Entertainment giant Walt Disney (DIS -1.01%) has had some bad luck over the past few years. The company spent $71 billion to acquire intellectual property from Fox, setting up Disney to launch its streaming service, Disney+.

However, the pandemic came shortly after and crippled Disney's business by shutting down its theme parks. That said, the company's 2022 first-quarter earnings have shown that Disney's getting back up to full speed. Here's what it could mean for investors moving forward.

Understanding COVID-19's impact on Disney

Disney+ gets all of the attention from investors these days, but don't overlook how vital Disney's theme parks are to its bottom line. The company's theme parks business did $26 billion in revenue and $6.7 billion in operating income in 2019, the year before the pandemic. To put it in perspective, operating income from the theme parks contributed 45% of Disney's total operating profits that year.

Image source: Getty Images.

Pandemic lockdowns forced the theme parks to shut down and eventually reopen at partial capacity; they only generated $455 million in operating income in 2020 and $471 million in 2021. Having the parks open but not at total capacity requires Disney to staff and run the parks, but they're not nearly as profitable. The significant drop in operating income has crushed Disney's free cash flow as seen in the chart.

DIS Free Cash Flow data by YCharts

What used to be $6 billion to $10 billion in free cash flow in a given year has fallen to less than $1.5 billion over the past year. Disney took on a lot of debt to help fund the Fox deal, probably intending to use its robust cash flow to pay it down. Unfortunately, the COVID-19 pandemic has pulled the financial rug out from under Disney.

Parks are coming back

The rebound in Disney's theme parks is arguably the most critical takeaway about the company's recent earnings for the first quarter of 2022. Disney's parks segment (Disney Parks, Experiences, and Products) did $7.2 billion in revenue. That's more than twice its revenue in the first quarter of 2021, and the increased traffic has also helped profitability return. Operating income for Q1 2022 was $2.4 billion compared to an operating loss of $119 million the year before -- and more than all of 2020 and 2021 combined.

Disney certainly isn't out of the woods yet; the company's free cash flow for the quarter was a negative $1.19 billion. The company is still spending money to keep guests safe from COVID-19 at parks while investing in marketing and programming for Disney+. Still, the company's revival of its parks is a welcome sign that Disney's financial woes since the pandemic may finally be ending.

Investors will undoubtedly want to see how free cash flow builds up over the remaining three quarters of 2022. Disney has plenty of cash on hand with $14.4 billion on the balance sheet. But its free cash flow will need to recover to pre-COVID levels if it wants to pay down its debt from the Fox acquisition.

It's still too soon

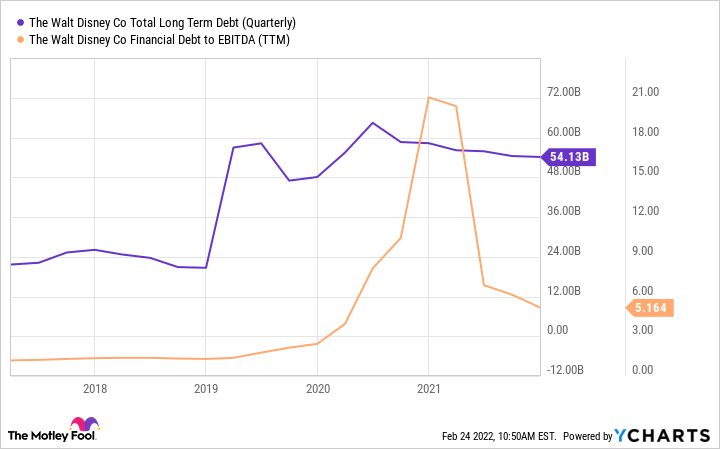

The company's bloated balance sheet remains my biggest concern with the stock; it hasn't progressed much since the Fox deal. Disney still has $54 billion in total long-term debt, more than double its 2019 amount. The company's debt-to-EBITDA (earnings before interest, taxes, depreciation, amortization) ratio, which measures debt against business profits before noncash adjustments, is still 5, as seen in the chart, which is a bit high and could limit the company financially until it improves.

DIS Total Long Term Debt (Quarterly) data by YCharts

It's great to see Disney's business coming alive, but there's still work to do. Meanwhile, the stock is trading at a price-to-sales (P/S) ratio of 3.6, higher than its historical average of 3.0 over the past decade. The stock market became frenzied and euphoric last year, and Disney's stock hit all-time highs, touching a P/S ratio of 6 in early 2021.

The stock is no longer so blatantly overvalued against its historical norms. Still, because its financials are much weaker than just a few years ago, it's hard to say confidently that the stock is a table-pounding buy today. The stock could head lower in today's chaotic market environment, but Disney's blue-chip entertainment content should ensure the business gets back on its feet in the long run. Interested investors can use dollar-cost averaging to build a position slowly.