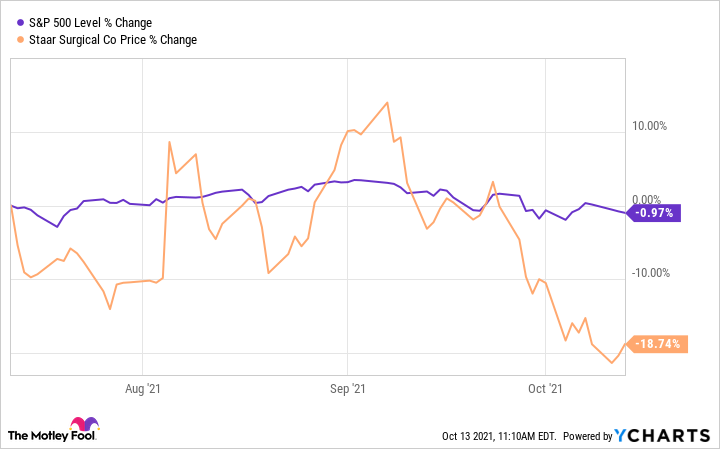

Sometimes, great businesses can have poorly performing stocks. On that note, STAAR Surgical (STAA -1.95%) is one of my favorite healthcare companies, but alas, its shares have fallen choppily in the last three months. And, even amid its ongoing success in the implantable lens market, my suspicion is that there are at least a few more storm clouds on the horizon.

It's too soon to call the recent decline a collapse, but it's understandable that investors are concerned. There's more than one issue at play here, so let's dive in and analyze the situation to see if the stock is still worth adding to your portfolio.

Image source: Getty Images.

There are plenty of reasons not to sweat the dip

Generally, short-term price movements aren't worth paying attention to, especially when they're not linked to any new developments that relate to a company's operations or its markets.

In case you're not familiar with STAAR, if you're reading this while using eyeglasses or contact lenses, you're already a customer in its target market. Its implantable lenses are a bit more involved to start using than the other solutions to nearsightedness, but many people find them to be more comfortable and less of a hassle, as they don't need to be cleaned or replaced.

So, when patients hear about the benefits of the lenses from the company's consumer marketing campaigns, they're likely to talk it over with their eye doctor and move forward with the implantation procedure. Then, the doctor buys the lenses from STAAR to top up their supply. As you may have guessed, the market for vision correction hasn't recently faced any exceptional new disruption that would disproportionately affect STAAR. That means investors shouldn't be panicking about the recent drop in its share price.

What's more, over the last five years, sales of its implantable lenses have driven quarterly revenue to increase by just over 183% and quarterly net profit to rise by 630.3%. In the same period, the company's profit margin has grown, and its total expenses as a percentage of quarterly revenue have fallen, so its operational efficiency is increasing while its business is scaling upward.

In the last three years, net sales grew with a compound annual growth rate of 22%. And, its market is growing steadily too. The prevalence of nearsightedness is on the rise worldwide, and more than 50% of people may be myopic by 2050, leading to higher demand for implantable lenses than ever before. In light of all of the above, it's no surprise that management is confident in the company's future. Essentially, this means that STAAR's business model is, has, and will continue to work as intended. I've even posited in the past that it's a stock that Warren Buffett might want to invest in. So, why the falling share price?

STAA revenue (quarterly) data by YCharts.

Nothing has changed about STAAR's product or its ability to compete within the most recent quarter. Nor have any powerful competitors made serious inroads or announced their intentions to attack its market share. There haven't been any scandals, and it hasn't reported any bad news. It even smashed analysts' expectations for its earnings last quarter. In short, there's no new information that could have been driving the dip. Still, there is one last thing that might be responsible for the fall, and it's STAAR's valuation.

The business is right, but is the valuation?

As strong as its core business is, STAAR's valuation is looking on the pricey side, to say the least. And that's a key factor that is likely responsible for the stock's recent performance.

Specifically, its trailing price-to-earnings ratio is 267.45, and its price-to-sales is just over 27. To put those numbers into context, consider that the average P/E of a stock in the medical instruments and supplies industry is close to 55, and the average P/S is near 5. In other words, there's a good chance this stock is outrageously overvalued, even if its recent drop in price has somewhat started to ameliorate the situation. Some of this overvaluation may be a result of its habit of crushing analysts' expectations for its earnings, which has led its share price to rise sharply several times in the past year.

I doubt that the company's revenue or earnings growth will decelerate anytime soon, but the stock could face a reckoning during a correction. Likewise, if by chance it whiffs on a quarter's earnings in comparison to what analysts expect, there might be a (likely minor) sell-off from institutional holders. For prospective investors, that means STAAR is a riskier buy than its fundamentals might make it seem, at least for now. Despite its valuation, I'd still buy STAAR's stock today, though admittedly I'd be much more comfortable with the decision if it sold off a bit more first.