Growth investing is losing momentum in the rapidly reopening world. There are many reasons why, including global political upheaval, rising interest rates, inflation, and a long stretch of skyrocketing valuations. Whatever the reason, investors have been moving their money out of riskier growth stocks and into safer blue chip stocks.

What does that mean for the growth investor? Despite the case for value investing in the current climate, and the need for diversification in every portfolio, there will always be investors looking for high-growth opportunities. At the same time, there are great, well-fortified businesses that can provide what growth investors are looking for, such as large market opportunities and new technology -- and, of course, the potential for high stock gains.

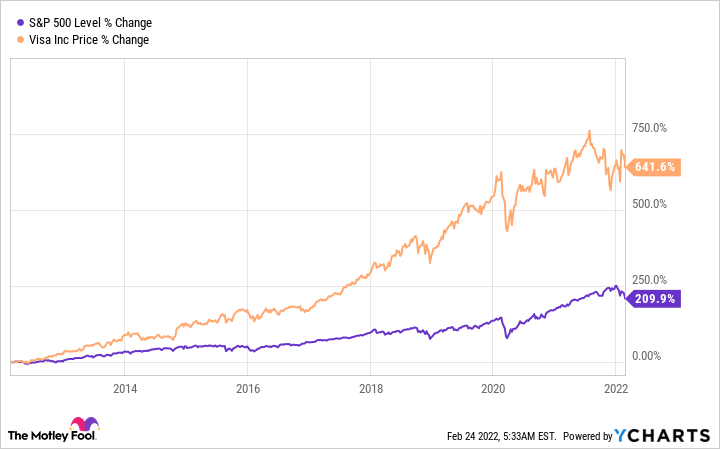

Growth investors should consider Visa (V 0.33%) stock, which has underperformed the broader market over the past year but has soundly outperformed it over time. Considering its dominance in its field and its branching into new areas of business, Visa stock has strong prospects -- and it may be undervalued at its current price.

Image source: Getty Images.

The father of fintech

Visa might seem ancient in the world of payments, but it hasn't been around for as long as you think. The payment processing network began operating in 1958 as an arm of Bank of America, and only went public in 2008. Its technology is really quite modern, and it's continually upgrading to match progress in payments.

It's also much more than a credit card processor, working with hundreds of partners to power all sorts of transactions, such as contactless payments and buy now, pay later plans. It recently acquired Currencycloud, a platform for simplifying cross-border payments.

At this point, Visa is the largest payments network in the world, enabling 3.6 billion global credits cards and processing $12.5 trillion in the 12 months ended June 30, 2021. It's accepted at more than 70 million merchant clients.

And although it seems everyone you know has a credit card, it's not like that in all parts of the world, leaving Visa with a significant addressable market for new volume. In Brazil, for example, a historically cash-based economy, revenue growth has been up 1.5 times typical growth levels in recent quarters. Visa is also embracing opportunities in cryptocurrency, and in the first quarter, crypto wallets had $2.5 billion in volume, or 70% of all volume in fiscal 2021.

A beacon of the broader economy

Visa's revenue declined at the beginning of the pandemic, when many shoppers put big spending on hold. But this strong company, which typically enjoys high margins from its low-cost business, posted profits throughout the declines.

It's now completely rebounded, and it posted a 24% year-over-year sales increase in the quarter ending Dec. 31 (the first quarter of its fiscal 2022) to $7.2 billion. Net income increased 27% to $4 billion, with earnings per share growing to $1.83. This is while parts of the world are still experiencing some pandemic-related restrictions and cross-border trade is still limited.

Visa's performance at any given time mostly mirrors the general state of the economy. When it's rough, people spend less, and Visa's sales reflect that. When the economy is strong, Visa is as well. Given that the economy is strong much more often that it's weak, Visa is a no-brainer stock to own and hold.

It also pays a dividend, which yields 0.68% at Monday's prices. That's well below the S&P 500 average around 1.4%, but the company has raised the dividend every year since it went public.

Stronger than the market it reflects

Even though Visa stock is trailing the S&P 500 over the past year, its stock has outperformed the S&P 500 over time, and as that time expands, the difference widens.

That makes it a strong growth contender despite displaying many signs of a classic value stock, including a mature, steady business, stable but low revenue growth rates, reliable earnings, and a dividend.

Visa stock has fallen lately as the market enters correction territory, and shares now trade at 36 times trailing-12-month earnings as earnings have improved. That's its lowest price-to-earnings ratio in a year and a half, although it's a fairly standard valuation for the company. It's lower than its closest competitor, Mastercard, which trades at a ratio of 41. Visa stock generally trades at a higher valuation than many traditional financial value stocks, which takes into account its fintech focus and positive prospects.

Given its market dominance, efficient business that almost runs by itself, new opportunities, and low valuation, Visa is a stock for anyone to consider, even growth investors.