Amazon (AMZN 0.58%) will report first-quarter 2022 earnings after the markets close on Thursday, April 28. The e-commerce giant thrived at the onset of the pandemic, when hundreds of millions of people relied on it to deliver essentials and nonessentials while cooped up at home.

As economies reopen, the sales boost is fading, and the pandemic is evolving into a headwind for the business. Supply-chain disruptions are causing shortages in everything from logistics to labor. Indeed, rising inflation could cost Amazon billions in the upcoming quarter. The recently announced stock split will do little to relieve the company from the headwinds when it reports results on Thursday.

Image source: Getty Images.

Rising costs are eating into Amazon's profits

In its fourth quarter of 2021, which ended Dec. 31, Amazon increased sales by roughly $12 billion from the same quarter the year before. The company generated a massive $137 billion in revenue. Impressively, that sales figure remained elevated despite economic reopenings worldwide. Consumers have significantly more choices on what to do with their time and money compared with last year. Amazon's sales increase shows that folks who tried the company during the pandemic appreciated the value enough to stick around even as brick-and-mortar businesses reopened.

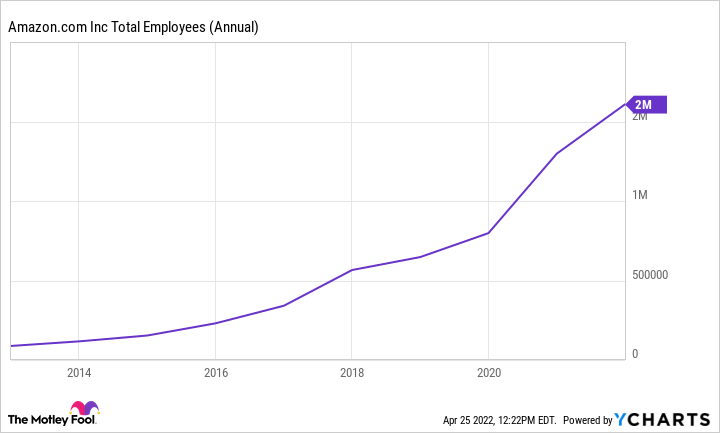

The biggest challenge that the economic reopening has created for Amazon is a competition for labor and shipping. While Amazon's sales increased by $12 billion year over year, operating expenses rose by more than $15 billion in Q4. Recall, at the beginning of the pandemic, businesses in directly impacted sectors like restaurants, hotels, and movie theaters laid off workers by the millions. That allowed Amazon to affordably hire the hundreds of thousands of additional employees it needed to fulfill surging customer demand.

AMZN Total Employees (Annual) data by YCharts

As business restrictions were removed, these venues started to hire employees back by the millions. The competition for labor is raising wages, and Amazon has announced several wage increases and bonuses to secure sufficient labor to fulfill demand. After all, it's not an easy task delivering on over $100 billion in sales every quarter. Management expects the headwinds to persist into 2022 and has forecast falling operating income in Q1. More specifically, Amazon has forecast an operating income of $3 billion to $6 billion.

If it hits that target, it would be a substantial decrease from the previous year, when the company earned $8.9 billion in that period. The decline is expected even though Amazon says sales will increase between 3% and 8% in Q1.

What this could mean for Amazon investors

Analysts on Wall Street expect Amazon to report revenue of $116.29 billion and earnings per share (EPS) of $8.13. If the company meets those projections, it will represent an increase of 11.3% and a decrease of 48.5%, respectively, from the same period a year earlier. Investors typically shy away from companies with rising costs and slowing growth, and Amazon has not been an exception. The stock is down 14% year to date in 2022.

To change the sentiment in the stock, Amazon needs to continue delivering excellent growth in its more profitable business operations: Amazon Web Services (AWS) and advertising. These two segments are more profitable than e-commerce sales with its high fulfillment costs. If Amazon can sell investors on the prospects of AWS and advertising, it might be enough to turn the stock around in 2022.