What happened

AMC Entertainment (AMC 1.36%) shareholders lost ground to the market on Wednesday. The stock was down 6% by 3 p.m. EDT, compared to a 0.9% boost in the S&P 500.

The decline was likely driven by profit-taking after shares jumped earlier in the week. But the company also announced it's taking on new debt.

Image source: Getty Images.

So what

AMC said in a press release that it plans to accumulate $500 million in new loans to help fund the business. The cash will be used to pay off higher-interest debt currently on the books, which is good news for the company's finances.

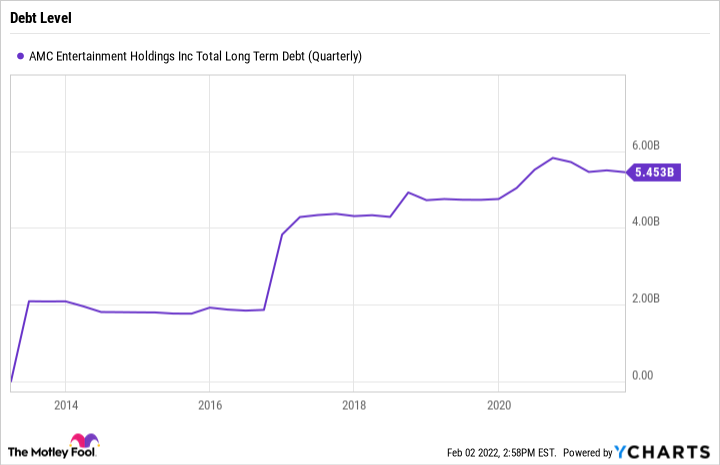

However, investors have been worried about the theater-chain's significant debt burden, which was above $5.4 billion in late September. AMC's new deal simply refinances a portion of those holdings at a slightly lower rate.

AMC Total Long Term Debt (Quarterly) data by YCharts.

Shares were also pressured by investors' decisions to take profits following yesterday's price surge. AMC's stock jumped over 14% on Tuesday after the company announced preliminary Q4 earnings. That report showed solid ticket demand as the U.S. market emerged further from pandemic traffic restrictions. In fact, revenue and adjusted profits were near two-year highs.

Now what

Investors can expect more volatility ahead for the meme stock, which has declined sharply so far in 2022 after soaring through much of last year. The theater business was under pressure before the pandemic struck and may continue shrinking in the coming years.

The good news is that AMC isn't approaching any kind of cash crunch. The company has $1.5 billion on its books today and has access to nearly $2 billion more in credit.

Still, AMC is likely to hold significant debt for the foreseeable future, which will act as an anchor on cash flow and earnings. Thus, growth-focused investors might want to look for better-capitalized companies in expanding industries when choosing their next stock to buy.