The United States' major economic data points continue to wobble between strength and weakness as we pass through springtime, never quite picking up enough steam to break away from their years-long ride down the road of mediocrity. The latest major release -- the Department of Commerce's U.S. retail sales data -- prolongs the trend of stumbling from weakness to strength to weakness, which has lately been led by a lousy first-quarter GDP report that was countered with a higher than average rate of new employment in April.

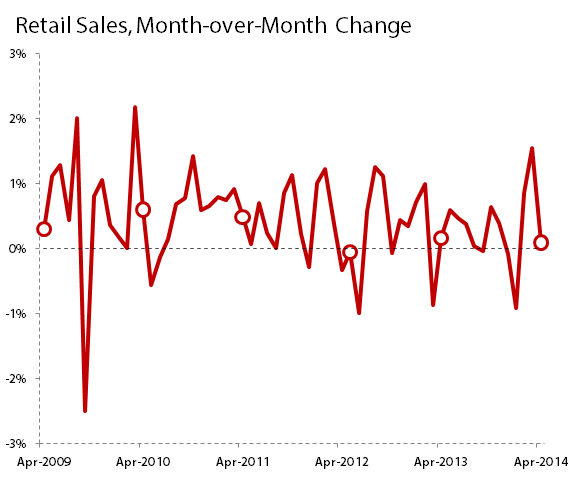

Today's headline number is 0.1%, which is the rate by which America's overall retail (including food service) sales grew from March to April. Expectations were already modest, but retail's barely there growth fell beneath even the 0.4% month-over-month growth rate many economists had anticipated. Despite this weakness, the Dow Jones Industrial Average (^DJI 0.58%) clung to a slim 20-point gain in early afternoon trading, although its retail-focused components were mixed shortly after 1 p.m. EDT.

The Commerce Department also revised years of its data using 2012's Annual Retail Trade Survey, but these revisions typically produced only small changes to the many varied elements of American retail sales, and the overall picture remains very much the same. However, one revision does help to explain why April's weakness may not be as bad as it seems on the surface. March's headline number got a big boost in the revision, from last month's strong 1.1% February-to-March growth rate to a whopping 1.5% rise, which is the strongest month-over-month growth in American retail sales since March 2010:

Source: U.S. Department of Commerce.

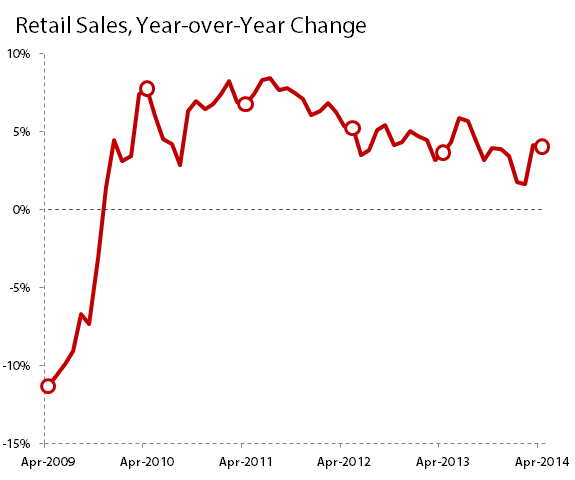

While the Commerce Department's data focuses on month-to-month changes, it's probably more important to study what the retail sales picture looks like year over year. On this measure, April came in strong as well, reversing the trend of declines endured through a lousy winter:

Source: U.S. Department of Commerce.

April's year-over-year growth was just over 4%, which is the second month in a row that this growth rate has been so high. It's also the first time since last August that year-over-year retail sales improved by more than 4% for two months in a row, although October and November both came very close to breaking through the 4% mark.

