Upscale home furnishings company RH (RH 0.11%) recently announced a 3-for-1 stock split. That news is providing some relief for the share price, which has been clobbered by the market recently. The stock is down about 53% from its all-time high, reached in August 2021.

The stock's downward trajectory runs contrary to the company's revenue trajectory, which grew 32% year over year in the fiscal 2021 fourth quarter, ending on Jan. 29. While growth is expected to slow in the next quarter due to inflationary headwinds and softening demand caused by the war in Ukraine, these are short-term issues that don't impact the company's intrinsic value.

Here are three reasons to consider buying shares right now.

Image source: Getty Images.

1. RH has a low valuation

The stock split is expected to take effect sometime this spring. Shareholders will receive three shares for every one share they own, and the stock price will be adjusted accordingly. At a recent quote of $357, the stock price would be $119 if the split went into effect then.

In a statement, the company said, "Although a stock split does not change the value of the company, we believe that a split should have a number of benefits, including the recruitment and retention of talent."

The most important reason to consider buying the stock before the split is RH's cheap valuation. Stocks follow earnings over time, but at these lows, investors don't have to pay much for RH's future growth.

The stock currently trades for 14 times this year's consensus earnings estimate. It was trading at nearly double that valuation just a year ago when the market wasn't nervous about war and inflation. All said, investors might be severely undervaluing the company's long-term prospects.

RH P/E ratio (forward). Data by YCharts. P/E = price to earnings; TTM = trailing 12 months.

2. RH has growth opportunities

RH is known as a high-end furniture brand. It operates across an integrated retail channel that includes large galleries, a website, and sourcebooks. But the company has greater ambitions.

Management wants to build RH into a lifestyle brand. This will potentially expand its addressable market from $170 billion for home furnishings to a market worth several trillion dollars.

It already has been successful with restaurants that are featured at its luxurious galleries across major cities. The average RH restaurant generates $10 million in annual revenue, but the company plans to expand into a wider ecosystem of services. This involves getting into real estate development, hotels (RH Guesthouses), and selling fully furnished luxury homes. This isn't expansion for growth's sake; there is a method behind the madness.

By offering a whole ecosystem of products, places, services, and spaces (The World of RH, as management calls it), it aims to form an emotional connection between the customer and the brand. That bond with the customer is at the root of all the great brands in history, from Coca-Cola to Apple.

How does this affect the stock price?

3. RH has rising margins

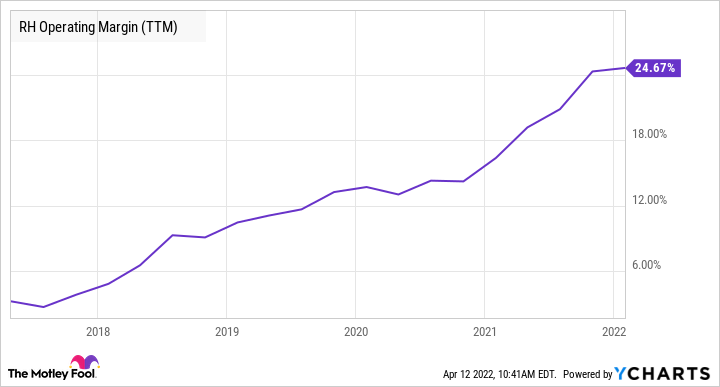

Furniture can be duplicated by competitors, but a lifestyle concept cannot. With its stellar operating margin, RH is already showing that it is offering value to the customer that is not found anywhere else. The company finished fiscal 2021 with a luxurious operating margin of 25%, up more than 10 percentage points from pre-pandemic levels.

RH operating margin (TTM). Data by YCharts.

While management expects fiscal first-quarter revenue growth to slow to between 7% and 8% over the year-ago quarter, investors are getting the chance to invest in an emerging global luxury brand at an incredible value. The low price-to-earnings ratio provides adequate compensation to investors for near-term headwinds caused by inflation and war.

Overall, RH has the right mixture of quality management, high margins, and a cheap valuation that makes the stock a great investment at these prices. The shares are up more than 600% over the last five years, but I believe more returns like this could follow.