What happened

Shares of Matterport (MTTR -1.96%), whose platform enables the creation of digital twins of physical spaces, rose 17.4% in September, according to data from S&P Global Market Intelligence. This pop is probably attributable simply to continued investor enthusiasm about the growth prospects of the company, which just went public in July via a special purpose acquisition company (SPAC).

For context, the S&P 500 and Nasdaq indexes fell 4.8% and 5.3%, respectively, last month.

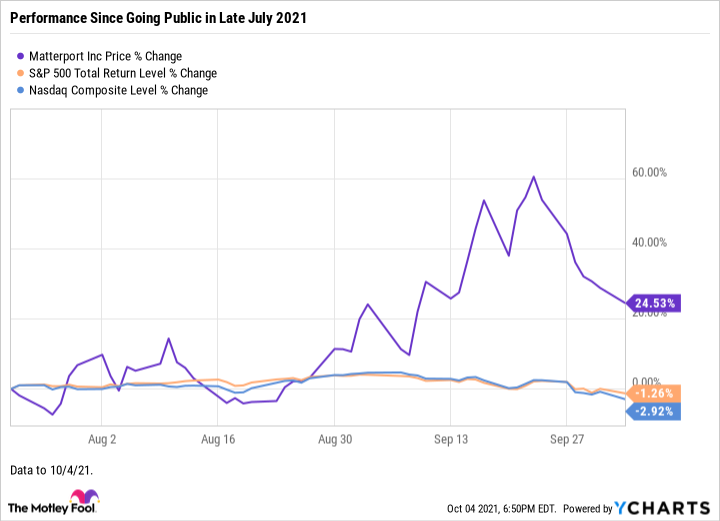

Since its July 23 debut on the Nasdaq, Matterport stock is up 24.5% through Oct. 4. The S&P 500 and Nasdaq indexes are down about 1% and 3%, respectively, over this period.

A view of a home using Matterport's "dollhouse view." Image source: Matterport.

So what

Matterport's revenue has been growing at a solid clip. In the second quarter, revenue increased 21% year over year (and 10% sequentially) to $29.5 million. Growth was driven by a 53% year-over-year rise in subscription revenue to $15.3 million. Its subscriber count jumped to 404,000, up 158% compared to the year-ago period.

Matterport isn't profitable, which is rather typical for newly public tech companies that are mainly focused on growing sales. In Q2, it had a net loss of $6.2 million, or $0.62 per share, compared to a net loss of $3.7 million, or $0.47 per share, in the year-ago quarter.

In the earnings release, CFO JD Fay said, "We continued to expand our business with enterprise customers, which drove our net dollar expansion rate to a record 132% in the quarter, above the 129% that we achieved in Q1." This means that existing customers expanded their spending on the company's offerings by 32% year over year.

Data by YCharts.

Now what

On last quarter's earnings call, management issued guidance for full-year 2021 as follows:

- Revenue in the range of $120 million to $126 million. This compares to 2020 revenue of $86 million (representing growth of 40% to 47% year over year) and 2019 revenue of $46 million.

- Adjusted loss per share between $0.17 and $0.25.

Matterport is worth watching. The company's tech is now largely used by real estate agents to provide virtual tours of homes they have listed for sale. But it has potential uses across many industries, including insurance, hospitality, and construction.