The market for legal sports betting is booming. Market Consult reports that the sports betting market doubled in size in 2021, with Americans wagering more than $52.7 billion during the year.

It raises the question: Is now the time to invest in sports betting companies? And specifically, is DraftKings (DKNG 0.59%) a buy right now?

A Supreme Court decision has fueled the growth of sports betting

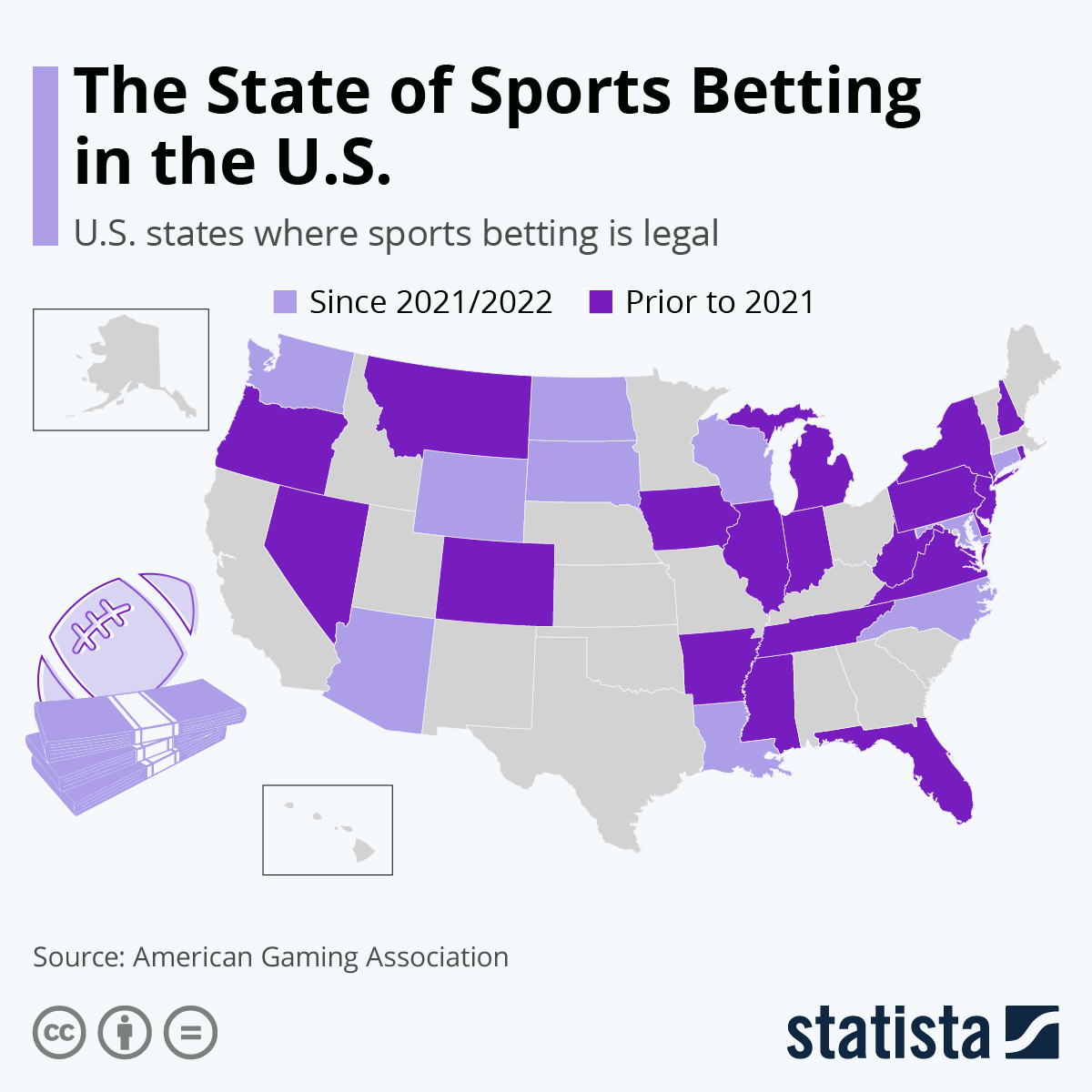

In 2018, the Supreme Court struck down the Professional and Amateur Sports Act. This cleared the way for U.S. states to set their own rules and regulations on sports betting. Over the last four years, many states have jumped on the bandwagon and legalized sports betting.

DraftKings, which went public in 2020, is one of the companies that has tried to capitalize on the increasing legalization of sports betting. The company has tried to parlay its brand as a well-known daily fantasy sports platform into being the go-to online sports betting venue.

However, the market for sports betting is a competitive one. FanDuel, long DraftKings' main competitor in the daily fantasy sports marketplace, is now its primary rival for sports wagering too. It's estimated that the two companies account for roughly 80% of U.S. sports wagering. But other competitors are circling. MGM, Disney (ESPN), and Bally's, among others, are showing interest in further expansion into the sports betting market.

MGM announced in January that BetMGM, its sports betting and iGaming product, generated net revenue of $850 million in 2021. Moreover, MGM has set a long-term goal of 20% to 25% market share in U.S. sports betting and iGaming, which will put pressure on Draftkings going forward. Others have found the market so cost-prohibitive, they're already pulling out. Former WynnBet (Wynn Resorts sports betting app) CEO Matt Maddox noted that "Competitors are spending too much to get customers; the economics are just not something that we're going to participate in."

Despite robust revenue growth, losses continue to pile up

DraftKings, like many growth stocks, is unprofitable. It's focused on growing revenue, shrinking its losses, and gaining market share from competitors. Unfortunately for DraftKings, this is proving to be a challenge. The chart below shows its yearly revenues compared to its earnings (or losses) before interest, taxes, depreciation, and amortization (EBITDA).

DKNG Operating Revenue (Annual) data by YCharts

As you can see, DraftKings is moving in the wrong direction. Revenues have grown to $1.3 billion, but its net losses have ballooned to ($1.4) billion. The company's marketing costs appear to be a big part of the problem. For fiscal year 2021, DraftKings reported $981.5 million in marketing expenses versus $495.1 million in 2020. Nevertheless, while analysts forecast 53% revenue growth in 2022, overall growth estimates are expected to decrease by 7% over the next five years.

Image source: Getty Images.

Draftkings is a sell for me

The chart of revenues versus earnings is one of my favorites. It's simple but also very telling. Ultimately, a stock only has value if the underlying business has value too. For that to happen, the company must produce profits -- or have a realistic chance of making profits in the future.

DraftKings isn't just losing money; it's doing so faster with each passing year. In the long term, that just isn't sustainable. Perhaps DraftKings can get disciplined and close the gap. But until then, I'd rather invest my money elsewhere.