Spotify (SPOT 0.20%) is one of the leading audio streamers in the world. Spotify's extensive catalog of music and podcasts reaches hundreds of millions of users every month through both a paid subscriber model and a free-to-use ad-supported platform. Let's dig deeper by examining what two charts reveal about the company's fundamentals.

Image source: Getty Images.

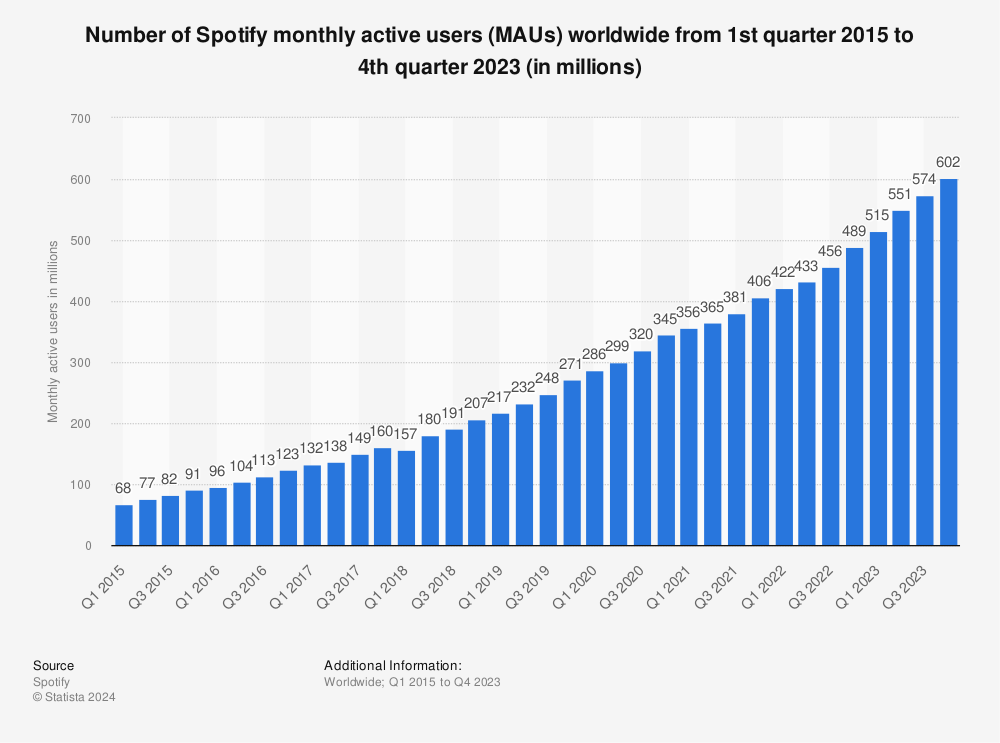

Monthly active users continue their steady rise

One key performance indicator for Spotify is its Monthly Active User (MAU) metric. Spotify has grown its MAUs in 27 of the last 28 quarters, stretching back to 2015. In the last year, Spotify grew MAUs from 345 million to 406 million -- a growth rate just shy of 18%. Spotify's MAUs are distributed evenly around the world, with 33% in Europe, 23% in North America, 21% in Latin America, and 22% in the rest of the world.

A revenue story in two segments

Spotify's revenue is divided between two segments: Premium and ad-supported.

Despite having grown revenues nearly tenfold over the last seven years, the ratio of segment revenue has remained more or less the same. In 2014, premium (paid subscriber) revenue made up about 91% of the company's total revenue. Last year, that figure was 88%. However, this ratio is bound to change for one reason: Podcasting.

Advertisers are keen to reach the large audiences attracted by popular podcasters. So Spotify developed ad insertion tools that allow advertisers to place ads throughout a podcast -- removing the need for the host to read the ad copy live. This innovation should allow Spotify to raise its ad rates, especially considering its exclusive deals with Joe Rogan and Michelle Obama. Spotify CEO Daniel Ek believes ad revenue will soon rise to 20%, and perhaps to 30% to 40% in another decade.

My verdict: It's a buy

Consider me a believer in Spotify. Its business model offers potential listeners a choice between ad-supported and premium, which gives the company flexibility in how it grows. It can raise subscriber rates but also boost revenue via ads.

Like most growth stocks, profits aren't the most crucial factor for Spotify right now. Nevertheless, I'm keeping my eye on them. Analyst estimates for earnings per share are $0.13 in 2022, rising to $1.28 in 2023. As an investor, I want to see the actual earnings live up to -- and hopefully surpass -- those estimates. Assuming Spotify can continue its impressive MAU growth and deliver on its goal of increasing its ad revenue, I think it has a great chance of success.