Treasury bonds are one of the safest ways to invest your money, but understanding how they work and how to buy them is key before you get started.

What is a Treasury bond?

A Treasury bond, often called a "T-bond", is a long-term loan you make to the U.S. government. When you buy one, you’re lending money to the federal government in exchange for regular interest payments and the return of your original investment when the bond matures.

Treasury bonds are fully backed by the U.S. government, making them one of the safest investments available. They’re issued in 20- and 30-year terms and pay interest every six months. Because of their safety, Treasury bonds typically offer lower interest rates than corporate bonds.

You don’t have to hold a Treasury bond for its full term. Bonds can be sold before maturity, though their market value may rise or fall depending on interest rates.

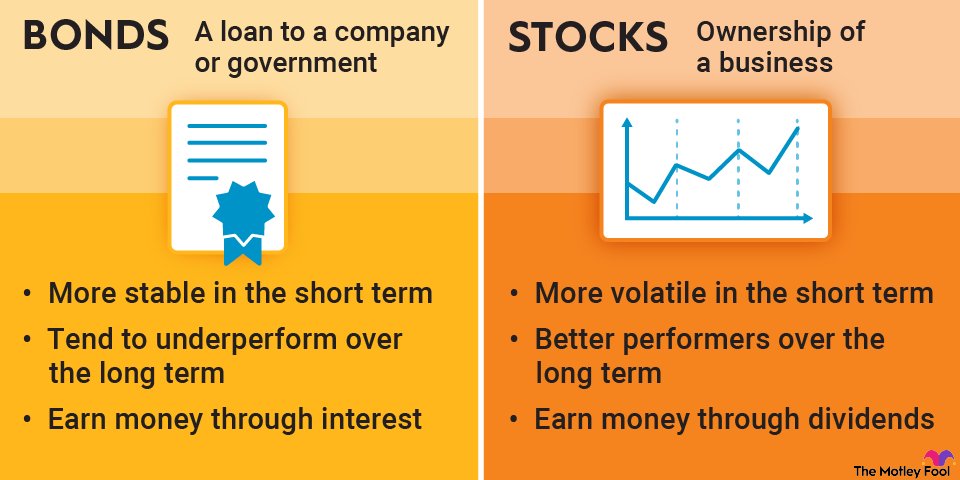

Bonds

Understanding interest rate risk

While Treasury bonds are very safe from a credit standpoint, they’re still subject to interest rate risk.

When interest rates rise, the value of existing bonds usually falls. That’s because newer bonds may offer higher yields, making older, lower-yield bonds less attractive to buyers. Longer-term bonds, like Treasury bonds, tend to be more sensitive to rate changes than shorter-term securities.

If you hold a Treasury bond until it matures, interest rate changes won’t affect the amount you get back -- you’ll receive the full face value plus interest. Interest rate risk mainly matters if you plan to sell the bonds before maturity.

How to invest in Treasury bonds

There are three common ways to invest in Treasury bonds, depending on how hands-on you want to be.

1. Buy Treasury bonds directly from the government

You can purchase Treasury bonds through TreasuryDirect, the U.S. Department of the Treasury’s official website. This option allows you to buy bonds directly at auction, often in $100 increments, without paying brokerage fees.

This approach works well if you plan to hold bonds until maturity and don’t expect to trade them. The main drawback is flexibility. Bonds purchased through TreasuryDirect generally must be held for at least 45 days, and selling early requires transferring them to a brokerage account.

2. Buy Treasury bonds through a brokerage account

Many of thebest online brokers let you buy and sell Treasury bonds just like stocks. This gives you more control and the ability to sell before maturity if your plans change.

The trade-off is that brokers often require a minimum purchase of $1,000 per bond, which can be a higher hurdle for newer investors.

3. Invest through Treasury bond ETFs

Another option is investing through Treasury bond ETFs, which hold baskets of government bonds in a single fund.

Treasury bond ETFs can make it easier to:

- Diversify across many bonds at once

- Manage interest rate risk

- Buy and sell without tracking individual maturity dates

This option is often the simplest starting point for investors who want Treasury exposure without managing individual bonds.

Treasury Bonds vs. notes vs. bills

The U.S. government issues several types of Treasury securities, which mainly differ by maturity length:

- Treasury bonds: Long-term securities with 20- or 30-year maturities

- Treasury notes: Intermediate-term securities with maturities from two to 10 years

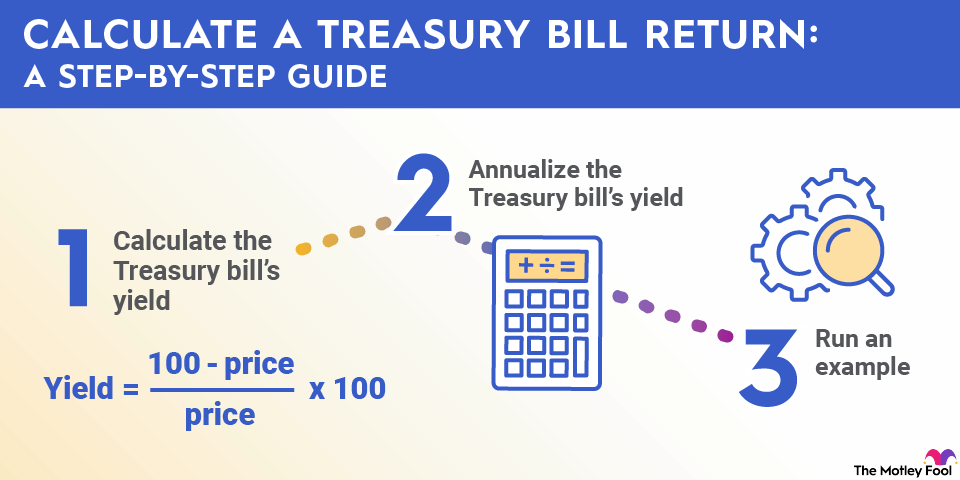

- Treasury bills: Short-term securities that mature in one year or less and are sold at a discount rather than paying interest

All are backed by the U.S. government, but shorter-term securities generally carry less interest rate risk than long-term bonds.

A note on savings bonds

Savings bonds, such as Series EE and Series I bonds, are also issued by the U.S. government but work differently from marketable Treasury bonds. They’re designed more for long-term saving than investing and must be purchased directly through the government.

Series I bonds, in particular, offer inflation protection, which can make them appealing during periods of high inflation. However, they come with purchase limits and early-withdrawal restrictions that don’t apply to Treasury bonds.

Taxes and treasury bonds

Interest earned on Treasury bonds is exempt from state and local income taxes, but it is subject to federal income tax. This tax advantage can make Treasuries especially attractive to investors who live in high-tax states.

The bottom line

Treasury bonds can play an important role in a diversified portfolio, especially for investors seeking stability and reliable income. Whether you buy bonds directly, use a brokerage account, or invest through ETFs, understanding how Treasuries work can help you choose the approach that best fits your goals and risk tolerance.