Dividends are such a valuable financial tool; they can be reinvested to boost your investment returns, or you can use them to pay your bills and living expenses without selling any of your stock. Dividends come in all shapes and sizes, and U.S. telecom company Verizon Communications (VZ 1.17%) happens to offer a big one.

Buy shares today, and you'll receive five percent of your investment back each year as the company pays you every quarter. But a dividend is only reasonable to you if it's reliable; here is why you can take Verizon's dividend to the bank.

Reliable like a utility

Verizon is among a small group of companies that control the telecommunications industry in the United States. Its wireless network has roughly 115 million connections (some people may have more than one device connected). Verizon's services go beyond cellphones and include landline telephone and internet for consumers and businesses.

Image source: Getty Images.

Verizon's services are critical for how people interact with the world and one another. Advancements in wireless and internet technology have also brought Verizon further into people's daily lives, often supporting the streaming service you watch or connecting you to social media.

In other words, your phone and internet bills are almost household necessities, like the rent, electric, and grocery bills you pay. Verizon sits near the top of the average household budget, which means that the business is resilient through most economic situations.

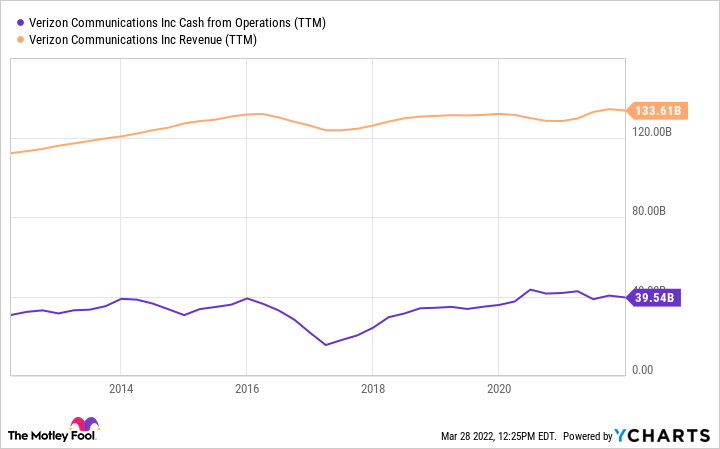

You can see in the chart below how Verizon's revenue is relatively steady without major changes. Revenue has only grown about 2% annually on average over the past decade, which means that Verizon is a slow-growing company. However, if you're focused on the dividend, the reliability of the business might make up for what it lacks in growth.

VZ Cash from Operations (TTM) data by YCharts.

Verizon produces billions of dollars each year in cash flow, which it uses to invest in maintaining and building cell towers and other equipment for its networks while giving most of what's left to investors as a dividend.

Strong financials support the dividend

The company's investments aren't always as predictable as its cash flow; they can fluctuate up or down. For example, Verizon is planning to spend almost $22 billion in 2022 because it's investing heavily in 5G technology. This amount could come down in future years as 5G networks become fully operational.

Maintaining a solid balance sheet becomes very important because of this. Verizon may strategically borrow to fund investments, and it has done just that. There is currently about $150 billion of long-term debt on the balance sheet, which sounds like a lot. But major credit bureaus like S&P hold "investment grade" ratings on Verizon's debt because of how reliable its revenue is.

VZ Payout Ratio data by YCharts.

It would be concerning if creditors downgraded Verizon, so investors should periodically check on how creditors rate Verizon's financials. The company discloses its ratings on its investor relations website, and a rating of "BB" or below from S&P would mean that Verizon's credit is no longer considered "safe."

Verizon can easily afford its payout, spending less than half of its profits on dividends. Again, Verizon is not a fast-growing company, so investors should expect the company to raise its dividend by about 2% each year (matching the revenue growth rate). What matters most for income-focused investors is that you can count on that 5% dividend yield.

Catalysts for future growth

I don't see Verizon growing much faster than it already is, but there are still reasons to be excited about the future. Numerous data-driven technologies are emerging like 5G, streaming, gaming, connected vehicles, and the internet of things (IoT) that should only increase how heavily Verizon's networks are relied on.

A company has more pricing power the more you need its products and services, so I expect Verizon to continue its slow and steady growth without much stress to investors. Increased demand will help support revenue growth, but Verizon should have some pricing power, even if there is competition from industry peers like AT&T.

Add everything up, and I think Verizon offers investors a 5% dividend yield that you can count on for the long term. Verizon's products and services are ingrained in its customers' daily lives and seem poised to become more so in the future. Yes, the business must spend heavily on equipment and towers, but those costs also keep other competitors out. As long as Verizon doesn't fall on its face, its 5% dividend yield seems as close to a slam-dunk as it gets in investing.