When is the SEP IRA contribution deadline?

The annual deadline for SEP IRA contributions is tax day, which is generally April 15. You have until April 15 every year to contribute up to the maximum permissible amount to your SEP IRA for the prior year.

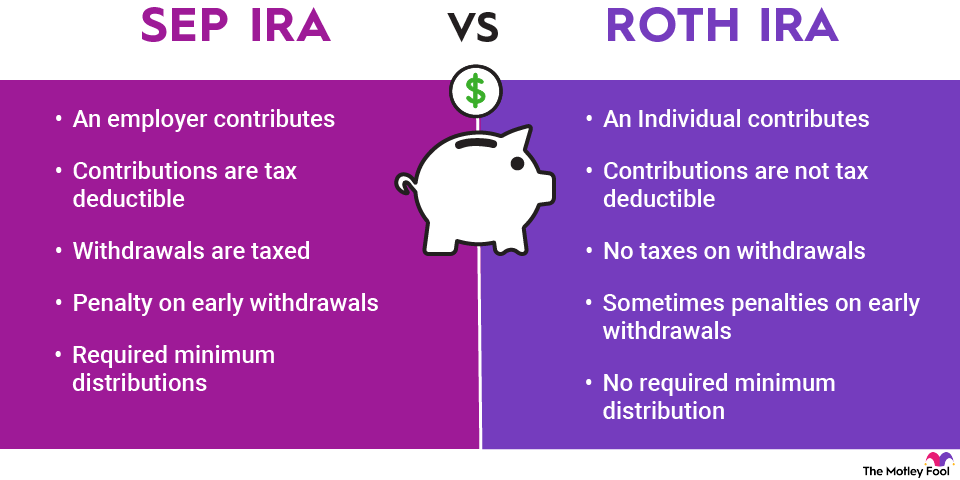

The biggest drawback of a SEP IRA

The biggest drawback of a SEP IRA, for employers, is the requirement that percentage-of-salary contributions for employers match those of employees. Of course, if you don't have any employees, that disadvantage is irrelevant. It is also less problematic if you have very few employees, low-paid employees, or no employees who meet the eligibility requirements.

Is a SEP IRA right for you?

Whether a SEP IRA is right for you depends largely on the nature and size of your business. Assuming you don't have a large number of eligible employees, SEP IRAs can be attractive because they are simple and allow you to invest in a wide range of securities.

Unlike 401(k) plans, SEP IRAs are administratively easy to establish and maintain. Most financial institutions have streamlined procedures, which include completing IRS Form 5305-SEP, to open SEP IRA accounts. Once you create individual accounts for yourself and your employees, each person is responsible for managing their own account.

Furthermore, with a SEP IRA, you can buy and sell a range of investments typically much wider than what is offered by other employer-sponsored plans -- another benefit attractive to many investors.

Related Retirement Topics