Shares of Netflix (NFLX -0.63%) plunged as much as 14% on Tuesday, before recovering to end the day with a more modest 5% loss. A Q2 earnings report that didn't live up to investors' lofty expectations was responsible for this wipeout.

As Netflix's management noted, the second quarter was "strong but not stellar." Yet with Netflix stock trading for more than 80 times the company's projected 2019 profit, strong results may not be enough to keep the stock aloft -- nothing short of extraordinary will do.

There are some signs in Netflix's Q2 earnings report that suggest that growth will be harder to come by in the future. However, other aspects of the report imply that the company is just scratching the surface of its profit potential. Thus, Netflix is likely to remain a battleground stock for the foreseeable future.

A rare miss on subscriber growth

Three months ago, Netflix estimated that it would add 6.2 million streaming subscribers globally in the second quarter: 1.2 million in the U.S. and 5.0 million in the rest of the world. Instead, its global subscriber count only rose by 5.15 million. The shortfall was split across the domestic and international markets. Netflix added 670,000 streaming subscribers in the U.S. and 4.47 million streaming subscribers in its international markets.

This was the first time that Netflix fell short of its subscriber growth forecast since Q1 2017 and the first time in two years that it missed by more than 10%.

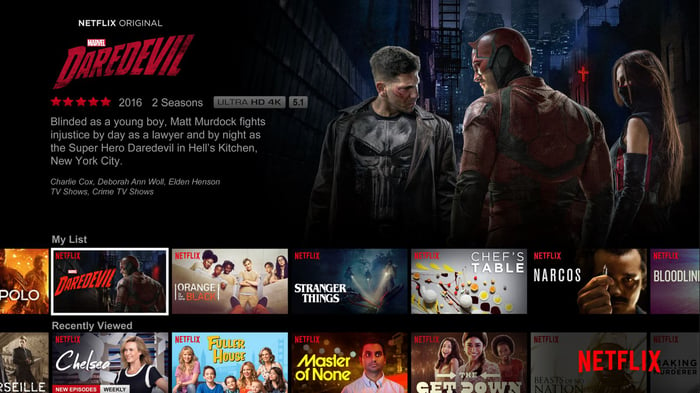

Netflix's domestic subscriber growth slowed last quarter. Image source: Netflix.

Netflix came much closer to meeting the other elements of its forecast in the second quarter. It even beat its earnings-per-share guidance by $0.06, thanks to an $85 million one-time gain. However, investors have focused most of their attention on the subscriber growth miss.

Rising marketing spending but slowing growth

The most troubling part of Netflix's Q2 earnings report was that domestic growth slowed despite a huge increase in marketing. Netflix doubled its marketing spending year over year last quarter, continuing a trend from the first quarter. Nevertheless, subscriber growth slipped to 670,000 from 1.07 million a year earlier.

Management noted that the company has still added 2.63 million domestic streaming subscribers in the first half of the year, up from 2.49 million in the first half of 2017. Still, this is little comfort given that Netflix has doubled its domestic marketing spending. Additionally, the streaming video pioneer expects domestic net subscriber additions to be down by 0.2 million year over year in the third quarter.

Despite the slowdown in subscriber growth, Netflix's domestic streaming business posted a 26% revenue increase last quarter, driving a 32% uptick in its contribution profit. This might make it seem like there's nothing to worry about.

However, due to the nature of Netflix's business model, it takes a full year for slower subscriber growth to be fully reflected in its revenue growth. Furthermore, Netflix is benefiting this year from a price increase it implemented last fall. Its domestic subscriber count was up just 10.5% year over year at the end of Q2, so revenue growth could slow dramatically over the next few quarters.

International growth and margin expansion could be the difference maker

Netflix's slowing domestic growth -- and the increasing amount of marketing spending needed to pull it off -- may be troubling, but the company is still on a roll outside the U.S.

While it fell short of its international growth forecast last quarter, it still added more net subscribers than it did a year earlier. Over the past 12 months, its international subscriber count has surged by more than 20 million (or 40%). This lifted its international contribution margin from negative territory all the way to 15.5% in the span of a year.

Netflix's international growth has also indirectly boosted the domestic segment's profitability, by absorbing more of the cost of original content that is available globally. That's a big reason why its domestic contribution margin expanded last quarter despite slowing subscriber growth and a huge increase in marketing costs.

Looking ahead, Netflix has plenty of room to continue growing outside the U.S. This should allow it to double its revenue within four or five years, enabling further margin expansion and rapid EPS growth.

So what could go wrong? The biggest risk is that rapidly rising content and marketing costs could prevent Netflix from ever matching its nearly 40% domestic contribution margin in its international segment. There would still be plenty of EPS growth in the future -- but perhaps not enough to justify the sky-high stock price.