What Customers Want From Banks: Online Banking Trends and Consumer Priorities

Between the big banks, credit unions, and online-only banks, there are more banking options than ever before. How do consumers decide which bank they'll use?

To find out, we surveyed 2,000 consumers to find out how important different banking features are to them.

Read on for the full findings of Motley Fool Money's 2024 Digital Banking Trends and Consumer Priorities survey and learn exactly what consumers value in a bank.

Key findings

- Top banking priorities: 91% of respondents view digital banking as an important factor in choosing where to bank, on par with security and fraud protection and quality customer service.

- The most important interest rates: A competitive savings interest rate matters most across all generations.

- Bank switching barriers: 3 out of 4 respondents would switch banks if they find one that better fits their needs, but the hassle of doing so and needing to update automatic payments and direct deposits are obstacles.

What do customers want from banks?

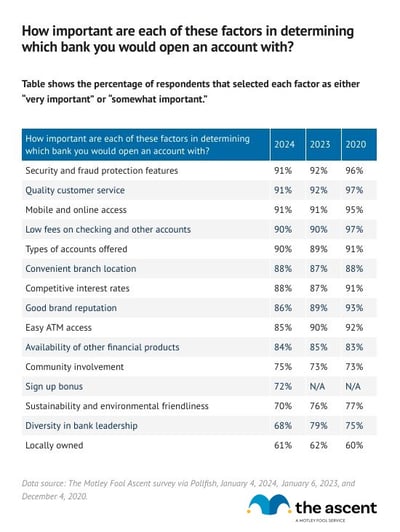

Here are the factors that Americans value most when choosing where to bank:

Security and fraud protection features, customer service, and mobile and online access are the most important features for Americans when it comes to picking a bank.

Low fees on checking accounts and other deposit accounts are also important. Brick-and-mortar checking accounts can have monthly fees of $10 to $15. There are ways to avoid monthly checking account fees, including by maintaining a minimum account balance.

Many of the top features cited by respondents go hand in hand with online banking.

Online banks can offer lower (or zero) fees on checking accounts than brick-and-mortar banks. while maintaining banking safety for their customers. Customers who bank online can also enable account balance notifications that can warn them if they're in danger of overdrafting and getting hit with a fee. Other online banks have stopped charging overdraft fees entirely.

Online banks offer multiple types of deposit accounts with low minimum deposit requirements. Direct deposits with online bank accounts are straightforward to set up. Like overdraft fees, some banks are doing away with minimum deposit requirements to open accounts altogether.

Banking priorities by generation

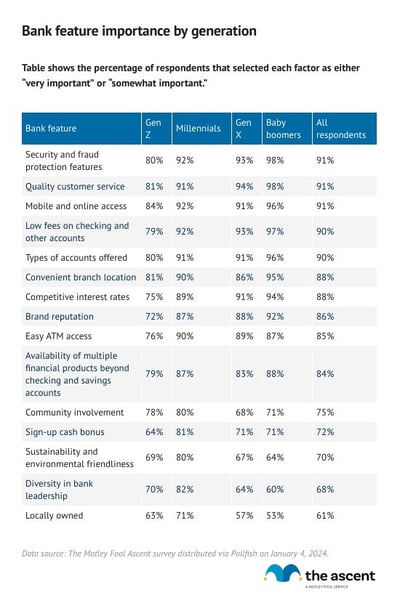

Banking priorities differ by generation -- reflecting the habits, needs, and preferences of each age group.

Gen Z are by far the least likely to value competitive interest rates offered by their bank.

They also place little importance on ATM access, convenient branch location, and low account fees relative to other generations. Less than 80% of Gen Z respondents said those factors were important, compared to close to 90% or more for older generations.

Availability of multiple financial products is less important to Gen Z (79%) than other generations.

Generational differences with regard to ATM and branch access reflect that Gen Z's experience with banking has been mobile-first, while older generations transitioned from brick-and-mortar banking to digital banking and may still appreciate some of those physical features. Older generations may still prefer to deposit checks through an ATM instead of through an app, or seek out a physical bank branch for cash deposits, for example.

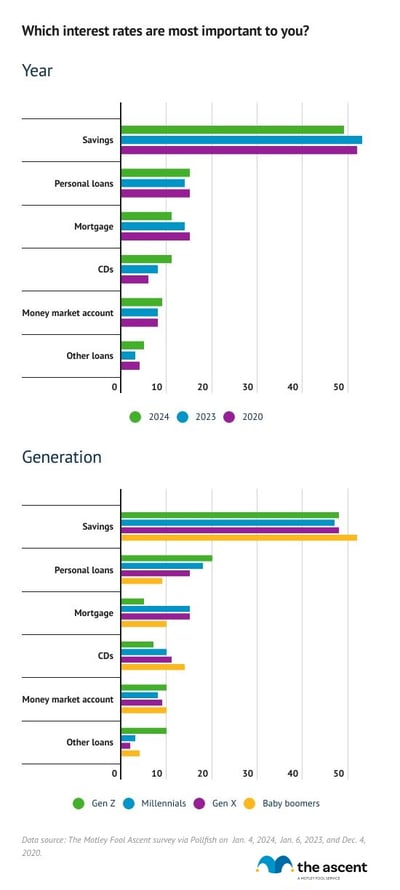

Banking trends: Savings rates are most important to consumers

The banks with the best savings accounts still have a big advantage in attracting customers, because savings interest rates are what consumers focus on the most.

| For which product are competitive interest rates most important to you? | 2024 | 2023 | 2020 |

|---|---|---|---|

| Savings | 49% | 53% | 52% |

| Personal loans | 15% | 14% | 15% |

| Mortgage | 11% | 14% | 15% |

| CDs | 11% | 8% | 6% |

| Money market account | 9% | 8% | 8% |

| Other loans | 5% | 3% | 4% |

While slightly fewer respondents in 2024 selected savings as the most important product for a competitive interest rate to be attached to, it's still by far the highest priority for competitive interest rates.

