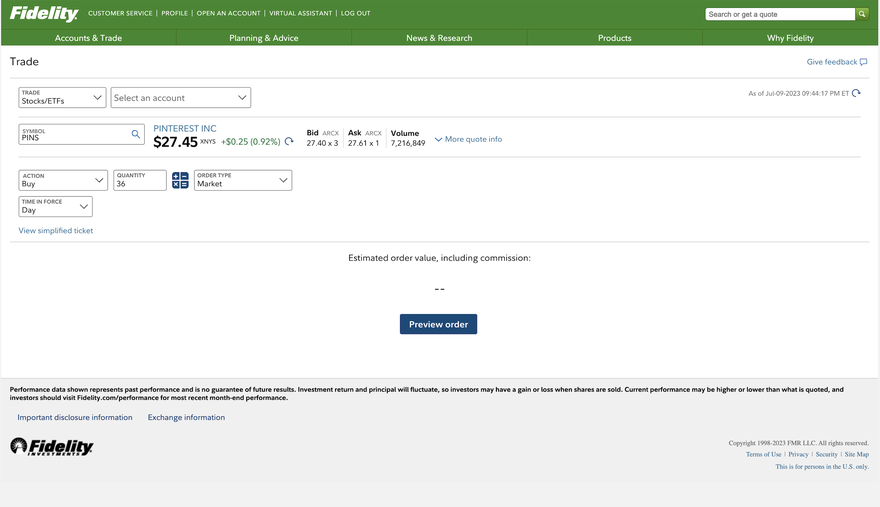

Step 1: Open a brokerage account

If you don't already have a brokerage account, you'll need to open one. You can do so with any of a number of brokerages, including Fidelity, Charles Schwab (SCHW 0.13%), E-Trade, Robinhood (HOOD 4.44%), Interactive Brokers (IBKR -1.01%), or others. Any will allow you to buy Airbnb stock, although it's worth studying the pros and cons of different brokerage platforms if you're a new investor.

Step 2: Figure out your budget

Once you have a brokerage account available, you'll need to decide how much you want to invest in Airbnb stock. If you don't already allocate money to invest regularly, such as every month, you should aim to use funds that you don't expect to need in the next five years so you can take advantage of the long-term compounding effects of the stock market.

You'll also want to maintain a diversified portfolio. Assuming you own other stocks, a good rule of thumb is to not invest more than 10% of your total account value into an individual stock, especially a more volatile one like Airbnb.

Stock

Step 3: Do your research

You should always research a stock before buying it. Make sure you understand its prospects and its risks. Know why you are investing in it. Are you buying it for growth, value, income, or something else? Why is it a better investment than the S&P 500? Does the company have a competitive advantage, and who does it compete with?

Finally, you should have an idea of the circumstances that would make you sell the stock. In other words, what would cause you to change your investing thesis?

Step 4: Place an order

Once you're ready to buy the stock, you will need to place an order.

You should be aware that there are two main types of stock market orders: Market and limit. A market order fills your order at whatever price the stock is currently trading. A limit order gives you more control; you can set the maximum amount you're willing to pay. The downside of a limit order, however, is that your order might not get filled if your price is too low.

Should I invest?

Should I invest in Airbnb stock?

Whether you should invest in Airbnb or not will depend on your investing style. Airbnb is a growth stock, and it doesn't pay a dividend. If you prefer to invest in dividend stocks, and like to buy value stocks, rather than growth stocks, then Airbnb probably isn't a good fit for you.

However, for the right kind of investor, Airbnb looks like a good choice.

The company has a promising growth opportunity since it can expand anywhere in the world as long as hosts sign up on its platform. It also continues to gain market share from hotels, providing an alternative for guests who want a different lodging experience. Airbnb is typically considered a better choice for families, groups of friends, long-term stays, or locations where there aren't any hotels.

