About the Author

The Motley Fool has a disclosure policy.

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

To keep track of your investments, it’s important to understand how to calculate an average stock price. If you like a stock, you’re probably not going to just buy it once and then never again. Investors often prefer dollar-cost averaging, putting a set amount of money into stocks at regular intervals. You can gradually increase your position this way while smoothing out some of the market’s volatility.

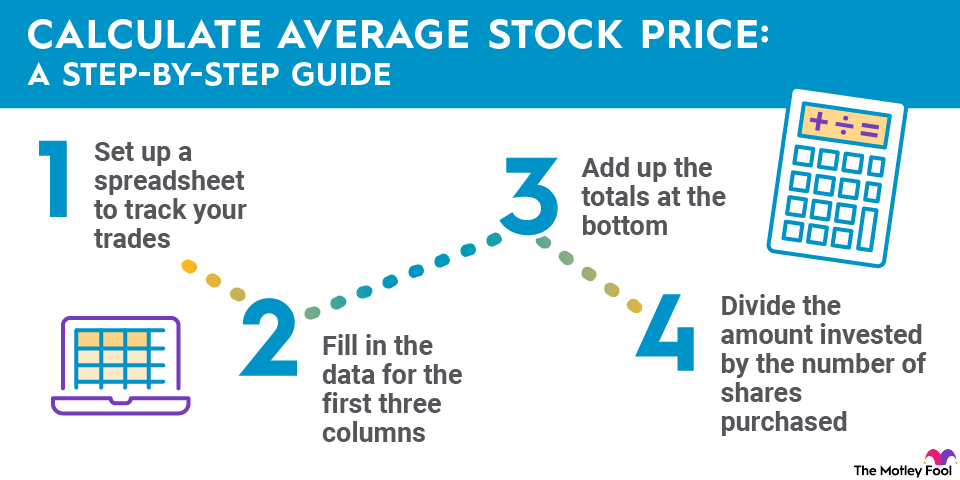

There is a little more work involved, though. Each investment will change the average price paid for the stock, which is your breakeven point. Fortunately, this is fairly easy to calculate. Here’s how to do it, step by step, based on how much you invest and how many shares you purchase.

You can do this with your program of choice, such as Excel, or by hand. Make columns for:

This information will be available in your brokerage statements. You can also fill it in after every trade.

In the last row, calculate the sum of the amount invested and number of shares purchased columns. If you’re doing this with a spreadsheet program, you can set up a formula to calculate it for you.

After you do this, you’ll have your average stock price paid on each purchase date, as well as a total average for all your trades.

Let’s say you’ve decided to invest in stocks, starting with $250 per month, in a company you like. You do that for the first six months of the year. It was originally trading for $25 per share, but the market was volatile, so it moved around quite a bit. To see if your decision paid off, you calculate your average stock price.

Here’s a sample of what this would all look like on a spreadsheet:

In this case, dollar-cost averaging paid off. Since you didn’t invest all your money at once, you paid a lower average stock price. While that’s not always the way it works, spreading out your investments is a good strategy for dealing with market volatility.

When you’ve purchased shares of a stock multiple times, being able to figure out the average price you’ve paid comes in handy. You’ll have a firm grasp of your breakeven point and be able to figure out your investing returns.