We're still a few weeks shy of the holiday season, so why not gift your loved ones a stock with an increasing dividend?

Last week gave us a fresh collection of potential raisers to choose from, among which were Rockwell Automation (ROK 0.50%), The Estee Lauder Companies (EL -1.61%), and Mercury General (MCY -1.67%). Here are a few details about each.

Image source: Getty Images

Rockwell Automation

Industrial machinery specialist Rockwell Automation has declared a quarterly dividend of just under $0.84 per share, which is 10% higher than its previous payout.

The company is in a very good position, as a leading industrial automation specialist in a world trying its best to automate technical processes. That's a key reason Rockwell attracted the attention of Emerson Electric, which recently tried several times to acquire the company but was rejected.

Rockwell's recent financials have been encouraging. In Q2, the company reported sales growth of nearly 9% on a year-over-year basis to just under $1.6 billion. Net profit came in 14% higher, at almost $217 million. The company attributed much of those improvements to what it termed "broad-based sales growth across regions and industries."

This has also given a boost to the company's operating and free cash flow, both of which have been on the rise lately. The latter has been more than sufficient to cover the company's spend on dividends and share repurchases, so I think the upcoming distribution will be at least sustainable for the time being.

ROK Free Cash Flow (TTM) data by YCharts

Rockwell's new dividend will be paid on Dec. 11 to shareholders of record as of Nov. 13. Its payout ratio on the Q2 adjusted net profit is 47%, while its yield would be 1.7%. The latter figure is slightly below the current 1.9% average of dividend-paying stocks on the S&P 500.

The Estee Lauder Companies

The world wants to look beautiful, and cosmetics industry veteran Estee Lauder is doing well satisfying this desire. Buoyed by strong fundamentals, the company is lifting its quarterly dividend by 12% to $0.38 per share.

In the company's inaugural quarter of its fiscal 2018, revenue rose an impressive 14%, while adjusted net profit advanced a more impressive 43% to $454 million. It seems that the company's efforts to appeal to younger consumers is paying off -- recent acquisitions, specifically Too Faced and BECCA, are contributing nicely to growth. The market was impressed with this performance; the company's stock popped on the results.

EL Net Income (TTM) data by YCharts

A resilient economy also helps: Estee Lauder said that the majority of its luxury and midsize brands saw double-digit sales increases during the quarter.

Similarly to Rockwell Automation, Estee Lauder's improved sales and profitability and filtering down into the cash flow statement. FCF has increased lately, clocking in at $1.5 billion on a trailing-12-month basis. That's nearly double what the company paid out in dividends and stock buybacks. Considering that and the company's good fundamental performance, I'd rate the new dividend as being very safe for now.

Estee Lauder is to dispense its next payout on Dec. 15 to investors of record as of Nov. 30. At the most recent closing share price, it would yield 1.2%; its payout ratio on Q1 adjusted net profit is 31%.

Mercury General

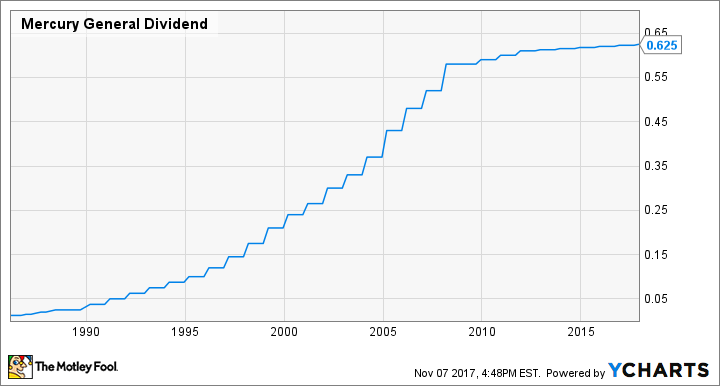

Insurance provider Mercury General is sticking to a long-established habit of raising its dividend, declaring a 0.3% bump in its quarterly payout to slightly over $0.62 per share. Raising is such a habit that the company is a Dividend Aristocrat, a prominent stock that has increased its payout at least once annually for a minimum of 25 years in a row.

MCY Dividend data by YCharts

Mercury's latest increase comes on the heels of its Q3 results announcement, which revealed a 6% increase in revenue to $858 million. This performance was due largely to nearly $21 million worth of investment gains -- quite a switch from the same quarter last year, when the company booked a loss of over $15 million. The flip had a sharper impact on the bottom line, which rose a precipitous 73% to land at over $46 million.

Mercury is an incremental dividend raiser, so this slightly enhanced payout won't affect its financials much. Meanwhile, both operating and free cash flow have risen notably over the past year or so. This situation provides greater coverage for shareholder payouts should the company decide to be more generous with raises.

The next Mercury General dividend is to be dispensed on Dec. 28 to shareholders of record as of Dec. 14. It would yield a beefy 4.5% on the most recent closing share price. The new distribution's payout ratio is 74%.

Expecting Santa

We're drifting away from the last earnings season of the year. As a result, the frequency of dividend raises should taper off somewhat. But 2017 has been a banner year for increases, so we should expect a clutch of new raises before the year is over. Watch this space for the latest ones.