A bond is a debt instrument that a government or corporation issues to raise money. Investors who buy bonds receive a fixed return based on the bond's interest rate. Most of us are used to borrowing money in some capacity, whether it's mortgaging our homes or asking a friend for a few bucks. Similarly, companies, municipalities, and the federal government borrow money, and they use bonds to do it.

How bonds work

Bonds are a way for an organization to raise money. Let's say your town is seeking investments. In exchange, it promises to pay back investments with interest over a specified period of time.

For example, you might buy a 10-year, $10,000 bond paying 3% interest. In exchange, your town pays you interest on that $10,000 every six months and returns your $10,000 after 10 years.

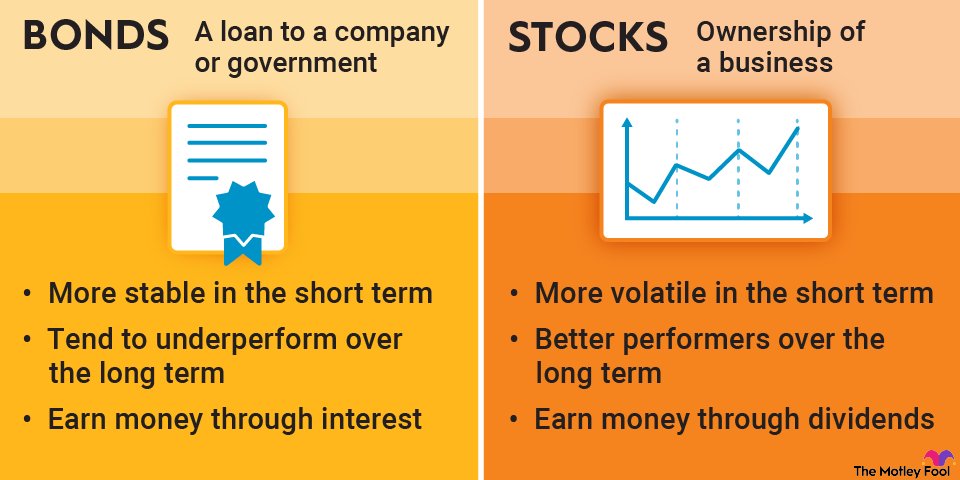

Bonds

How to make money from bonds

There are a few ways to make money by investing in bonds:

- Hold bonds until their maturity date and collect interest payments on them. Bond interest is usually paid twice a year.

- Buy zero-coupon bonds and hold until the maturity date. This type of bond is sold at a discount to its face value, so you receive more than what you paid when the bond matures.

- Sell bonds at a price higher than you initially paid.

Bond prices can fluctuate, giving bond traders the opportunity to make a profit. For example, if you buy $10,000 worth of bonds at face value -- meaning you paid $10,000 -- and then sell them for $11,000 when their market value increases, you can pocket the $1,000 difference. Bond prices normally rise for the following reasons:

- The borrower's credit risk profile improves. This indicates they're more likely to repay the bond, so the price would typically rise.

- Interest rates on newly issued bonds decrease. The value of older bonds at higher rates will go up.

Yields, or the interest rate a bond pays, and bond prices tend to have an inverse relationship, meaning they move in opposite directions. If interest rates increase, prices for existing bonds are likely to fall because they offer lower rates than newly issued bonds.

Investing in bond funds

Bond funds take money from many different investors and pool it for a fund manager to handle. Usually, this means the fund manager uses the money to buy an assortment of individual bonds. Investing in bond funds is even safer than owning individual bonds.

Types of bonds

Bonds come in a variety of forms, each with its own set of benefits and drawbacks:

- Corporate bonds: These tend to offer higher interest rates than other types of bonds, but the companies that issue them are more likely to default than government entities.

- Municipal bonds: Also called muni bonds or simply "munis," these are issued by states, cities, and other local government entities to finance public projects or offer public services.