The importance of competitive rates for personal loans has remained mostly stable in recent years.

Respondents placed slightly less importance on interest rates on mortgages, perhaps reflecting less interest in home buying as mortgage rates have increased.

As rates have risen, respondents have placed more importance on competitive rates for fixed-term products, like certificates of deposit (CDs). The best CDs offer interest rates that are comparable to the best high-yield savings accounts, but CD owners can't touch their money for the duration of their account's term.

Interest rate priorities by generation

Respondents across generations are in agreement that competitive interest rates are most important for savings accounts.

Twice as many baby boomer respondents placed top importance on CD interest rates than Gen Z, 10% compared to 5%. A larger share of Gen Z see rates on "other loans" as most important than any other generation.

Gen Z are also least likely to see mortgages as the most important product to get a competitive interest rate for, likely because they don't yet make up a significant part of the home-buying market.

| For which product are competitive interest rates most important to you? | Gen Z | Millennials | Gen X | Baby boomers | All respondents | Savings |

|---|---|---|---|---|---|---|

| Savings | 48% | 47% | 48% | 52% | 49% | 40% |

| Personal loans | 20% | 18% | 15% | 9% | 15% | 49% |

| Mortgage | 5% | 15% | 15% | 10% | 11% | 58% |

| Certificates of deposit (CDs) | 7% | 10% | 11% | 14% | 11% | 53% |

| Money market account | 10% | 8% | 9% | 10% | 9% | |

| Other loans | 10% | 3% | 2% | 4% | 5% |

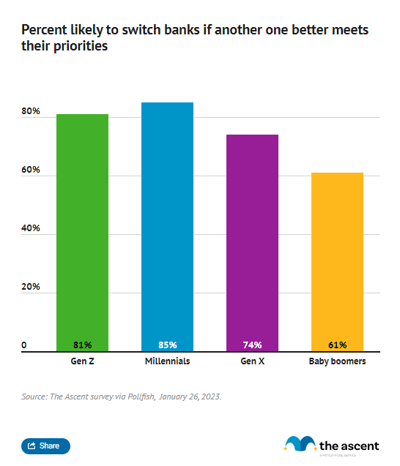

76% of consumers are likely to switch banks if they find one that better fits their needs

Seventy-six percent of respondents said they are likely to switch banks if they find one that better meets their priorities, up from 52% in 2020 and in line with 79% of respondents in 2023.

Consumers are willing to move their money to a bank that better suits their needs -- whether it be by offering better interest rates, lower account fees, or other factors.

| How likely are you to switch banks if you find one that better meets your priorities | Likely |

|---|---|

| Gen Z | 73% |

| Millennials | 86% |

| Gen X | 77% |

| Baby Boomers | 67% |

| All respondents | 76% |

Younger generations are more likely to switch banks than older generations. Millennials show the most willingness to switch banks, while baby boomers show the least -- although 67% of baby boomers say they would be likely to do so if they found one that's a better fit.

This may be a reflection of younger generations feeling less loyal to their banks or more comfortable with jumping through the hoops of switching banks, which can be an entirely online process in most instances.

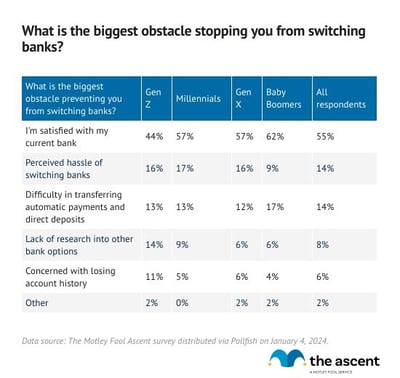

Hassle, changing automatic payments and direct deposits are biggest obstacles to switching banks

For the majority of respondents, the main reason they don't plan to switch banks is that they're satisfied with their current bank. Beyond that, the expected hassle of switching and having to set up automatic payments and direct deposits with a new bank are the most-cited blockers to switching banks.

Gen Z was the only generation for which the majority of respondents did not say they're satisfied enough with their bank to not switch. Baby boomers are most likely to be satisfied enough with their bank to not consider finding a new one.

Opening a new bank account is relatively painless as long as you have the right personal information on hand. Setting up automatic bill pays and direct deposits, however, can be more of a hassle, and was cited by 14% of respondents as the largest obstacle to switching banks.

Banks need to have it all

To keep consumers happy, banks can't neglect anything. Consumers consider just about every banking feature important. They look for accounts with low fees and competitive interest rates. They want their money to be both secure and easy to access. They expect quality customer service and a good brand reputation.

It's nice to see that social responsibility matters for a majority of consumers when choosing a bank. People want a bank with environmentally friendly practices, diversity in its leadership, and community involvement. These factors may not be at the very top of the list yet, but we expect to see them become more and more important to consumers.

FAQs

-

Motley Fool Money's survey revealed three key consumer trends in banking:

- Digital banking, fraud protection, and customer service are top banking needs.

- Savings rates are the most important type of interest rates for bank customers.

- There is a growing willingness to switch banks if customers feel their banking needs aren't being met.

-

Mobile and online banking was a top priority among 91% of respondents. Importance placed on digital banking was consistent across generations.

Methodology

Motley Fool Money, distributed surveys via Pollfish on Jan. 4, 2024, Jan. 6, 2023, and Dec. 4, 2020. Results were post-stratified to generate nationally representative data based on age and gender. Pollfish employs organic random device engagement sampling.

Our Research Expert

Motley Fool Stock Disclosures

The Motley Fool has a disclosure policy.