Consumer products company Kimberly-Clark (KMB -0.87%) recently raised its dividend for the 50th consecutive year, a rare feat that only a handful of companies accomplish. The Kleenex maker offers investors a juicy dividend that yields nearly 3.6% on its current share price.

The stock can do wonders for investors looking for steady income, but there are near-term challenges that the company is working through at the moment. Let's see how safe Kimberly-Clark's dividend is and what investors need to monitor moving forward.

Image Source: Getty Images.

A reliable, defensive company

Companies generally need to have steady business models to be good dividend payers. Kimberly-Clark sells various paper household products like facial tissue, toilet paper, paper towels, diapers, and more, which consumers need and buy often.

You can see in the chart below how the company's revenue has remained pretty stable over the past four decades. Various tumults, like the 2008-2009 financial crisis and the COVID-19 pandemic, have had little effect on Kimberly-Clark's revenue. But to be fair, it's certainly not a growth stock, and the company's revenue has been stagnant for most of the past decade.

KMB Revenue (TTM) data by YCharts

The company will need to get back to positive revenue growth at some point but has used stock buybacks to help muster 3% annual earnings-per-share (EPS) growth for the past 10 years -- just enough to keep paying and raising its dividend.

Kimberly-Clark is now a Dividend King, having raised its dividend 50 consecutive times. The dividend yield is 3.6%, which is near the highest it's been over the past decade. The company's dividend payout ratio is currently high at 88% of cash flow, but inflation has dramatically suppressed Kimberly-Clark's profits; the payout ratio was between 60% to 70% before the pandemic. Investors should feel reasonably confident that the dividend is safe; management is likely aware of how important a Dividend King's payout is to shareholders.

Inflation is hurting the business

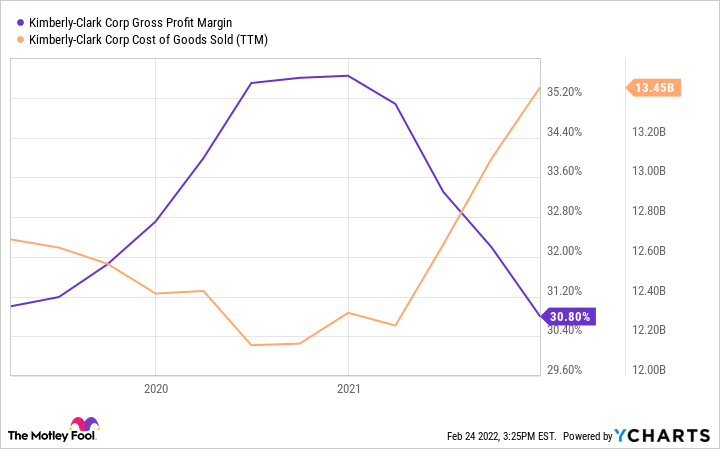

However, the company is working through some issues. Management just tied off fiscal 2021 by reporting fourth-quarter earnings. Kimberly-Clark reported a $530 million year-over-year increase in input costs due to rising commodity prices, and increasing distribution and energy costs. But operating profits fell just $228 million from Q4 2020 figures, so the rising input costs are masking what would have been growing profits. You can see the falling gross profit margins and the increasing cost of goods sold below.

KMB Gross Profit Margin data by YCharts

The challenges are likely to worsen in 2022; management is expecting input costs to increase another $750 million to $900 million, reducing the company's operating profits by a low- to mid-single-digit percentage.

Kimberly-Clark ultimately sells commodity products; there's no real difference between Kleenex and generic facial tissue. That limits its pricing power although management uses cost increases to offset some of its margin pressures.

Investors should approach with caution

If you're trying to generate income from your investments or have a dollar-cost averaging strategy, Kimberly-Clark should continue putting cash into your pockets. However, if you're concerned with a stock's total returns, looking for both dividend income and share-price appreciation, being a bit cautious right now may be a good choice.

The stock's averaged a price-to-earnings (P/E) ratio of 20.7 over the past decade but currently trades at a P/E ratio of 24. It's fair to argue that the company's earnings would be higher without the inflation challenges, but the stock seems fairly valued in a best-case scenario.

The stock may continue to struggle over the next few quarters because of the increasing input costs that Kimberly-Clark is projecting for this year. At that point, the stock may fall to a lower valuation that gives investors a bit more room for growth. Kimberly-Clark's low, single-digit revenue growth makes getting the valuation right a vital part of owning the stock.