The stock market can be intimidating even for experienced investors, and it's easy to feel overwhelmed if you're new to the world of investing. There are also several myths surrounding the stock market that make it seem scarier than it is, which could deter you from investing.

Investing in the stock market is one of the best ways to supercharge your savings, however, and the sooner you start, the more money you can make. So if you're thinking about investing, don't let these three myths trip you up.

Image source: Getty Images.

Myth no. 1: The stock market is basically gambling

Many people compare investing in the stock market to throwing money into a slot machine at the casino. However, while there is always a certain amount of risk involved when investing, you can stack the odds in your favor.

The key to investing is choosing stocks that are likely to perform well over the long term. If you're brand new to investing (or if you're looking to take a hands-off approach), your best bet may be to invest in index funds or mutual funds. These are large collections of stocks bundled together into a single investment; each fund can contain hundreds or even thousands of different stocks.

One of the biggest advantages of investing in mutual funds is that they're instantly diversified. When you're investing in hundreds of different stocks at once, it won't matter if a few of them tank. This limits your risk significantly, keeping your investments safer.

Myth no. 2: You need to hire a financial advisor

The stock market can seem complicated and confusing, and you may think you can't handle your investments alone. But even if you know next to nothing about investing, it's easier than you may think to get started.

One of the easiest ways to get started with the stock market is to invest in your 401(k) or IRA. When you contribute to a retirement account, you're generally investing in a variety of mutual funds. This makes your job easy, because all you need to do is start putting money into your 401(k) or IRA. You don't need to worry about choosing stocks, deciding when to buy or sell, or making any other complicated investing decisions.

If you'd feel more comfortable talking to a financial advisor, that's always an option. But you don't need to be an expert to get started with the stock market, so don't let the idea of hiring a professional be the only barrier keeping you from investing.

Myth no. 3: You'll lose all your money if the market crashes

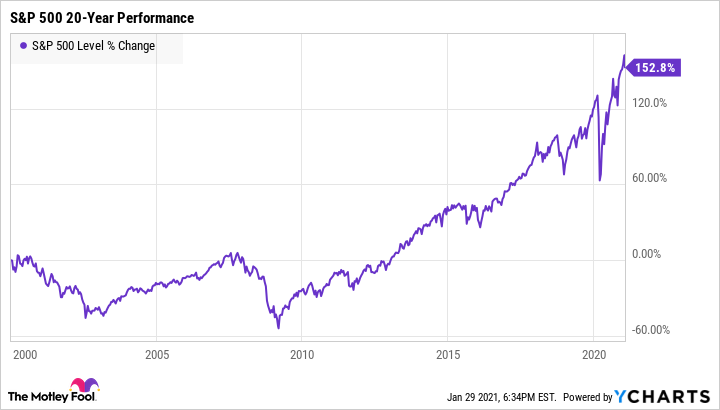

Perhaps the most daunting aspect of investing is preparing for stock market crashes. Here's the good news, though: When you invest for the long-term, it's a lot harder to lose money -- even if the market takes a nosedive.

When it comes to market crashes, the most important thing to keep in mind is that you don't lose any money until you sell your investments. Say you own 100 shares of stock that you bought for $10 each. Your investments in this scenario are worth $1,000. If the market crashes and the stock price drops to $7 per share, the value of your investments falls to $700. If you were to sell at this point, you would lose $300. But if you wait it out until the market recovers and the stock price bounces back to $10 per share, you haven't lost anything.

The stock market experiences downturns relatively often, but every correction or crash has been followed by a rebound. So as long as you're putting your money in solid investments, your savings will very likely bounce back.

Keeping your money invested for the long term is key here. As a general rule, don't invest any money you may need in the next decade or so. This means making sure you have a solid emergency fund so that if you're faced with an unexpected cost, you don't need to risk pulling your savings out of the stock market and potentially losing money.

It can be intimidating to invest in the stock market, but it's not as scary as it seems. Remember that it's perfectly fine to take baby steps as you're getting started, and simply learning more about how the market works is the first step. The more comfortable you get with investing, the easier it will become.