A SEP IRA is a special type of retirement account designed for small business owners and their employees, as well as self-employed individuals.

"SEP" stands for "Simplified Employee Pension," and "IRA" is short for "Individual Retirement Account." SEP IRAs can help self-employed individuals and small business owners save for retirement in a tax-advantaged manner.

What is a SEP IRA?

A SEP IRA is a type of retirement plan that enables small business owners, along with their employees, to save money for retirement. Like other IRAs, SEP IRAs are fully owned and controlled by the beneficiary of the account.

While SEP IRAs are available to businesses of any size, they're best suited for the self-employed or businesses with very few employees. An employer that establishes a SEP IRA is responsible for 100% of the contributions and must provide equal benefits to all eligible employees.

How does a SEP IRA work?

Individual employees do not make contributions to a SEP IRA. Instead, the company owner contributes all the funds into the employees' accounts.

As a percentage, contributions to the SEP IRA of each owner and employee must be equal. If an employer contributes to his or her own SEP IRA an amount equivalent to 10% of their annual compensation, then the employer must contribute for each employee an amount equal to 10% of the employee's salary.

The funds in a SEP IRA are owned and managed by the individual employee. There is no vesting requirement like many 401(k) plans have.

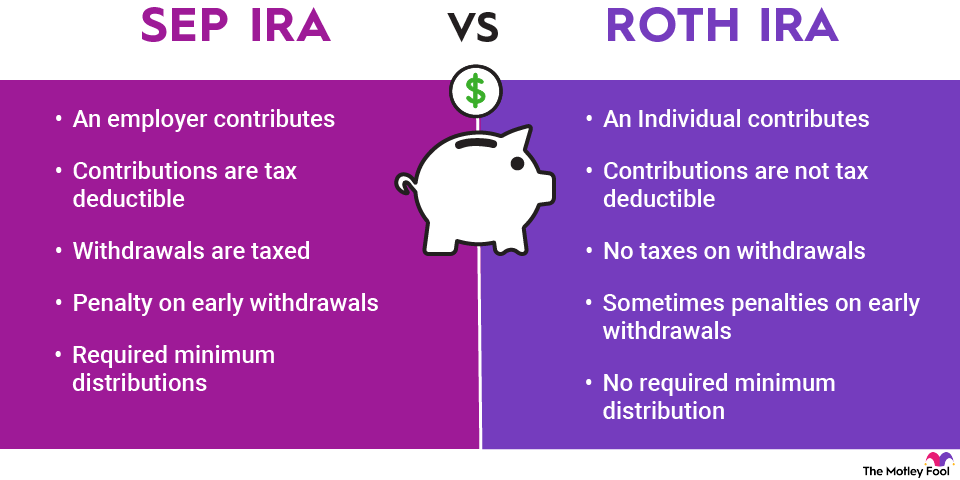

Most SEP IRAs have the same investment, distribution, and rollover rules as traditional IRAs, with investments in SEP IRAs increasing on a tax-deferred basis until the owner withdraws from the account. However, under new Secure Act 2.0 rules, you can make Roth (post-tax) contributions to a SEP IRA and receive post-tax withdrawals in retirement.

Individuals are required to pay taxes on their withdrawals in retirement from a SEP IRA. Just as with a traditional IRA, SEP IRA withdrawals are treated as ordinary income for tax purposes. Early withdrawals, or those taken before the age of 59 1/2, are subject to an additional 10% penalty on the amount withdrawn. SEP IRA holders must take required minimum distributions (RMDs) starting at age 73.

Investment options with SEP IRAs

SEP IRA owners have relatively few restrictions on the types of securities they can hold in their account. Collectibles and life insurance, for example, are not permitted by the Internal Revenue Service (IRS), but these asset types are unlikely to appeal to most investors. The IRS also prohibits investors from using their SEP IRA funds to trade derivatives with undefined or unlimited risk.

The specific investment options available to each SEP IRA holder vary depending on where the account is held. Most brokerages permit SEP IRA owners to buy and sell most securities and financial instruments, including stocks, bonds, exchange-traded funds (ETFs), mutual funds, money market funds, and certificates of deposit (CDs). Some brokerages restrict certain types of trading activity, such as options trading.

