What happened

Shares of software darlings Datadog (DDOG -0.95%), Appian (APPN 3.06%), and MongoDB (MDB -0.09%) were down 7.8%, 7.7%, and 7.9%, respectively, on Wednesday.

The severe sell-off, in nearly equal proportions, indicates the drawdowns didn't have anything to do with these top tech names specifically. Rather, the likely culprit was the release of minutes from the Federal Reserve's December meeting, which indicated tighter financial conditions could be ahead.

Image source: Getty Images.

So what

Fed officials had already announced in December that the Federal Reserve would be tapering its purchases of Treasury bonds and mortgage-backed securities, and officials had already increased estimates for interest rate hikes this year. However, the minutes released on Wednesday revealed the possibility for even more aggressive moves, including letting the Fed's balance sheet shrink in short order.

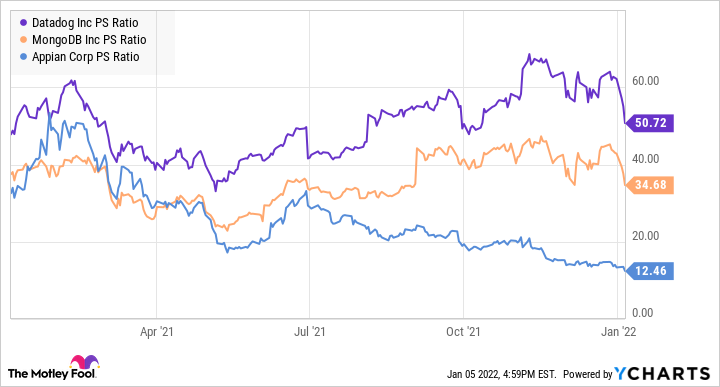

Markets have been helped along by the injection of liquidity from the Federal Reserve for really the last decade, with very few periods of tightening. Datadog, MongoDB, and Appian are all somewhat disruptive software products posting impressive revenue growth rates, and high revenue growth combined with zero interest rates has helped technology growth stocks like these trade to very frothy valuations. Even after big drawdowns in each of these stocks, they still trade at price-to-sales (P/S) ratios of 51, 35, and 12, respectively. And for all their growth, none of these stocks currently make profits.

DDOG PS Ratio data by YCharts

Not making any profits in the present is fine, but all stocks do trade with the expectation that one day, profits will come. The problem with these names is that when interest rates rise and financial conditions tighten, investors have more of a present need for earnings and dividends, so earnings far, far off in the future become much less attractive -- even if nothing has changed within these businesses.

Furthermore, each of these three stocks has grown in size recently, and it may be more difficult to keep up their pace of growth as they get bigger. So decelerating growth combined with higher discount rates is a scary combination. No wonder investors are taking profits amid this tightening cycle.

Now what

MongoDB and Datadog are about 17.5% off their all-time highs, but Appian is down a much uglier 75%. But does this mean these stocks are now "on sale?"

It's still very hard to say. If you are young and own these growth stocks with an eye toward holding for the very long term based on their high-quality businesses, then you will have to endure drawdowns periodically. That is obviously much harder to do in practice, especially on ugly days like these.

All three stocks have also been big winners since their respective initial public offerings (IPOs) in the last few years, so anyone who bought in then won't be complaining. Still, the fact that these stocks have run so far so fast makes them vulnerable to even more profit-taking. And given that the market hasn't really seen the Fed tighten for a sustained period of time during their public lives, these software stocks remain at risk for further drawdowns even if their businesses continue to perform well.

Believers in these names for the long haul may wish to hold on but prepare for sub-standard returns this year. Meanwhile, older investors near retirement may want to think about rotating with the market into cheaper, dividend-paying stocks, which may be at a lower risk of declines as the Fed raises rates.