Renewable power is an increasingly important source of electricity around the globe. If you are a dividend investor looking to add a renewable power stock to your portfolio, then you've probably already stumbled upon Brookfield Renewable Partners LP (BEP 0.19%) and Pattern Energy Group Inc (PEGI), which yield 6.7% and 8.9%, respectively.

Although these two both invest in renewable power assets, there are some very important differences between them. Here's what you need to know to make your pick.

Working back from the edge

Pattern Energy went public in late 2013. It started off strong, increasing its dividend every quarter between 2014 and 2017. That steady dividend growth stalled in 2018, however, with the dividend stuck at the same level it was in the fourth quarter of 2017. The main reason was a high payout ratio.

Image source: Getty Images

When the company reported second quarter earnings, it projected full-year distributable cash flow between $151 and $181 million. Through the first six months of the year, however, it paid out roughly $82.5 million in dividends; doubling that gives you an annual figure of $165 million. The best case scenario is a payout ratio of just over 90%, which is within the company's targets -- but the worst case is that distributable cash flow doesn't cover Pattern's distribution, which would be a worrisome development for investors trying to live off of the income their portfolios generate.

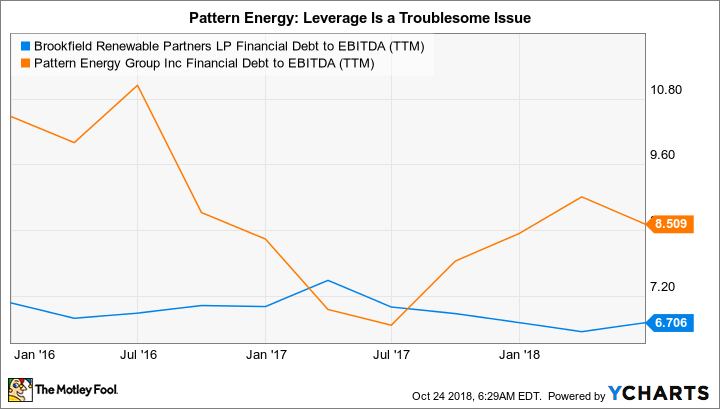

This situation will likely correct over time as new investments add to cash flow and contractual price increases start to kick in within the existing portfolio. However, with debt to EBITDA at around 8.5 times, Pattern is also dealing with a heavily leveraged balance sheet. For reference, Brookfield's debt to EBITDA ratio is around 6.7 times.

The low price of Pattern stock doesn't help, since the company uses both equity and debt to fund its growth. With the stock down roughly 50% since peaking in mid 2014, and the yield at nearly 9%, selling equity is an expensive proposition right now, one that management would rather avoid.

So growth via acquisition is going to be difficult to achieve. In fact, the company has noted that it will be buying smaller pieces of projects over the near term, and will start working to recycle capital by selling assets. While that will allow it to raise cash to invest in new renewable power facilities, it will likely also lead to short periods of EBITDA volatility because of the delay between sales and purchases.

BEP Financial Debt to EBITDA (TTM) data by YCharts

Meanwhile, Pattern noted that it will have to deal with a 2019 headwind from the loss of hedges on the Gulf Wind project. It has yet to give any projections for the impact that will have on distributable cash flow, which just adds to the uncertainty here.

If you are relying on your investments to provide a steady income stream, Pattern Energy's ability to maintain its high-yield payout is just too uncertain today.

A better position

Brookfield Renewable Partners is in a much better situation. As noted above, leverage is notably lower, which gives it much more balance sheet flexibility. And while the units are down nearly 20% from their peak in 2017, that's a materially better situation than the roughly 50% Pattern Energy's stock has fallen from its highs. Simply put, unit sales are still a realistic option for Brookfield Renewable Partners.

To be fair, the partnership is expecting an adjusted funds from operations payout ratio of 100% in 2018, so there is some uncertainty here as well. However, Brookfield Renewable Partners is in a better financial position to deal with the issue. Moreover, it is targeting a payout ratio of around 90% by 2022 after accounting for sustaining capital expenditures. And, equally important, it has provided a plan for how it will get there. This plan includes contractual cost escalators, efficiency improvements, and ground up construction, which together are expected to grow funds from operations between 6% and 11% a year over the next five years.

Stepping back, investors basically have been given a yardstick by which they can measure Brookfield Renewable Partners' performance -- while there's no such measure available at Pattern. Although Brookfield Renewable Partners' yield is lower at 6.7%, there's a lot less uncertainty here. For investors looking to live off of the income their portfolios generate, it's a much better option today.

Some risks aren't worth taking

Pattern Energy could very well work through this difficult patch without cutting its dividend, and that's management's goal. In fact, it believes it will be able to increase the dividend again in the future. But there's a lot of uncertainty; the company is dealing with multiple headwinds that aren't likely to abate any time soon.

Brookfield Renewable Partners, while facing its own issues with regard to its payout ratio, is in a better financial position to deal with the problem and has provided a realistic path to bring that number down. For most investors that's a much better investment proposition.