Check out the latest Canopy Growth earnings call transcript.

What happened

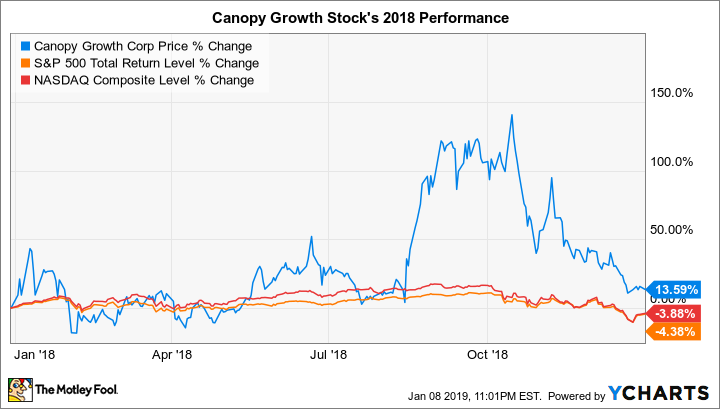

Shares of Canadian marijuana grower Canopy Growth (CGC 2.41%) gained 13.6% in 2018, according to data from S&P Global Market Intelligence. That's a solid gain, considering the S&P 500 (including dividends) lost 4.4% last year.

In 2019, Canopy Growth stock has gained a whopping 58.1% through Monday, Jan. 14. While most of the cannabis stocks have started the new year off with a bang, Canopy is one of the top performers. It's leading its four largest peers -- Tilray, Aurora Cannabis, Cronos (CRON 3.60%), and Aphria -- whose shares are up 42%, 36.7%, 32.4%, and 23.9%, respectively. The broader market has returned 4.1% over this period.

On Jan. 1, 2019, industrial hemp became legal across the U.S., clearing the way for Canopy Growth to enter the U.S. market. Image source: Getty Images.

So what

2018: The opening of the Canadian recreational marijuana market

Canopy Growth stock blasted off late last summer due to investor anticipation of the opening of Canada's recreational marijuana market, which occurred on Oct. 17.

Data by YCharts.

As is rather typical, after the actual event occurred, Canopy stock sold off, as did shares of nearly all of the cannabis stocks, which we can attribute to profit-taking. Compounding the usual profit-taking that often occurs in such instances, the stock market in general had a bad month. In October, the S&P 500 dropped 6.8%, with shares of highly valued stocks hit particularly hard.

2019: Passage of the Farm Bill provides a path for Canopy Growth to enter the U.S. market

We can attribute at least part of Canopy stock's 2019 rise to investor enthusiasm stemming from the passage of the U.S. Farm Bill in late December. This legislation, which went into effect on Jan. 1, 2019, removes industrial hemp from the federal government's list of controlled substances. It thus clears the way for farmers across the country to grow marijuana's cannabis cousin and opens up a potentially huge market for hemp-derived cannabidiol (CBD) products. CBD, which can be extracted from both marijuana and hemp, is a nonpsychoactive chemical that's been linked to various wellness and medicinal benefits.

Data by YCharts.

Moreover, as I wrote in mid-December after Congress passed the bill:

U.S. legalization of hemp has huge implications for Canopy Growth...as it will allow the company to enter the U.S. market. Despite medical and recreational marijuana being legal in a good number of U.S. states, Canopy can't currently enter the U.S. cannabis market because of the stock exchanges the company is listed on, the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX). Both exchanges prohibit their listed companies from engaging in any enterprise in the U.S. that's illegal on a federal level.

At that time, I also wrote:

Based on [Canopy Growth CEO Bruce] Linton's comments [on the most recent earnings call], it seems the company is ready to launch hemp-derived CBD products in the U.S. market. With the green flag likely to go up on the U.S. hemp market on Jan. 1, 2019, investors should probably expect some concrete news from Canopy Growth in early 2019.

Indeed, this is what just happened on Monday, Jan. 14, resulting in Canopy Growth stock soaring 11.1%. The company announced that it's received a license from New York State to process and produce hemp. According to the press release:

Canopy Growth will establish within the Hemp Industrial Park large-scale production capabilities focused on hemp extraction and product manufacturing within the United States. ... Depending on Board approval of a specific site, Canopy Growth intends to invest between $100 million USD and $150 million USD in its New York operations, capable of producing tons of hemp extract on an annual basis.

Now what

Canopy Growth deserves a spot on cannabis investors' watch lists. A main reason is that it has a huge cash position relative to its peers, thanks to its $4 billion investment from alcoholic-beverage giant Constellation Brands, which recently upped its stake in Canopy to 38%. This deal was announced in August and closed on Nov. 1. (Cronos is the only other major cannabis grower that has landed a big-name partner that's acquiring a big stake by investing a considerable amount of money. In early December, Cronos announced that tobacco giant Altria is buying a 45% stake in Cronos for approximately $1.8 billion.)

Canopy's strong cash position will enable it to rapidly expand its business. Moreover, its teaming with Constellation -- with which it's developing cannabis-infused beverages -- will be beneficial in that the alcoholic beverage maker already has an extensive global distribution network in place.