Who's eligible for a SEP IRA

You are eligible to establish a SEP IRA if you're either self-employed or a business owner. If you have employees, they are considered by the IRS as "eligible" for a SEP IRA if they meet these criteria:

- Are at least 21 years old

- Have worked for the company in three of the past five years

- Receive at least $750 in compensation in 2025 and 2026

All eligible employees must have SEP IRAs established for them. While an employer may set less strict eligibility requirements, the same requirements must apply equally to all owners and employees of a company. A business owner can change a company's eligibility criteria at any time provided that the criteria is at least as strict as the IRS criteria.

SEP IRA contribution limits

The per-person annual contribution limit for a SEP IRA is the lesser of:

- 25% of the business owner or employee's compensation, or

- $70,000 in 2025 or $72,000 in 2026

That's a lot more than the $7,500 standard contribution limit for an IRA in 2026. An employer can also opt not to fund a SEP IRA in a given year provided that all owners and employees receive equal treatment.

Combining a SEP IRA with other retirement accounts

If you have a SEP IRA, you can still establish other types of retirement accounts. But because a SEP IRA is an employer-sponsored retirement plan, the IRS imposes some additional restrictions on your ability to contribute to other retirement funds.

SEP IRAs combined with traditional IRAs

If you participate in a SEP IRA, you can still open a traditional IRA. But if your employer contributes to your SEP IRA and you earn more than a certain amount of income, your contributions to your traditional IRA are not fully tax-deductible.

For 2025, the tax deduction starts phasing out when your modified adjusted gross income reaches $79,000 for individuals and $126,000 for people married filing jointly. In 2026, these thresholds increase to $81,000 for single filers and $129,000 for married couples filing a joint tax return.

SEP IRAs combined with Roth IRAs

You can establish a Roth IRA even if you participate in a SEP IRA. The maximum amount that you are annually allowed to contribute to a Roth IRA is unaffected by holding any employer-sponsored plan such as a SEP IRA. However, the ability to contribute to a Roth is restricted for all high earners.

SEP IRAs combined with 401(k)s

You are unlikely to have a SEP IRA and a 401(k) from the same employer since the annual contribution limits for employers apply to both types of accounts combined. If you have two separate jobs offering two retirement plans, you can fully participate in both employer-sponsored retirement plans. You can have a SEP IRA at one job and a 401(k) at the other.

SEP IRAs combined with HSAs

You can contribute to both a SEP IRA and a health savings account (HSA). SEP IRA contributions don't affect HSA contribution limits or the tax treatment of HSA contributions. If your employer offers both a SEP IRA and an HSA and contributes matching funds to the HSA, those HSA funds are not counted as income to you as an employee.

How to open a SEP IRA

Opening a SEP IRA is very simple. Most banks and brokerages offer a pre-approved SEP IRA plan prototype that meets IRS standards. The IRS also offers business owners the option of using its own model SEP or a custom plan.

Employers must provide all pertinent information about the SEP IRA to employees. Then the business owner can open individual accounts for each eligible person.

The annual deadline to open and fund a SEP IRA is the due date of the company's income tax return. The deadline to open and fund an account for 2025 is when the business files taxes in 2026.

Is a SEP IRA right for you?

SEP IRA contributions are deductible as a business expense on corporate tax returns, and, for self-employed individuals, SEP IRA contributions are tax-deductible on individual tax returns. These tax benefits, combined with the low cost and administrative simplicity of establishing a SEP IRA, make them appealing to many entrepreneurs.

But since business owners are responsible for 100% of contributions to SEP IRAs and must contribute equally on a percentage basis to the SEP IRA of every owner and employee, SEP IRAs are not well suited for every business. SEP IRAs are best designed for small businesses with few employees and with few or none of those employees meeting the eligibility requirement. Highly compensated owners of single-person businesses can also benefit from SEP IRAs because of the high contribution limits.

If you earn enough money to contribute the maximum permissible amount to a SEP IRA, a SEP IRA may be a smart choice. But if you are self-employed with no employees, then a solo 401(k) may be a better option.