Share prices of Lululemon Athletica (LULU 0.72%) are currently down 22% from their all-time high, but the stock got a nice bounce following the release of its recent fiscal fourth-quarter earnings report late last month.

It's difficult to predict where the stock goes for the rest of the year, but if you have more than 10 years to allow an investment to mature, there's a lot to like about Lululemon as a growth stock. Let's look at two charts that should help investors visualize where the company (and stock) are headed over the long term.

Image source: Lululemon Athletica.

Gaining market share in e-commerce

Lululemon's e-commerce operation is second to none. Several years ago, the company made improvements to the online shopping experience, including implementing better photography of the product and offering an easier checkout experience, and it hasn't looked back. Lululemon's direct-to-consumer revenue, which is the term used by the company to reference its e-commerce business, comprised just 22% of total revenue in fiscal 2017 but now represents nearly half of the business.

In the fiscal year 2017 (which ended Jan. 30, 2018), direct-to-consumer revenue accelerated from flattish growth to 44% growth by Q4 that year. It's impressive that online sales are still growing at that level four years later. The company reported that digital revenue grew at an annualized rate of 50% over the last two fiscal years in the most recent quarter.

This chart shows Lululemon's e-commerce business growing much faster than the rate of global e-commerce -- a sign of the brand's strength. Between 2017 and 2021, global e-commerce grew at a compound annual rate of 20% to reach $4.9 trillion. It's expected to reach over $7 trillion by 2025, according to eMarketer.

Management sees more opportunities to get better. "Looking forward, we will fuel ongoing growth in both traffic and conversion by continuing to make foundational investments across our digital platform," CEO Calvin McDonald said during the fiscal Q4 earnings call with analysts.

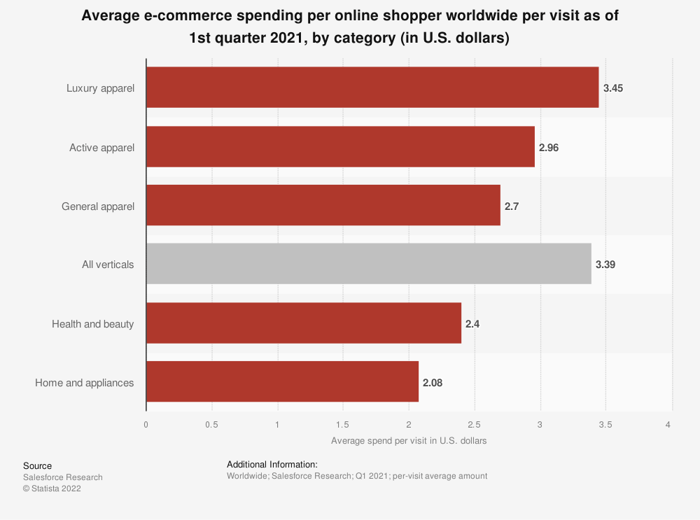

The next chart shows why Lululemon is gaining market share in the e-commerce market and why there is still so much opportunity to keep growing.

The intersection of fashion and athletic apparel

In the first quarter of 2021, luxury apparel and activewear were the top-two ranking categories in average e-commerce spending per online shopper per visit.

Fashion is expected to be the second-biggest spending category online in 2022. Why is this good news for Lululemon? Because Lululemon has pushed the athletic apparel industry forward by blurring the lines between fashion and activewear.

Nowhere is this more apparent than the brand's collection of high-end apparel with Lululemon Lab. These fashion-forward activewear styles help management test new ideas as it seeks to raise its brand profile in markets like Europe and Asia.

The combination of growth in online sales, which generate nearly twice the margin as the company's physical stores, and higher selling prices from its premium assortment translate to a very profitable business.

Over the last five years, Lululemon's operating margin has improved from the high teens to 22% and is currently trending higher. Operating margin improved slightly to 27.7% in the recent quarter, which is quite high in retail.

Stocks follow earnings over the long term. Strong top-line growth and higher margins have more than tripled Lululemon's earnings per share over the last five years, and the stock has followed suit. The stock can do whatever it wants in the near term, but over time, the compounding effect of the company's growth can deliver wealth-building returns.