Lowe's (LOW 1.18%) recently thrilled Wall Street with its latest quarterly earnings update. Sure, sales dropped slightly through late July. But the sales footprint is still much higher today than it was before the pandemic, with earnings being amplified by rising profit margins.

In a conference call with analysts, CEO Marvin Ellison and his team broke down those results and explained why they're so bullish about the home improvement industry over the next several years. Let's take a look at some highlights.

Image source: Getty Images.

Nine words that say a lot

Ellison spent some time detailing why executives feel confident about the home improvement industry beyond the current boom in 2021. Demand for new homes is outpacing supply right now by enough to imply years of continued strength in the housing market, for example.

But the bigger factor is tied to home remodels and upgrades, which make up two-thirds of Lowe's annual sales. Growth in this niche is heavily dependent on steadily rising home prices.

"[People] see upgrades and enhancements to their home as an investment and not an expense," Ellison said, with this important caveat: "As long as their home is increasing in value."

That perception helps explain how Lowe's and rival Home Depot (HD 1.00%) have added tens of billions of dollars to their annual sales footprints since early 2020.

Margin boosts

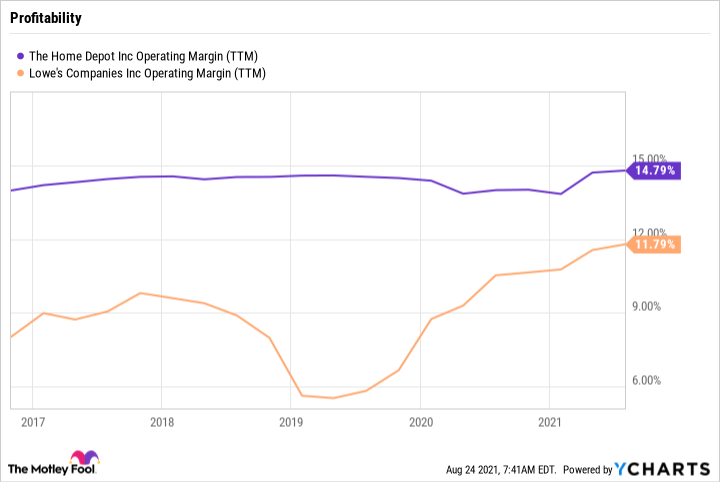

Lowe's is on track to close its performance gap with Home Depot when it comes to profitability. Years of effort improving the supply chain are finally paying off, and operating margin for the quarter jumped to 14.5% of sales compared to 12.66% a year ago.

That metric will contract over the next six months, executives warned. But Lowe's is still targeting an over 12% operating margin in 2021 compared to roughly 10% last year. Home Depot is still leading the industry at nearly 15%.

HD Operating Margin (TTM) data by YCharts

Most of the credit for that shrinking gap goes to Lowe's massive supply chain transformation project. "The foundation of this transformation is transitioning the company from a store-based delivery model to a market-based delivery model," Ellison said. That new process is up on a regional basis right now and will be rolled out nationally by late 2022.

The short-term outlook

Lowe's is taking a short-term hit from collapsing lumber prices but still sees the drop as a long-term positive. The slump is lifting customer traffic in early Q3, for example, as people pull the trigger on projects they had been delaying when prices were higher.

The rest of the 2021 outlook is bright, due to fundamental tailwinds like rising home prices and intense consumer focus on home upgrades and maintenance. "Lowe's is clearly tracking well ahead of our robust market scenario that we shared with investors back in December," Executive Vice President Dave Denton said.

That means sales should rise again in 2021, to at least $92 billion, after jumping $17 billion last year to reach $90 billion. Comps on a two-year basis will be 30%, management estimates.

Plenty of factors could threaten that bullish outlook, including new COVID-19 outbreaks and an economic pullback. But the core of the business should be strong through most industry cycles, so long as consumers continue viewing their home spending as an investment rather than an expense.