Sometimes, there's nothing better than owning a stock with a steady, growing stream of dividend payments. Especially if you are invested in a nontaxable account like a Roth IRA, these durable businesses can help provide you with life-changing wealth if you buy and hold them for many years.

While dividends are nice, they can be hard to find in the technology sector, with many companies either staying unprofitable or opting for share repurchases instead.

But not all technology companies avoid paying out dividends to shareholders. Here are three dividend-paying technology stocks to buy in February.

Image source: Getty Images.

1. Texas Instruments: 2.79% yield

The first company on the list is Texas Instruments (TXN +0.99%). Yes, this is the same company that makes those bulky graphing calculators for students, but that is only a tiny part of this $150 billion business. Texas Instruments is the leading manufacturer of analog semiconductor chips, mainly serving the automotive, industrial, and personal electronics industries.

Unlike the leading-edge semiconductor manufacturers (which we'll get to with the third company on this list), Texas Instruments has minimal competition and a defensible position, with tens of thousands of patents on different technologies.

Given the steadily rising demand for semiconductors around the globe, Texas Instruments has been able to grow its top and bottom lines at a healthy clip over the past decade. For example, in the fourth quarter of 2021, the company grew sales 19% year over year to $4.8 billion. Over the past 12 months, it generated $6.3 billion in free cash flow, up 15% year over year.

This free cash flow is what funds Texas Instruments healthy 2.79% dividend yield. Over the past decade, Texas Instruments' dividend payouts have grown tremendously, now at $4.21 a share over the past 12 months compared to under $1.00 back in 2010. If revenue and free cash flow continue to compound as they have in the past, the stock's annual dividend payouts will likely grow along with it.

TXN Dividend Per Share (TTM) data by YCharts

2. Visa: 0.66% yield

Most of you reading this will know Visa (V 0.70%), one of the two dominant digital payment rails along with Mastercard. Visa makes money by partnering with banks and credit card and financial technology (fintech) companies, taking a small fee on every transaction processed on its network. With the steady decline of physical cash payments and the rise of digital payments globally, Visa has ridden a nice secular tailwind over the last few decades.

There are no signs of this "war on cash" slowing down anytime soon. In the first quarter of fiscal year 2022, which ended in December, Visa did $7.1 billion in revenue, up 24% year over year. Growth in revenue was mainly driven by a 20% increase in payment volume around the world. Since Visa's network is extremely asset-light, most of its revenue falls directly to the bottom line. In the first quarter of 2022, the company had a best-in-class 66% operating margin, which shows how incredible Visa's business is.

With these outsized profits, Visa has started to return a healthy amount of money back to investors through dividends and share repurchases. This has mainly been through share repurchases, with $4 billion bought in the first quarter of fiscal year 2022 alone, but management has also consistently raised its dividend per share since instituting one a little over 10 years ago.

Visa's dividend yield right now is quite small, at 0.66%, but with a dividend per share that has grown substantially over the last decade, investors will likely be quite happy with Visa's dividend payouts over the next 10 years.

V Dividend Per Share (TTM) data by YCharts

Lastly, Visa stock is a perfect inflation hedge. Since the company takes a percentage of every transaction on its network, if overall payments volume rises due to inflation, Visa's revenue will grow along with it.

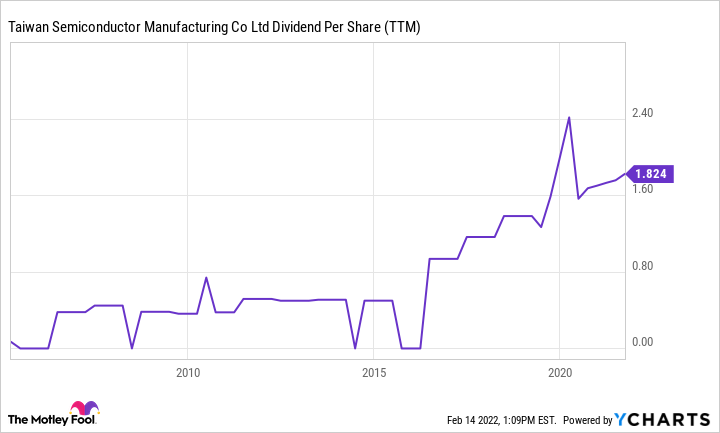

3. Taiwan Semiconductor Manufacturing: 1.24% yield

Taiwan Semiconductor Manufacturing (TSM +1.77%), or just TSM, is one of the largest companies in the world, with a market cap of $600 billion. The company is the largest manufacturer of semiconductors worldwide, focusing on the cutting-edge layer of chips for companies like Apple, Nvidia, and many others. Unlike an integrated manufacturer like Intel, TSM does not actually sell semiconductors to end customers but manufactures them based on designs outlined for them by companies like Apple and Nvidia.

This foundry strategy, as it is called in the industry, has led TSM to gain an impressive lead over competitors like Intel due to its massive scale and resources. The company has an estimated 54% share of the foundry market worldwide. Like Texas Instruments, TSM has been able to ride the global tailwind of semiconductor demand while also gaining market share over competitors like Intel, pushing the company to double-digit annual revenue growth over the last few decades. In the fourth quarter of 2021, TSM did $15.7 billion in revenue, up 24% year over year, with a 42% operating margin.

TSM Dividend Per Share (TTM) data by YCharts

TSM has a dividend yield of 1.24%, which likely could be a lot higher if the company still wasn't in a big investment phase. In 2022 alone, management expects TSM to spend $40 billion to $44 billion on capital expenditures.

While costly, this shows that TSM thinks there is a huge opportunity to reinvest for future growth in the coming years, which will hopefully drive revenue and profit growth as well. Once the company matures and spends less of its revenue on capital expenditures, TSM will likely start raising its dividend per share because of the excess free cash flow it will be generating.