Retirement planning isn't for the faint of heart. You have many options to choose from -- sometimes, too many. Some people may want to consider commingled trust funds on top of typical retirement plans.

What is a commingled trust fund?

What is a commingled trust fund?

A commingled trust fund is a type of trust that's not regulated by the Securities and Exchange Commission (SEC). They're instead governed by the Office of the Comptroller of the Currency (OCC). Commingled trust funds often represent a combination of various assets under one investment strategy and managed by the same entity.

The money in commingled trust funds typically comes from retirement plans but can also be from trusts and similar accounts. The funds are becoming increasingly popular due to their cheaper fees. Still, there is always some concern that putting so much money together -- especially when state pension funds are involved -- puts it at greater risk.

Eligibility

Who is eligible to use a commingled trust fund?

Typically, commingled trust funds are available only to investors whose companies allow them to access this tool. They're popular with government bodies and others that tend to offer pensions but are not exclusive to these types of entities.

If you are interested in a commingled trust fund, ask your human resources department if one is available. Typically, you are offered the option when you sign up for your retirement account.

Commingled trust funds vs. mutual funds

Commingled trust funds vs. mutual funds

Commingled trust funds and mutual funds are both popular vehicles for retirement investing, but they're very different products. As mentioned, commingled trust funds are regulated by the OCC and mutual funds by the SEC.

That means commingled trust funds aren't required to have such extensive disclosures about risk and performance. So, you could be getting into a not-so-great investment without understanding the potential for losses.

On the other hand, this lack of regulatory control means commingled trust funds are often much cheaper because they're not required to meet the same stiff regulatory requirements as mutual funds.

The other big difference, of course, is that not everyone can invest in a commingled trust fund. They're only available to investors with specific retirement plans, generally employer-sponsored retirement plans. Mutual funds, on the other hand, can be invested in by anyone, regardless of their employer or employment status.

Example

An example of a commingled trust fund

There are a fair number of commingled trust funds out there, but let's look at a real-life example. The Washington State Investment Board manages investments for 34 different funds. These include:

- 17 retirement plans for people like public employees, teachers, firefighters, and law enforcement officers

- Five industrial insurance funds for injured workers

- Seven funds to benefit schools, colleges, and universities

- Five trust funds that include college tuition programs, scholarships, and an endowment for people with developmental disabilities

This pool of assets is treated as one giant asset. The asset classes the pool has bought into include real estate, public equity, and private equity investments. This portfolio has a lot of diverse investment classes, indicating it could be pretty well balanced, too.

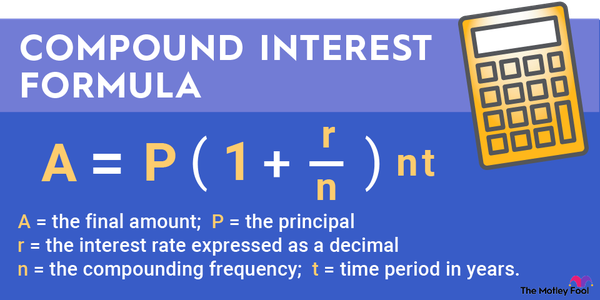

As the value of the investment grows, so do the funds that are part of the commingled trust fund. Just like you'd split a dinner bill with friends, the various funds generally split the proceeds by their contribution to the overall fund.

So, for example, if the retirement plans each contributed 5% of the money to the commingled trust fund, they'd each be entitled to 5% of the profits from the shared investment. They also share the cost of growing the pool of funds in much the same way.