As a business, Airbnb has many attractive qualities. The company's two-sided marketplace gives it a competitive advantage and creates barriers to entry into the space. Although it does have competition, like Expedia's (EXPE -0.4%) VRBO, Airbnb is estimated to own a majority of the market share among home-sharing platforms, and its first-mover status and scale give it an advantage since it benefits from network effects. Hosts are going to be attracted to the platform with the most potential guests, and travelers are going to want to search on the site with the most places. That advantage helps draw new users to Airbnb.

Additionally, its marketplace has helped it generate wide and expanding profit margins. In 2023, it had an adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) margin of 37%.

Airbnb stock is still growing steadily, with revenue expected to increase by double digits in 2024, and the stock looks fairly valued at the moment.

Profitability

Is Airbnb profitable?

Airbnb is profitable. For most of its history, the company operated at a loss, but CEO Brian Chesky was forced to overhaul the business when the pandemic struck and the travel industry essentially shut down.

Airbnb ended up laying off about a quarter of its staff and committed to running a much leaner operation. The company has been profitable since, and its margins have been expanding. In 2023, it reported $3.7 billion in adjusted EBITDA on $9.9 billion in revenue.

Airbnb benefits from an asset-light business model, and its hosts do the hard work of receiving and accommodating guests. Its model allows the business to collect commissions as long as it keeps the site running and provides customer service as needed for its hosts and guests.

Dividends

Does Airbnb pay a dividend?

Airbnb does not pay a dividend and has not announced any plans to do so. Although the company could afford to pay a dividend, it is unlikely to pay one since it's still investing in its growth.

Additionally, its closest rivals, like Booking Holdings (BKNG 0.53%) and Expedia, don't pay a dividend, which makes it less likely that Airbnb will offer one.

ETFs

ETFs with exposure to Airbnb

There are many ETFs with exposure to Airbnb. The stock was added to the S&P 500 in 2023, so any ETF that tracks the S&P 500 will include Airbnb. Some of the bigger ones include SPDR S&P 500 ETF (SPY 0.95%), Vanguard 500 Fund (NYSE:VOO), and iShares Core S&P 500 ETF (IVV 0.98%).

Airbnb is also in the Nasdaq-100, meaning it's a part of ETFs like the Invesco QQQ Trust (QQQ 1.54%) that track the Nasdaq 100.

Additionally, Airbnb is in several travel and leisure ETFs, as well as others focused on discretionary spending. According to Tipranks, the stock is held by 443 ETFs.

Exchange-Traded Fund (ETF)

Stock splits

Will Airbnb's Stock Split?

Airbnb went public in Dec. 2020, and the company has never split its stock.

A stock split for Airbnb seems unlikely soon since shares have traded around $160 per share, comparable to other tech stocks. It's possible that the company will split its stock at some point in the future, but that seems unlikely to happen for at least several years.

Related investing topics

The bottom line on Airbnb

Airbnb has a lot of attractive qualities in a stock. It's the leader in home-sharing. It benefits from a number of competitive advantages, including network effects, switching costs, and a well-known brand, and its business model is capable of generating wide profit margins, showing the company has pricing power.

The stock also trades at a reasonable valuation and is delivering solid growth in an industry that will almost certainly expand over the years.

Although Airbnb may not belong in every portfolio, there's a good argument for most investors to own the stock since the company looks set to continue to disrupt the travel industry, and may expand into new products and services.

FAQ

Investing in Airbnb FAQs

How do I become an investor in Airbnb?

Airbnb is publicly traded. The company had its IPO in 2020. You can buy Airbnb shares through your brokerage.

Is Airbnb a good investment?

It's impossible to know for sure what will happen with Airbnb stock. The stock has been volatile, but it's been a good investment since shares have more than doubled from its 2020 IPO.

It's a strong business with a bright future, and it looks like a good investment.

What is Airbnb's stock symbol?

Airbnb trades on the Nasdaq under the symbol, or ticker, ABNB.

Is Airbnb publicly traded?

Yes, Airbnb is publicly traded. The stock has been available to the public since its IPO in 2020.