For much of 2020, investors bid shares of companies that benefited from COVID to lofty valuations. The ability to work from anywhere, coupled with the inability to take part in normal social gatherings, created a sense that the world had forever changed.

That feeling is fading now, and Fiverr (FVRR 3.74%) is in the crosshairs. The freelance contracting platform was in the right place at the right time with remote work, labor shortages, and many opting to downsize their careers while caring for children who attended school online. The stock has been crushed. And despite the company's most important metrics still trending in the right direction, the stock might have further to fall.

Image source: Getty Images.

A huge fall but not back down to earth

The stock price has collapsed 75% from its highs early last year. Although that's a tough pill to swallow for those who bought in 2021, it is still up by almost 250% since the beginning of 2020.

It would be logical to assume that after a stock falls that far that fast, it must be cheap -- especially when you consider the performance of the actual business.

Getting back to normal

Looking at the number of active annual buyers on the company's platform, it's clear that COVID significantly accelerated the business. Quarter-over-quarter growth was double digits from April 2020 through March 2021. It has since returned to a pre-pandemic rate.

Data source: Fiverr. Chart by Author.

It remains to be seen whether Fiverr can maintain this rate or if it will fall further in the quarters ahead. What is known is that the company is still growing the demand side of its platform. The annual spend per buyer follows a similar pattern.

The average buyer was spending $170 per year on Fiverr's platform at the end of 2019, and the spend has been growing about 4% every quarter. Growth rose as high as 6% during the pandemic before falling back to 3.5% in the most recent period. The latest number was $234 per year. That's a 38% increase since the end of 2019. Add that to a 75% rise in active buyers and it's an impressive combination.

Investors are giving where it's due

A company with a collapsing stock price and key growth metrics that are still expanding is a good place to look for bargains. But Fiverr may not be on sale yet.

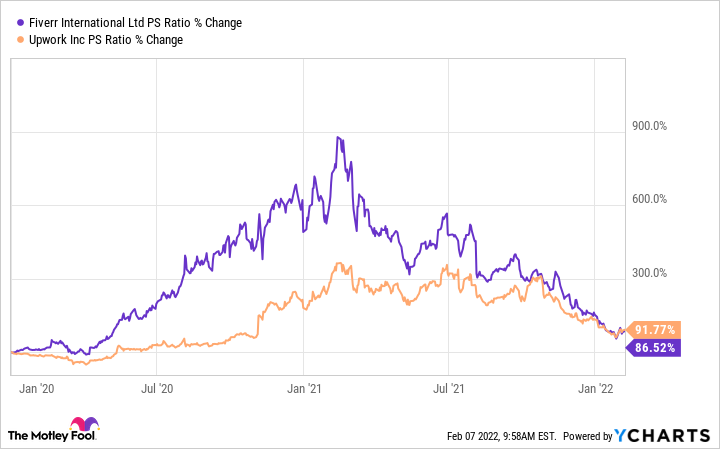

It turns out both Fiverr and its rival Upwork (UPWK 3.40%) are trading at price-to-sales (PS) ratios about 90% higher than where they ended 2019. That's a big dent in the argument that the stock has gotten too cheap.

FVRR PS Ratio data by YCharts.

In fact, it's quite the opposite. Actually, investors are paying more now for every dollar of sales that they were in 2019. Based on analyst-expected 2021 revenue of $295 million, the current PS ratio is over 10. For context, the ratio hovered around 5.0 throughout 2019. That might be uncomfortable to acknowledge for current shareholders.

Fiverr's business could continue expanding and become the de facto method for connecting work and talent. There is no doubt it's a stronger business now than it was in 2019. But based on the numbers, its stock could still fall 50% if it were valued like it was back then.