Zoom Video Communications (ZM -0.99%) posted fiscal third-quarter earnings way above guidance, and management raised its full-year outlook again. Yet because of its lofty valuation, the company's stock price dropped following the release of these phenomenal results. Let's see whether Zoom's various growth opportunities could lift the stock price higher again.

Impressive quarterly results

The coronavirus pandemic certainly contributed to Zoom's stellar fiscal third-quarter results. Revenue increased to $777.2 million, up 367% year over year, way above the guidance range of $685 million to $690 million. During the earnings call, CFO Kelly Steckelberg explained that this outstanding performance is thanks to the lower-than-expected churn rate -- an encouraging sign for the demand for Zoom's products no matter how the coronavirus situation evolves.

Image source: Getty Images.

Zoom's customer base also grew significantly. The number of customers with more than 10 employees increased to 433,700, up 485% year over year. And Zoom's products attracted large enterprises too, with 1,289 customers spending more than $100,000 over the last 12 months, up 136% from the prior-year quarter.

Given these positive developments, management again raised its full-year revenue guidance to a range of $2.575 billion to $2.580 billion, which corresponds to a 314% year-over-year increase, compared to a previous range of $2.37 billion to $2.39 billion.

Attractive growth drivers

With these impressive results, Zoom will face a tough base comparison for revenue growth next year, though. And the coronavirus-induced boost in demand for the company's remote communication solutions should wane with diminishing travel restrictions associated with potential coronavirus vaccines. However, Zoom will be pulling several levers to fuel its growth.

Over the last few years, the company has been expanding beyond its core video communications business to become a comprehensive unified communications player, partly thanks to its Zoom Phone. As a result of the company's solid execution, the research outfit Gartner recently positioned Zoom as a leader in its magic quadrant for unified communications, based on its completeness of vision and ability to execute. Management doesn't communicate specific metrics about the performance of Zoom Phone, but it planned increased sales and marketing efforts to boost the product, which should solidify the company's positioning as a unified communications specialist and contribute to revenue growth.

The new online events platform OnZoom should also support revenue growth over the next several years with a monetization strategy executives will announce in 2021. And beyond the extra revenue potential that remains difficult to estimate, the company may benefit from an attractive and free opportunity to raise its brand awareness, as influential broadcasters may leverage social networks to advertise their Zoom-based gatherings and events.

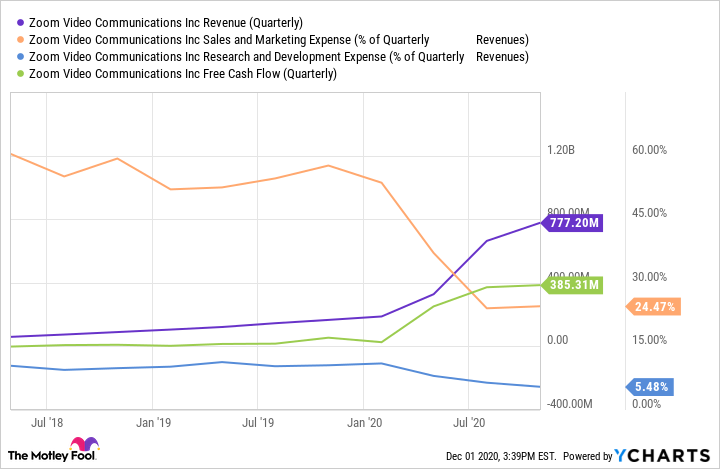

In addition, during the earnings call, Steckelberg confirmed Zoom's ambition of increasing sales and marketing and research and development expenses to fuel revenue growth. Indeed, the company's spendings couldn't keep pace with exploding revenue over the last couple of quarters, which resulted in enormous free cash flow, as you can see in the chart below.

ZM Revenue (Quarterly) data by YCharts

However, that underspending could lead to missed or reduced long-term growth opportunities. The result of these investments remains to be seen, but it shows management's focus on long-term growth instead of immediate free cash flow.

Besides, thanks to its strong profitability, the company accumulated a comfortable safety net of $1.9 billion of cash, cash equivalents, and marketable securities and no debt at the end of last quarter, which can be used to fuel its growth and expand its addressable market via acquisitions. For instance, Steckelberg expressed satisfaction in providing contact center capabilities via partnerships. But I wouldn't be surprised to see the company expanding its portfolio in the medium term with a contact center solution it could acquire or develop thanks to its large resources.

Limited upside potential

Zoom will also leverage several other growth opportunities thanks to its other products and partnerships. The potential of all these growth levers remains uncertain, but even if you assume flawless execution and strong growth, the stock looks expensive. Zoom's market cap corresponds to 46 times revenue, based on the midpoint of full-year guidance, which indicates phenomenal results are already priced in despite intensifying competition and no matter how the coronavirus pandemic pans out.

Thus, given Zoom's limited stock price upside potential even if growth opportunities materialize, investors should wait for a deeper pullback before considering investing in the high-growth communications specialist.