Everyone wants to build their wealth to improve their lives and the lives of their family members. For many people, owning a business or buying real estate are out of reach. However, putting some of your money into investments such as stocks and bonds is within reach of anyone with disposable income.

History has shown that owning stocks and bonds is a good way to build wealth. According to data compiled by Vanguard, a 60/40 portfolio -- 60% stocks and 40% bonds -- generated an average of 8.8% compounded annual returns between 1926 and 2019. That might not sound like much, but earning an average of 8.8% per year compounded annually doubles your money every nine years.

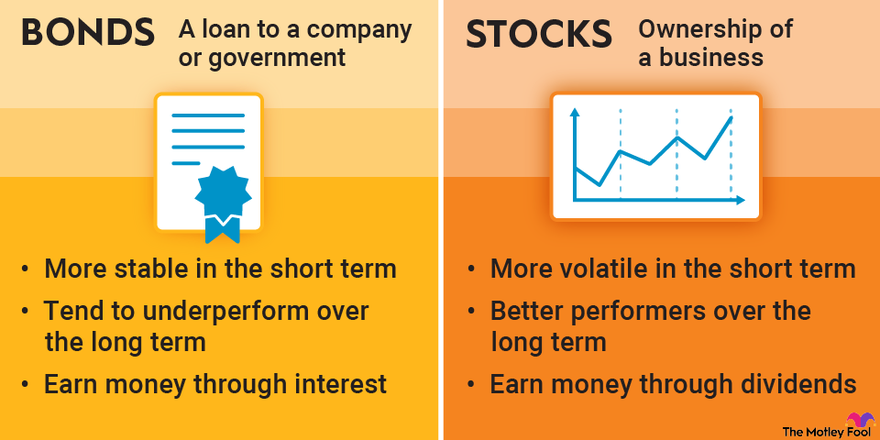

Below, we will discuss stocks, bonds, and the differences between them. If you're looking to learn how to grow -- and protect -- your wealth, this article should answer a lot of your questions.

What are stocks?

What are stocks?

Stocks are ownership of a business. When you buy stock in a company, you become a partial owner. Over time, if the company does well and becomes more valuable, your share of the company will also gain in value. Of course, the opposite is also true: If a business struggles, or its profits (or prospects for future profits) decline, the value of the company -- and its stock price -- can fall, resulting in losses.

How do I make money with stocks?

Buying stocks in high-quality companies at fair prices and then holding them for years is the simplest and most accessible strategy to make money with stocks. Although stocks are volatile in the short term, it's often based more on short-term economic and stock market sentiment than individual company issues. But, when measured in years, the biggest measure of a stock's value is the company's growth of earnings per share. The more profitable a company becomes, the more valuable its stock.

Stocks can also be great ways to generate income, typically via dividends, or cash paid by a company directly to shareholders. Not all stocks pay dividends, but more mature, stable companies that generate more cash than they need to fund improvements and growth will usually return what's left in dividends.

Investors can also invest with options, which are contracts among investors to either buy or sell shares of a stock at an agreed-upon price in the future.

Types of stocks

Types of stocks

The most common kind of stock is, well, common stock. You have an ownership stake in a company and usually also have a vote in shareholder matters at the annual shareholder meeting. Some companies have multiple share classes, with the difference usually being voting power. For example, there are two classes of Alphabet (GOOGL -1.23%)(GOOG -1.1%) shares, with GOOG owners able to vote shares and GOOGL owners having no voting rights.

Preferred stock is very different from common stock. It's closer to a bond, with a redemption price, a set dividend, and usually a redemption date (meaning the company will repay investors the redemption value plus dividends owed). Preferred shares tend to hold up their value, but they have very limited upside. The upside is usually a higher dividend yield than common stock in the same company with less volatility and a smaller risk of losses.

Pros and cons of stocks

Pros and cons of stocks

Pros

- Upside potential is only limited by a company's ability to increase earnings per share.

- Easily accessible to anyone with some disposable income.

- Very long track record as a reliable long-term wealth generator.

Cons

- Potential risk of permanent losses if a company struggles or fails.

- Volatility increases losses, especially for short-term investors.

- Market swings can make it emotionally difficult to hold through stock downturns.

How do I buy stocks?

How do I buy stocks?

Buying stocks has never been easier, with a wide range of reputable online brokers offering low-cost (or no-cost) trades and different kinds of accounts, depending on your needs. Many brokers also offer very low or even zero-commission trading, as well as fractional investing, which allows you to invest a set amount of money in a stock even if it's less than one full share.

