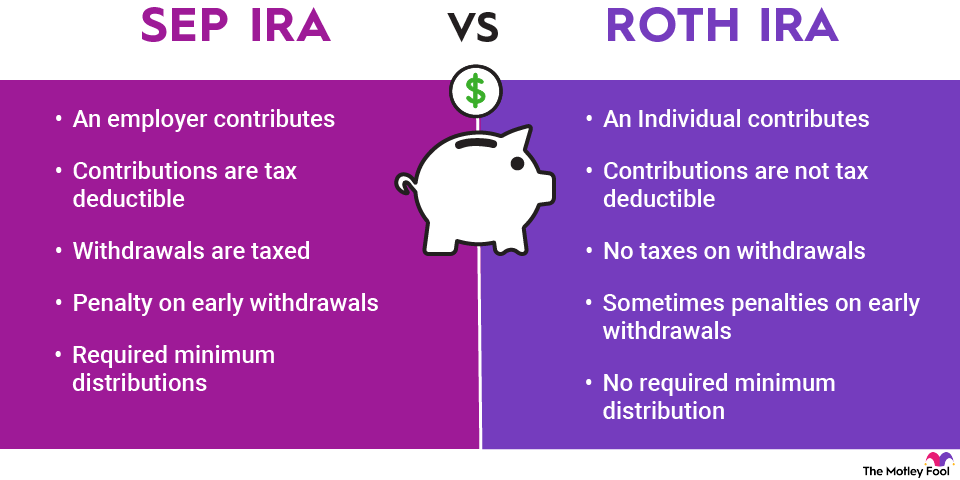

Like most retirement accounts, early withdrawals taken before age 59 1/2 from a SEP IRA are subject to a 10% penalty. Additionally, SEP IRAs funded with pre-tax money are subject to required minimum distributions starting at age 73.

The SEP IRA is a simple retirement plan for small businesses. A better option for individual business owners with no employees may be a Solo 401(k). There are several advantages to a Solo 401(k) vs a SEP IRA.

What is a Roth IRA?

A Roth IRA is a retirement savings account available to most individuals with earned income.

The big difference between a Roth IRA and a traditional IRA is how they're taxed. Unlike a traditional IRA or SEP IRA, contributions to a Roth IRA are not exempt from income tax. Individuals still pay taxes on any amount they put into a Roth IRA, but their investments inside the account still grow without incurring any taxes. In exchange for paying taxes on contributions, Roth IRA withdrawals are completely tax-free.

An additional benefit of a Roth IRA is that you can withdraw contributions at any point in time without paying any penalties. Even if you haven't reached the age of 59 1/2, as is required for other retirement accounts, you can take out any amount you contributed directly to the Roth IRA at any time. You can take a penalty-free withdrawal of any amount converted from a traditional IRA, SEP IRA, 401(k), or other retirement account to a Roth IRA five years after the conversion. This advantage makes it an extremely flexible retirement savings account.