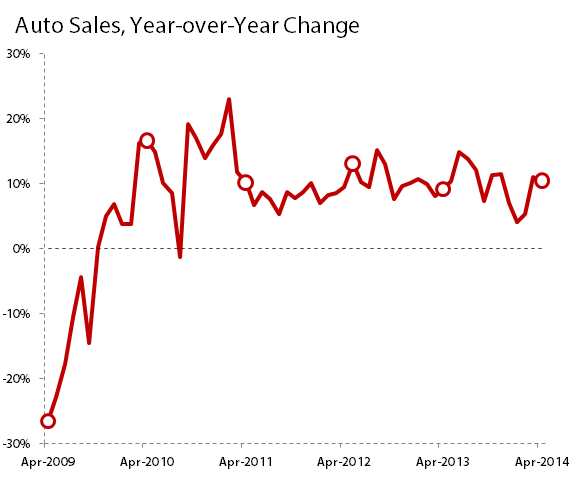

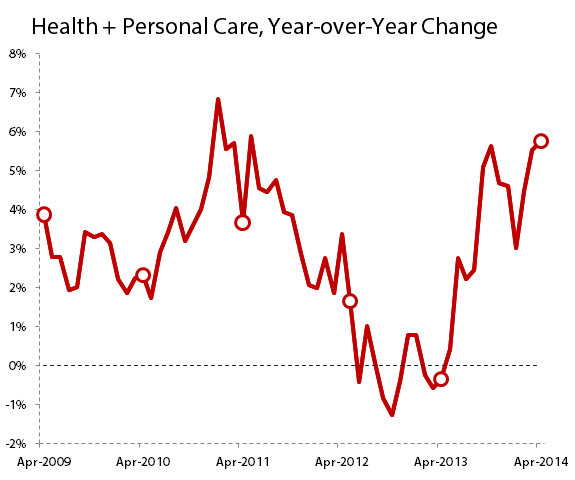

April's retail sales were saved from a month-over-month decline largely by the strength of two major sectors of the retail economy: auto sales and health care, which as a retail sector is largely represented by pharmacies.

Source: U.S. Department of Commerce.

Source: U.S. Department of Commerce.

Auto sales grew by more than 10% over last April's result, making this the second-consecutive month of double-digit growth for year-over-year sales for car dealers. Health care (which also includes beauty and personal care products) is again growing strongly after a weak patch from 2012 to 2013. It shouldn't be too surprising, then, to see the Dow's health-care components on the rise -- both Johnson & Johnson (JNJ +0.76%) and Merck (MRK 0.92%) were safely in the green this afternoon.

However, few other sectors of the retail economy put forth much growth in April. Home improvemen, led by Dow component Home Depot (HD +0.72%), barely grew at all from last April. Apparel retailers have seen year-over-year sales growth weaken for years, and April was no different. Specialty retailers (bookstores, sporting goods stores, and music stores) and electronics stores both showed negative year-over-year growth.

|

Retail Sector |

Month-over-Month Growth |

Year-over-Year Growth |

|---|---|---|

|

Home improvement |

0.4% |

2.2% |

|

Clothing and accessories |

1.2% |

1.1% |

|

Specialty retail |

0.7% |

(2.1%) |

|

Electronics stores |

(2.3%) |

(1.5%) |

|

Gas stations |

0.8% |

(0.2%) |

|

Restaurants and bars |

(0.9%) |

3% |

Source: U.S. Department of Commerce.

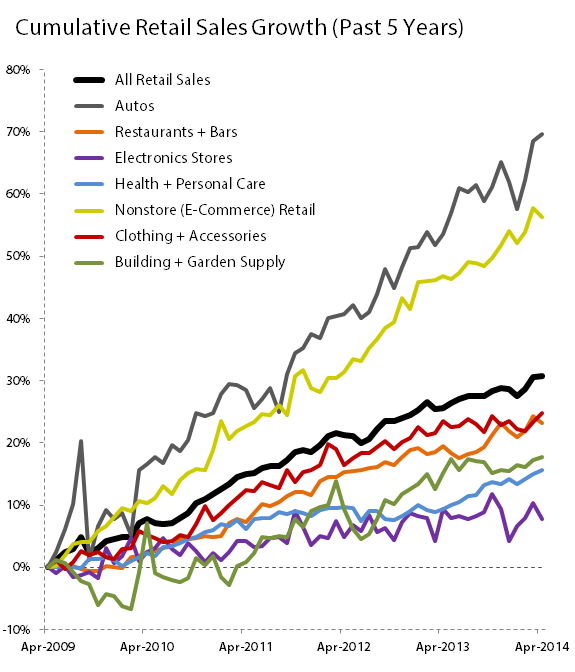

Auto sales continue to drive (pardon the pun) retail sales growth in the United States, as this sector has put together more cumulative growth over the past five years than any other, including the red-hot nonstore retail sector, which tracks e-commerce sales:

Sources: U.S. Department of Commerce, author's calculations.

This data doesn't translate adequately to every retail company in the country, of course. Restaurant sales may be lagging the pack, but some restaurants continue to dominate year after year. Strong e-commerce sales don't necessarily mean that every e-commerce company has a boundless opportunity. But this data can nonetheless help investors better understand what they're buying into, and where this vital sector -- it accounts for roughly 35% of GDP -- might lead the rest of the American economy. Today's results aren't great, but they're not as terrible as the headline number might make it seem. Retail sales continue to grow, and the American economy continues to march onward, slowly but surely.