It has never been easier to get started investing with a small amount of money. The brokerage industry is quickly transitioning to free stock trades and fractional shares. This is a game-changer for individual investors. No longer do you have to save up $1,870 to buy a single share of Amazon.com (AMZN -1.65%) -- now you can buy 0.053 shares for just $100 at the current trading price.

Some of the brokers that offer both zero-commission trading and fractional shares are SoFi, Robinhood, and Interactive Brokers. Also, Square's Cash app offers fractional share trading for hundreds of U.S.-listed stocks and ETFs.

As for traditional brokers, Charles Schwab is expected to launch fractional trading soon. That means TD Ameritrade isn't far behind, given that the two brokers recently announced a merger.

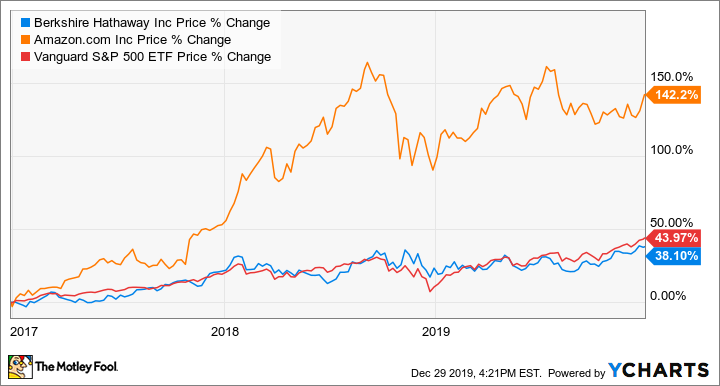

So, you have $100 with a broker that offers fractional shares -- where do you start? We'll review a few options, starting with the Vanguard S&P 500 ETF (VOO -0.41%). If you want to start with individual stocks, Berkshire Hathaway (BRK.A -0.30%) (BRK.B -0.26%) and Amazon.com are two quality choices that I believe are compelling buys right now, and can anchor a winning portfolio for the long haul.

Image source: Getty Images.

Keep things simple with an index fund

It doesn't take much to turn $100 into a lot of money: You only need patience and persistence. Over the last century, the broader market has averaged a return of about 10% annually. If you invest $100 per month at the historical rate of return, in 30 years you'll have $226,000. Invest $500 per month, and you'll be a millionaire.

You can keep things simple by investing in the Vanguard S&P 500 ETF, a sure way to get instant diversification across many of the best companies in the world. This ETF does what it sounds like: It seeks to track the return of the S&P 500 index. And as with Vanguard's other ultralow-cost ETFs, it is very efficient at achieving that objective. Since the fund's inception in 2010, the Vanguard S&P 500 ETF has returned 14.47% compounded annually, which is nearly identical to the underlying index return of 14.49%.

There is nothing wrong with indexing your way to retirement; even Warren Buffett has recommended this simple method for most investors. Then again, it might be even better to just invest in Buffett's Berkshire Hathaway.

Partner with the greatest investor of all time

I prefer to invest in individual stocks, and Berkshire Hathaway is one of my favorites. Warren Buffett has created substantial wealth for investors. His company owns dozens of quality businesses that spin out tremendous profits, which Buffett gets to reinvest as he sees fit. The price of a Class B share is currently $226, so if your broker offers fractional shares, you could buy 0.44 shares at the current trading price with $100.

Berkshire's business operations have generated over $30 billion in cash from operations in each of the last three years, and the company is currently sitting on $143 billion in cash and short-term investments. That's money that Buffett will eventually put to work in a great business, setting Berkshire up to accumulate even more cash from operations over time.

All that cash sitting on the balance sheet is dragging growth in book value, and as a consequence, Berkshire has fallen somewhat off Wall Street's radar. But with a price-to-book-value ratio of 1.39 -- within the lower part of its range over its 20-year trading history -- the stock could be undervalued.

You can bet that if there's another recession, Buffett will find something to pounce on, as he did nearly 10 years ago, when the markets were beginning to climb out of the trough of the 2008 market crash and Berkshire acquired Burlington Northern Santa Fe. Until an opportunity presents itself, Berkshire's collection of quality businesses will continue to grow in value, which should translate to a gradually rising share price over time.

Go for a higher return with a fast-growing tech giant

Amazon is growing fast enough that its stock should continue to outperform both Berkshire Hathaway and the broader market. The tech titan continues to dominate online shopping every year, especially during the holidays, when just about everyone is in a spending mood. Amazon just reported a record holiday season, including an additional 5 million people joining Amazon Prime.

The stock has been stuck in a trading range over the last year, but the recent news about record holiday sales sent shares sharply higher, and there could be more gains as we head into 2020. The top line is still growing fast, at 24% year over year in the third quarter. And Amazon has proven it can generate tremendous profits, thanks to the higher margins of Amazon Web Services (AWS) -- the fast-growing cloud services provider for organizations around the world.

The stock has always looked expensive on a price-to-earnings basis, but some analysts believe the stock is currently undervalued based on the future growth and profitability of AWS, which currently generates the bulk of Amazon's quarterly operating income. At a minimum, consider dollar-cost averaging to build a position in the stock.

Build a foundation for future gains

The days of waiting several months to save up money to open a brokerage account and start investing are over. The beauty of fractional shares is that you could invest in 100 stocks for just $1 each and get instant diversification with a small sum.

I prefer to pick no more than a few stocks at a time, and build a diversified portfolio slowly. Berkshire Hathaway and Amazon are great anchor stocks for the long term, and both have the potential to outperform in the next year.