Image source: Micron Technology.

I bought shares of Micron Technology (MU +0.81%) in the summer of 2011. At the time, the memory chip maker was battling through Japanese courts to secure a game-changing buyout -- and the final outcome was far from certain.

Nearly three years later, Micron is the proud owner of bankrupt rival Elpida. The acquisition makes Micron the second-largest memory producer in the world, just behind market leader Samsung. Micron is now a giant, standing strong in the rubble of a massive industry consolidation. Unit prices have stabilized thanks to Micron's foot on the throttle and brake pedal of the global production pipeline.

My original investment thesis has played out to a T, and it shows in the stock's fantastic returns -- most of it materializing after the Elpida buyout's closing:

In short, I've made out like a bandit. With a 179% return in 33 months, Micron stands shoulder to shoulder with Netflix (NFLX 0.48%) as my most profitable current holding. Netflix has also delivered a 179% return in roughly 3 years, driven by a strong rebound from the Qwikster debacle in 2011. For Micron, I simply held my horses while the courtroom drama worked itself out. With Netflix, I bought more near the bottom, while critics gloated and other investors panicked.

I'm convinced that the Netflix story is still in its infancy, and that the real payoff for holding that stock is yet to come. I'm nowhere near selling a single share.

But what about Micron?

Like I said, the original Elpida-based investment thesis has already played out, and the stock soared as expected. That's always fun to see, but happy endings raise their own questions.

Is it time to cash in my Micron chips, or is this another long-term winner with a huge runway up ahead?

Wall Street analysts still like Micron's chances to beat the market. The average one-year price target stands at $28 today, leaving nearly 30% headroom for short-term growth. That is, assuming that the average analyst's assumptions and analysis are on target.

The Greek chorus of Street firms sings about stable pricing and smart supply side management. Those are my thoughts exactly, and it's how Micron's surging shares got this far.

On top of that, some of them see expanding price-to-earnings multiples even as the fundamental earnings base grows. That's because Micron's pricing power may not yet have been fully appreciated by most Micron investors.

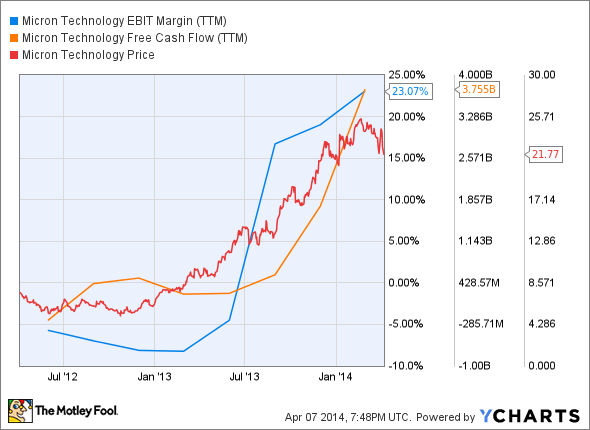

These two charts seem to support that argument:

MU EBIT Margin (TTM) data by YCharts

MU P/E Ratio (TTM) data by YCharts

Micron is indeed growing its earnings very quickly, not to mention experiencing a tremendous surge in free cash flows. And yet, the stock now sells for less than 10 times trailing earnings.

It's still a high-octane growth stock, but priced like a sleepy value play.

So it's not like Micron's stock has priced itself out of reach -- despite the recent share price gains. Forget about analyst forecasts, this company is executing like a machine and delivering on its promises. I'll buy the "expanding multiples" theory at face value, and I'm very comfortable holding on to my Micron shares at the end of the day.

I'm doing it under a brand new thesis, of course.

What I'm looking for in Micron, v2.0

I'll keep a close eye on Micron's execution, particularly how it manages the manufacturing flow into the separate DRAM and NAND Flash memory markets. The company is currently shifting some of the acquired DRAM capacity from Elpida into more profitable NAND production.

If done correctly, Micron's margins should stay strong for the foreseeable future, giving investors a chance to catch up to the increasing value of Micron's business.

So I'll keep an eye on Micron's margins to make sure that management keeps executing properly. And I'll keep another eye on valuation ratios, particularly price to earnings and price to free cash flows. If Micron's shares climb up to industry-standard P/E ratios around the 20x trailing earnings mark, it's time to reassess this analysis again.

But by then, my Micron gains may have doubled again -- or more. So I'm in no hurry to get there.