Roblox Corporation (RBLX 3.52%) is an entertainment platform for gaming and game development that allows users to play and create games where users interact in three-dimensional "worlds." The company's stock went public in March of 2021 and has risen over 70% since doing so.

Roblox burst onto the scene in the early days of the pandemic in the United States as a place where people could game and interact while stuck at home. Because of this, the stock was often seen as a "pandemic play" that would suffer as the country reopened. Now the company is looking to prove that its results are sustainable while taking advantage of the rise in interest in the metaverse.

But what exactly is the metaverse? In the broadest of terms, it's a virtual world accessed through the internet where users interact with both each other and the physical world in a seemingly limitless variety of ways. As it pertains to Roblox, metaverse games are developed by third parties using its platform and then played on the platform where they are tethered. Games are free to both play and develop. The company makes the majority of its money selling "Robux," a virtual currency that allows users to enhance their in-game experience. Most of the users of Roblox are kids, but the stock is anything but child's play.

Source: Getty Images.

The stock breaks out after a lackluster IPO

Roblox stock has seen several extreme swings since going public. After the IPO the stock gained nearly 18% over the following month. It then pulled back 22% from April 13, 2021 to May 10, 2021. From there, it shot up over 55% through the beginning of June before again cratering 29% through mid-October. Third-quarter earnings effectively reversed the downtrend and sent the stock skyrocketing yet again. The volatility boils down to sentiment surrounding so-called "pandemic stocks." A pandemic stock is one in which the company's success is related to COVID-19 conditions and whose success may not last post-pandemic.

Source: YCHARTS

The company looks to prove it is more than a pandemic play

It seems investors aren't yet sure whether the company's success will be lasting or will fade along with COVID restrictions. You see, Roblox really took off during the worst of the lockdown periods in the United States. Daily active users (DAUs) of the platform went from just 18.4 million in Q3 2019 to 36.2 million the following year, a gain of 97%. The chart below of DAUs shows that growth has slowed. However, it has continued to climb. Investors appear particularly impressed by the increase reported in Q3 2021. It seems as though users who began to play during the pandemic are sticking around and likely spurring others to use the platform as well. The number of DAUs will be critical to the stock and the company's future success.

Source: Roblox

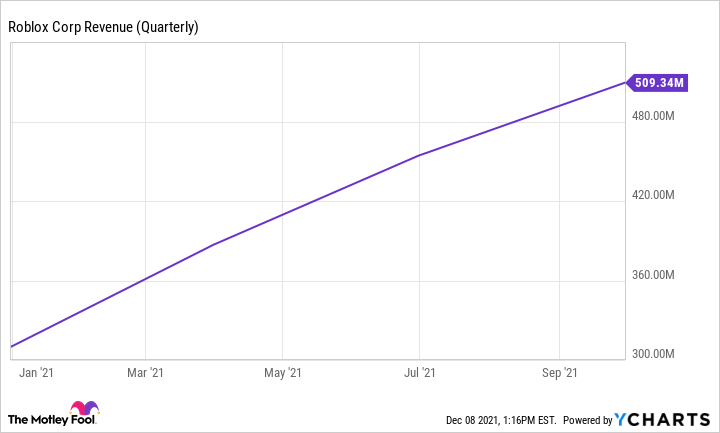

Revenue has exploded; however, valuation is a serious concern

Roblox has more than tripled its quarterly revenue since going public. In March 2020, the company reported $162 million in quarterly top-line revenue. This has steadily increased to over $509 million in Q3 2021. Q3 2021 revenue exceeded Q3 2020 by more than 100%. This is incredible growth that is driven by the increasing DAUs of the platform and the hours in which they are engaged. Obviously, gamers who play longer will likely purchase more Robux, providing more revenue for the company. Engagement hours reported by Roblox have shown impressive gains since the pandemic, but the number jumped significantly in Q3 2021 over the prior quarter, going from 9.7 billion to 11.2 billion hours. This is a very positive sign for the future of Roblox and likely contributed to the tremendous stock gains after Q3 earnings were released.

RBLX Revenue (Quarterly) data by YCharts

While revenue has exploded, the valuation metrics remain unfavorable. The current forward price-to-sales ratio is over 24. Like many growth stocks, Roblox will need to continue to grow rapidly to justify this valuation. The company has been impressive in proving that the platform can be self-sustaining post-pandemic. However, there is still a risk that players become bored or switch to other competitive products. There are also macroeconomic concerns in the market for growth stocks currently. Inflation may turn out to be much more than transitory. In this case, the Federal Reserve would likely need to raise interest rates faster than originally planned. Growth stocks are often valued lower as interest rates rise.

The Verdict

Roblox has proven many critics wrong. The growth spurred by lockdowns has been sustained thus far. Users are increasing, and the hours spent are going up as well. Revenue has exploded since the company went public -- more than tripling. Investors loved Q3 2021 earnings, and for good reason. Despite these positive trends, there remain serious risks to the price of the stock, which has been extremely volatile since going public. First, the company must continue to show that the platform can attract and retain more players over a longer period of time. Consumer habits are often fickle, and any reduction in growth could cause a significant stock pullback. In addition, macroeconomic conditions related to growth stocks are in question. Roblox is certainly a stock to watch closely, however at the current level is advisable only for aggressive long-term growth investors.