Dividend stocks outperform non-dividend-paying stocks over the long run. It happens in good markets and bad, and the benefit of dividends can be quite striking -- dividend payments have made up about 40% of the market's average annual return from 1936 to the present day.

But few of us can invest in every single dividend-paying stock on the market, and even if we could, we're likely to find better gains by being selective. Today, two popular mall-based fashion retail chains will square off in a head-to-head battle to determine which offers a better dividend for your portfolio.

Tale of the tape

Founded in 1969, The Gap (GAP 0.71%) is a global specialty apparel retailer that offers clothing, accessories, and personal care products for men, women, and children. The company operates retail stores primarily under the Gap, Old Navy, and Banana Republic banners, while newer brands Piperlime and Athleta are also offered in domestic and international markets. Headquartered in San Francisco, Gap has more than 137,000 employees, and operates more than 3,500 company-owned and franchised stores throughout Asia, Europe, Africa, the Middle East, and the U.S. However, Gap recently finalized plans to shut down around 189, or 21%, of its domestic stores by the end of 2013, while simultaneously expanding its geographical presence in China and Brazil.

Founded in 1948, The Buckle (BKE 0.06%), formerly known as Mills Clothing, is a leading retailer of footwear, casual apparel, and accessories for men and women in the U.S. The company operates stores under the Buckle banner, primarily in regional shopping malls and lifestyle centers, and has also begun selling products online. Headquartered in Kearney, Neb., Buckle employs more than 8,000 people in more than 450 stores in 43 states. Buckle boasts a strong product portfolioof ubiquitous brands, such as Lucky, Hurley, Roxy, Silver, Billabong, Fossil, and Ed Hardy. Since 2010, the company has opened a new state-of-the-art distribution center in Kearney, and also undertook the opening of 50 new stores, 21 full remodels, and 20 smaller remodeling projects.

|

Metric |

Gap |

Buckle |

|---|---|---|

|

Market cap |

$19 billion |

$2.1 billion |

|

P/E ratio |

15.1 |

12.7 |

|

Trailing-12-month profit margin |

8.1% |

14.3% |

|

TTM free cash flow margin* |

5.9% |

14.7% |

|

Five-year total return |

302.8% |

168.4% |

Source: Morningstar and YCharts. *Free cash flow margin is free cash flow divided by revenue for the trailing 12 months.

Round one: Endurance (dividend-paying streak)

According to Dividata, Gap has paid uninterrupted quarterly dividends for more than 26 years since initiating distributions in 1987. On the other hand, Buckle only started paying quarterly dividends in late 2003. A 26-year dividend-paying streak lets Gap win the endurance crown without breaking a sweat.

Winner: Gap, 1-0.

Round two: Stability (dividend-raising streak)

According to Dividata, Gap started raising shareholder distributions in 2010 after holding fast for two years due to the financial crisis. By contrast, Buckle has increased its dividend payouts at least once every year since it began paying back shareholders in 2003. That's an easy win for Buckle.

Winner: Buckle, 1-1.

Round three: Power (dividend yield)

Some dividends are enticing, but others are merely tokens that barely affect an investor's decision. Have our two companies sustained strong yields over time? Let's take a look:

GPS Dividend Yield (TTM) data by YCharts.

Winner: Buckle, 2-1.

Round four: Strength (recent dividend growth)

A stock's yield can stay high without much effort if its share price doesn't budge, so let's take a look at the growth in payouts during the past five years.

GPS Dividend data by YCharts.

Winner: Buckle, 3-1.

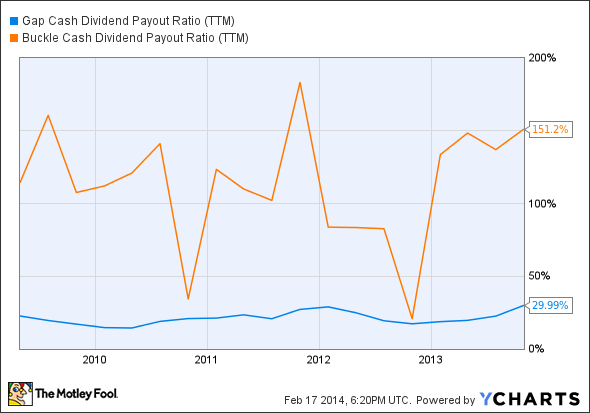

Round five: Flexibility (free cash flow payout ratio)

A company that pays out too much of its free cash flow in dividends could be at risk of a cutback, particularly if business weakens. We want to see sustainable payouts, so lower is better:

GPS Cash Dividend Payout Ratio (TTM) data by YCharts.

Winner: Gap, 2-3.

Bonus round: Opportunities and threats

Buckle may have won the best-of-five on the basis of its history, but investors should never base their decisions on past performance alone. Tomorrow might bring a far different business environment, so it's important to also examine each company's potential, whether it happens to be nearly boundless, or constrained too tightly for growth.

Gap opportunities

- Gap is putting Athleta in direct competition with lululemon athletica's locations to draw in customers with lower prices.

- Gap opened 25 new stores in Asian markets out of 65 total new openings in the third quarter.

- Gap recently announced a $1 billion share repurchase plan to win shareholders' confidence.

- Gap teamed up with new designers to develop innovative products to lure more customers.

Buckle opportunities

- Buckle plans to open 16 new stores and complete 14 to 16 full remodels by the end of 2014.

- Buckle benefits from dynamic inventory and cost-management initiatives.

- Buckle has been expanding its product portfolio to include activewear and footwear.

- The global market for denim jeans is expected to grow to $56 billion by the end of 2018.

Gap threats

- Under Armour is also pushing hard into yogawear with an athlete-centric marketing campaign.

- Under Armour has also been opening new stores aimed at young athletic girls.

- Nike is similarly focused on the women's yoga-apparel business.

Buckle threats

- Gap's core Gap and Banana Republic brands seem to be gaining traction with shoppers.

- Denim retailers have been overlooked as shoppers focus on larger investments and purchases.

One dividend to rule them all

In this writer's humble opinion, it seems that The Buckle has a better shot at long-term outperformance, thanks to a strong competitive and pricing advantage over peers that more typically retail only in-house brands. Buckle's management seems confident that it can spark significant revenue growth on the back of rising global demand for denim wear, combined with a diversification into activewear and footwear.

While Gap has been aggressively expanding into new international locations, its recent domestic shutdowns are a bad sign for the future appeal of its core brands. You might disagree and, if so, you're encouraged to share your viewpoint in the comments below. No dividend is completely perfect, but some are bound to produce better results than others. Keep your eyes open -- you never know where you might find the next great dividend stock!