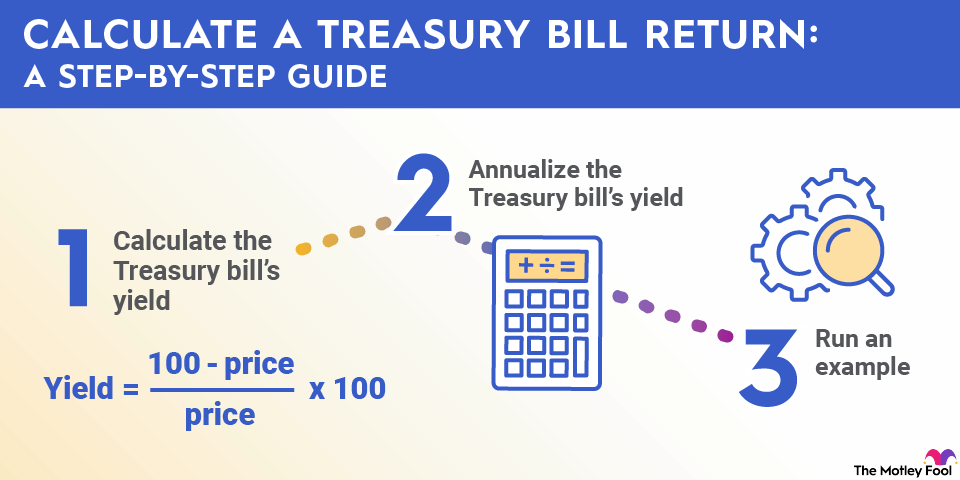

- Treasury bonds: Nicknamed T-bonds, these are issued by the U.S. government. Because of the lack of default risk, they don't have to offer the same (higher) interest rates as corporate bonds.

How to buy bonds

Unlike stocks, most bonds aren't traded publicly but rather trade over the counter, meaning you must use a broker. Treasury bonds, however, are an exception. You can buy those directly from the U.S. government at TreasuryDirect without going through a middleman.

The problem with this system is that investors have a harder time knowing whether they're getting a fair price because bond transactions don't occur in a centralized location.

A broker, for example, might sell a certain bond at a premium (meaning above its face value). Thankfully, the Financial Industry Regulatory Authority (FINRA) regulates the bond market to some extent by posting transaction prices as that data becomes available.

Pros and cons of investing in bonds

Pros:

- Safety: One advantage of buying bonds is that they're a relatively safe investment. Bond values don't fluctuate as much as stock prices.

- Income: Bonds offer a predictable income stream, paying you a fixed amount of interest twice a year.

- Community: When you invest in a municipal bond, you might help improve a local school system, build a hospital, or develop a public park.

- Diversification: Perhaps the biggest benefit of investing in bonds is the diversification they bring to your portfolio. Over the long run, stocks have outperformed bonds, but having a mix reduces your risk. Investors tend to allocate more money to bonds as they get older and want to trade growth for safety.

Cons:

- Less cash: Bonds require you to lock your money away for extended periods of time.

- Interest rate risk: Bonds carry the risk of interest rate changes. Imagine you buy a 10-year bond paying 3% interest. If that same issuer offers bonds at 4% interest a month later, then your bond drops in value. If you hold it, you'll lose out on potential earnings by getting stuck with that lower rate.

- Issuer default: This is uncommon, but if an issuer defaults on its obligations, you risk losing out on interest payments, getting your principal repaid, or both.

- Transparency: There's less transparency in the bond market than in the stock market, so brokers can sometimes get away with charging higher prices. You might have a harder time determining whether the price you're quoted for a given bond is fair.

- Smaller returns: The return on investment you'll get from bonds is substantially less than what you might get with stocks.

How to choose bonds

Here are the main factors to consider when choosing bonds to buy:

- Security: You can get an idea of a bond's safety from its credit rating. Treasuries don't have credit ratings but are the safest choice, since they're backed by the federal government.

- Yield: Check both the annual percentage yield (APY) and the total amount you'll make over the life of the bond.

- Term: Decide your bond duration. Longer bonds provide more stability but also carry more interest rate risk.

- Tax implications: Treasuries and municipal bonds both offer tax benefits that can reduce your tax liability.

Related investing topics

Should you invest in bonds?

It makes sense to buy bonds when you want a fixed-income investment or need to reduce risk and volatility in your portfolio. Here are some situations when investing in bonds could be a good choice:

- You're near retirement or already retired. You may not have the time to ride out stock market downturns, in which case, bonds are a safer place for your money.

- You're heavily invested in stocks and want to diversify for protection from market volatility.

- You're risk-averse and can't bear the thought of losing money in stocks.

Most people are advised to shift away from stocks and into bonds as they get older. It's not terrible advice, provided you don't make the mistake of dumping your stocks completely in retirement.