The new earnings season got its symbolic start when Alcoa (AA +0.00%) released its results after the market closed on Tuesday. As ever, investors will want to know what its outlook says for the global economy. Alcoa management always gives good industry-specific guidance, as the aluminum producer has a privileged viewpoint on early stage order patterns in long-cycle industries. In this article, I will focus on the aerospace and automotive sectors, the strongest parts of the industrial economy over the last year.

Alcoa updates its industry outlook

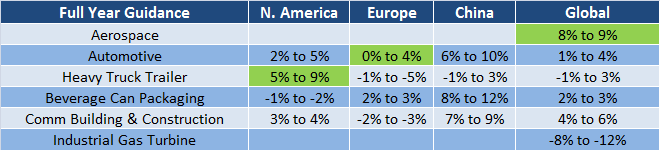

A graphic depiction of Alcoa's end demand forecast for 2014 versus 2013 reveals much about trends in the global economy. The green coloring refers to areas in which Alcoa raised guidance from its previous quarter.

Source: Alcoa Presentations.

The first thing to note is that the only increases came in Europe and North America, which is pretty much in line with the general theme of the developed world starting to outperform emerging markets. Indeed, this theme was evident when looking at what industrial gas suppliers such as Praxair and Air Products were saying about the industrial economy.

The European industrial sector seems to be performing relatively better than the U.S. For example, in discussing its ground rolled products segment, Alcoa's management noted that "improved industrial volumes in Europe were offset by weaker demand in North America," with particular weakness in U.S. packaging. Indeed, industrial companies Emerson Electric and RPM International have also both spoken of improved conditions this year in Europe.

Aerospace getting stronger?

Alcoa's management upgraded its forecast for the aerospace industry from 8% to 9%, and pointed out that Boeing (BA 0.02%) and Airbus have aircraft backlogs of over eight years. Management also cited the outlook from the International Air Transport Association, or IATA, which forecasts a strong aviation market in 2014. This is somewhat puzzling, because the IATA actually reduced its global airline profitability forecast by $1 billion to $18.7 billion and referred to emerging market risk in its latest economic forecast in March.

However, it seems that Alcoa's management looked at recent order wins by Airbus and Boeing (particularly at the Singapore Airshow) and decided to upgrade its forecast. Furthermore, according to Alcoa, the regional jet market has rebounded "nicely"-- usually a good indicator of a cyclical recovery.

Automotive driving forward

The automotive market entered the first quarter on a strong footing, but with some concerns as to how it would leave it. At the start of the quarter, Alcoa reported that North American car inventories were running 14% higher than last year. Meanwhile, Europe was still weak, and China's outlook was uncertain. Fast forward to the latest earnings and, according to Alcoa, incentives by automakers helped reduce inventory days (the number of days' worth of sales held in inventory) to 62 from 75 in February, where "the historic average it's around 60 to 65 days."

Furthermore, the European forecast was upgraded following a better quarter, and the estimate for China was maintained. This is all good news for a company exposed to the automotive sector like Johnson Controls (JCI +1.47%). The company is discussed in more detail in an article linked here. Johnson Controls is strongly exposed to the global automotive sector, with its power solutions and automotive segments representing nearly 70% of its segmental sales.

The bottom line

All told, Alcoa's report was good for companies exposed to aerospace and automotive spending, such as Boeing and Johnson Controls. These sectors have been particularly strong in recent years, and it looks like companies with exposure to them are set to continue to outperform as well. The improvement in Europe mirrors what other companies are saying about the industrial sector, and Fools should start to look at other companies with exposure to the region.