Moderna (MRNA 1.04%) has been a stock to watch -- and buy -- ever since it entered the coronavirus vaccine race. The biotech company brought a vaccine to market in less than a year. And it's delivered billions of dollars in revenue and profit thanks to that product. As a result, the shares have soared. They climbed 1,200% over the past two years.

But the stock has lost some of its sparkle in recent times. It's down more than 60% since its peak in August. That's as investors worry about revenue prospects post-pandemic. Moderna has been great in the short and medium term. But, today, it's fair to ask: Is this vaccine superstar a good long-term option? Let's find out.

Image source: Getty Images.

Moderna's biggest problem

First, let's have a look at the biggest problem Moderna faces right now. And that's uncertainty about future coronavirus vaccine sales. This year looks promising. The company has already predicted $18.5 billion in sales, according to advance purchase agreements so far. If Moderna can deliver those doses, it's set to generate even more revenue this year than last year.

Moderna is set to report full-year earnings on Feb. 24. The company has already offered us a glimpse of what to expect -- vaccine sales of $17.5 billion.

Beyond these first two years of vaccine sales, though, it's unclear if governments will continue to order as many doses -- especially if the pandemic shifts to an endemic situation. That said, we can use the information we have today to make a general prediction. And here, I say, sales probably won't sink like a stone. That's because the coronavirus will continue to circulate -- and people will need protection. And that protection will come in the form of vaccines or boosters. Moderna is even working on strain-specific boosters to more effectively fight the ever-evolving coronavirus.

Of course, governments (or, eventually, healthcare providers) may order fewer doses in the coming years. But revenue still may remain in blockbuster territory for quite some time. Moderna's development of a combined flu/coronavirus vaccine candidate could become the next big product in this program. So, the coronavirus vaccine story isn't over.

The pipeline and ability to advance it

But I'm not looking at the coronavirus program as the main reason to buy Moderna for the long term. Instead, it's Moderna's entire pipeline and ability to move these projects forward that makes this company a good long-term option.

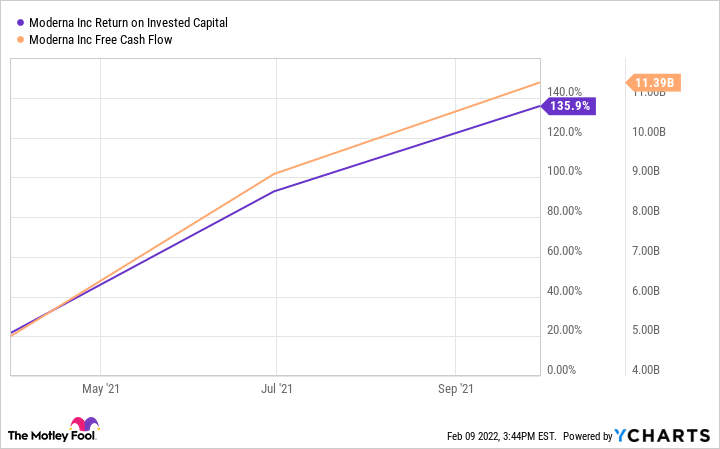

Moderna is generating an enormous amount of revenue right now -- and the company's cash position has been growing. Moderna's cash and equivalents totaled $15.3 billion as of Sept. 30. That's up from $5.2 billion at the end of 2020. At the same time, free cash flow and return on invested capital are on the rise.

MRNA Return on Invested Capital data by YCharts

All of this means Moderna can advance its pipeline and invest in outside programs. For example, Moderna just recently invested more than $45 million in Carisma Therapeutics Inc. to establish a cancer treatment collaboration. This involves using Moderna's mRNA technology along with Carisma's engineered macrophage technology -- these cells play a role in immune response. As part of the deal, Moderna can choose as many as 12 targets to develop and potentially commercialize.

Moderna's own pipeline offers many opportunities. The biotech has a total of 40 programs in development across various therapeutic areas. Some opportunities are right around the corner, while others may take shape in the long term.

The next blockbuster?

The next big product from Moderna may be a cytomegalovirus (CMV) vaccine. The company began a phase 3 pivotal trial this past fall. CMV is a common virus that can be particularly devastating for unborn babies and people with weakened immune systems. Right now, a CMV vaccine doesn't exist. Moderna has the possibility of entering the market first. And the company expects a potential vaccine to be a blockbuster.

As for the long term, investors should keep an eye on Moderna's work on HIV vaccine candidates. The company recently launched a phase 1 trial for one of these candidates. Many other companies have failed in this area. And HIV remains a major problem worldwide. More than 1.5 million people acquired the virus in 2020, according to UNAIDS.

So, Moderna's pipeline and its current financial strength put it in a great position to build its product portfolio -- and therefore its ability to continue generating blockbuster revenue in the future. And that means Moderna isn't a company that will deliver only as long as the coronavirus is around. Instead, this biotech player has what it takes to perform over the long term.