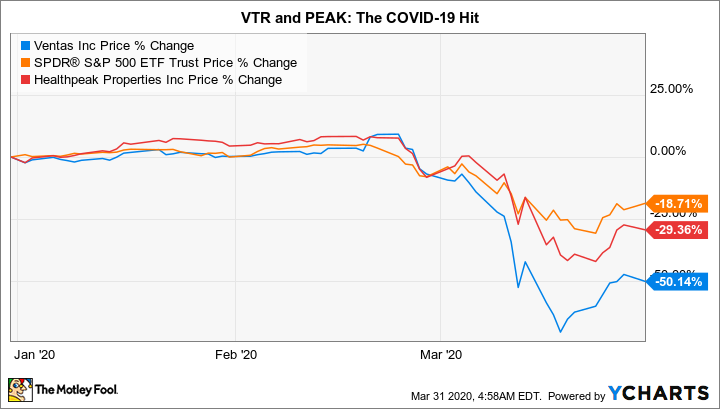

Reaction to the coronavirus pandemic has changed the world as we know it, but even before the virus started to really expand its presence the United States, Ventas (VTR -0.57%) and Healthpeak (DOC -1.56%) were already facing headwinds. Those headwinds have only gotten worse over the past six weeks.

But the difficulties that this pair of diversified healthcare real estate investment trusts (REITs) were dealing with led each of them to change how they report information to investors and analysts. Here's why and what it means, particularly now that COVID-19 is in full force domestically.

The problem and the change

Ventas and Healthpeak own senior housing assets, among others. The real estate investment trusts both lease these buildings out to others and operate some of their own properties (known in the industry as a senior housing operated portfolio, or SHOP). The SHOP setup allows the companies to participate directly in the performance of the assets they own, in good times and bad. When they reported full-year 2019 earnings, the performance of their leased-out senior housing was fine, backed by long-term leases. The SHOP portfolios, however, were facing a supply overhang that caused some problems. Net operating income in Ventas' SHOP portfolio fell 4.4% for the year, with Healthpeak seeing a 4.5% decline.

Image source: Getty Images

The supply overhang, though, doesn't have a uniform impact across the SHOP portfolios here. Properties that have been around for a bit and are basically full of residents only have to replace seniors who move out. These facilities are basically profitable to own, even if occupancy is a little lower than usual and it takes a bit longer to fill an empty room.

Newly built assets, however, have to compete with other facilities to attract residents, with the goal of reaching a tipping point where the property can be profitably operated. The oversupply has put new assets at a distinct disadvantage. The REITs have been forced to lower rents, and it has taken longer to reach their desired occupancy levels.

To help show the difference between these two scenarios, Ventas and Healthpeak have decided to alter the definition of a same-store property, which is roughly akin to same-store sales for a retail company. Before, a property was considered to be same-store if it had been owned for two years, which allowed for a year-over-year comparison of performance. Now a property will become same-store only after it has been fully stabilized (which basically means it has enough residents to be profitable) in both periods being examined. Properties being redeveloped will be treated the same way if there is a material disruption to occupancy levels. And assets held for sale will be pulled out of the same-store metrics.

The impact of the change

Tightening the definition of same-store will help to better show the performance of each REIT's mature SHOP assets. That's not a bad thing at all, though the companies are obviously making this change to paint their SHOP portfolios in the best light possible. What will be interesting to see is how much detail Ventas and Healthpeak provide on the new SHOP assets that are still being leased up, and thus not a part of the same-store portfolio. At this point, there's no clear indication of what information they will be releasing -- and it would be helpful to know since these are the buildings that are facing the biggest headwinds.

That said, COVID-19 has changed many things for healthcare REITs. The virus spreads easily in group settings and seniors are at an elevated risk of death; both facts present issues for senior housing assets. Having pulled out new buildings, investors will get a clearer picture of the impact of COVID-19 on properties that have been around for a while.

Investors should go into the first quarter expecting increased move-outs, which is usually a euphemism used to mean that a resident has died (though sometimes they really move out). Also expect the REITs to have an increasingly difficult time finding new residents because of the oversupply situation, COVID-19-related concerns about moving into a group setting, and the fact that social distancing has made it hard to give prospective tenants tours. And rent concessions will likely be needed, too, which crimps profitability. On top of all of that, costs are likely to rise as the properties take extra precautions to ensure a healthy environment. In other words, the same-store property reporting change will make it clear just how bad COVID-19 is for the senior housing portfolios of these two REITs.

A hard time for all

Ventas and Healthpeak didn't decide to make these changes because of COVID-19; the real reason was the industry oversupply, which lengthened the time it took to get new properties filled. That's kind of a window-dressing thing, potentially leaving analysts and investors to push for information on the new properties to get a full view of the entire portfolio. Without the coronavirus this was just something that investors would want to be aware of.

Now, however, the change will help reveal the full impact of COVID-19 on the senior housing sector. Ventas and Healthpeak didn't intend that, but it is what investors will get. While it's too soon to tell how bad it will be, based on the stock performance of healthcare REITs of late, investors are expecting troubling results. The updated same-store performance will be the telltale sign if Wall Street is right.