What are bonds?

What are bonds?

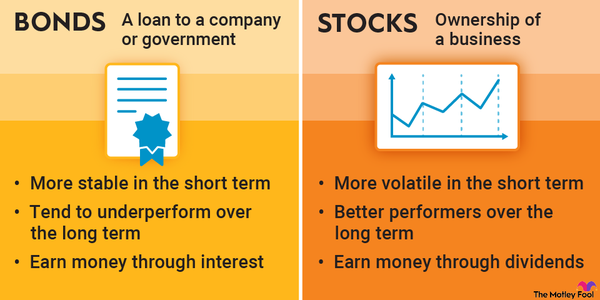

While stocks are ownership in a company, bonds are a loan to a company or government. Because they are a loan, with a set interest payment, a maturity date, and a face value that the borrower will repay, they tend to be far less volatile than stocks. That's not to say they're risk-free; if the borrower has financial trouble and is at risk of defaulting on their debt, bonds can lose value. But even in a worst-case scenario of bankruptcy liquidation, bond holders are ahead of other debtors and shareholders to get repaid.

How do I make money with bonds?

Generally, investors profit from the yield they earn by owning bonds. Bond prices can fluctuate, losing value as interest rates rise and gaining value as they fall. But, in general, if you buy a bond at (or even below) face value and hold to maturity, you will earn some yield and get your principal back.

Types of bonds

Types of bonds:

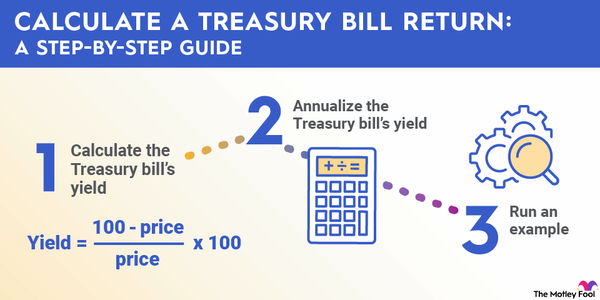

- Treasury bonds, notes and bills are issued by the U.S. government. They range from four weeks to 30 years before maturity and are generally viewed as the safest bonds on Earth.

- Municipal bonds are issued by state and local governments, are generally very safe, and usually pay higher yields than Treasury bonds.

Corporate bonds are issued by private companies. Depending on the financial strength and creditworthiness of the issuer, bonds can be very safe or more risky, and investors are paid a premium in higher yield based on that risk.

Pros and cons of bonds

Pros and cons of bonds

Pros

- A stable, low-volatility source of income.

- Lower risk of permanent losses than stocks.

- Higher yield than savings helps protect value against inflation.

Cons

- Can lose value if the bond issuer cannot make interest payments or repay at maturity.

- Can lose value if you sell the bond before maturity and interest rates have increased.

- Have generally underperformed stocks as a long-term investment.

How do I buy bonds?

How do I buy bonds?

Just like with stocks, most online brokers have a trading platform for buying and selling corporate and municipal bonds, both new issues (from the company) and secondary markets (from other investors). You can buy Treasury securities directly through the Treasury Direct website.

However, most investors own bonds through bond exchange-traded funds (ETFs) or bond mutual funds. These funds specialize in buying and selling bonds and pool investors’ money to do so, collecting a fee (expense ratio) to cover costs and earn a profit. Depending on the type of bonds you want to own, you can invest in a bond ETF that specializes in it.

Related investing topics

Stocks vs. bonds: Which is the right investment for you?

It's important to remember that stocks and bonds, just like cash, real estate assets, precious metals, cryptocurrency, and a litany of others, are the financial tools in your wealth-building (or maintaining) toolbox. It's important to use the best tool for the job at hand via asset allocation.

What do we know about stocks and bonds as financial tools? Bonds are more stable in the short term, but they tend to underperform stocks over the long term. The inverse is true with stocks, which can be volatile -- very volatile during periods of economic uncertainty -- but have been better wealth-generators when held for five years, a decade, or even longer. That's particularly true if you're regularly contributing new money and making investments.

As a rule of thumb, the further you are from a financial goal, the more stocks and the fewer bonds you should own. But as you move closer to that goal, such as retirement, paying for a child's education, etc., you should move more of your assets into bonds. The idea is to maximize the wealth-building power of stocks over the long term while using bonds to protect that wealth.