With many companies sending their employees back to the office as pandemic worries ease, investors may be wondering how the companies that enable remote work are doing. The stock prices for many of these companies may not look promising at the moment, but the actual businesses for some are doing quite well.

Take Zoom Video Communications (ZM 0.83%), for example. Even in the fourth quarter of its 2022 fiscal year (ending Jan. 31), the communications technology company still posted quarterly revenue growth of 21% year over year. However, its stock is down more than 82% from its all-time high and 75% from its 52-week high.

Is Zoom Video worth consideration as a falsely maligned growth stock? Is the stock's outlook permanently damaged despite its non-stop growth?

Image source: Getty Images.

Profitable and dirt cheap

Zoom isn't like a lot of other young and growing tech companies; it's fully profitable from a generally accepted accounting principles (GAAP) standpoint. In fiscal 2022, Zoom produced $1.4 billion in net income on $4.1 billion of revenue. That's a solid 34% annual profit margin; many companies would be thrilled with that number. Moreover, when assessed from a quarterly standpoint, Zoom's profit margin has only gone up.

ZM Profit Margin (Quarterly) data by YCharts

Should Zoom maintain its latest 46% profit margin for the entire year, it will rank among the highest profit margins of large-cap public companies.

However, the market doesn't believe it can maintain its current margins for the year. This sentiment is reflected by its relatively dirt-cheap valuation.

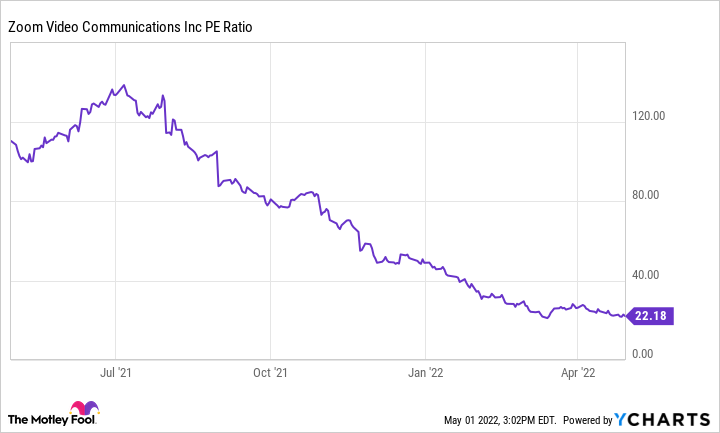

ZM PE Ratio data by YCharts

A price-to-earnings (P/E) ratio around 22 for a growing tech company is absurdly cheap unless the consensus is that it won't be able to maintain its margins or growth.

Despite what the market thinks, management seems to have an upbeat look for fiscal year 2023.

Management plans to capitalize on its cheap stock

Based on management's guidance, it believes fiscal year 2023's revenue will be between $4.53 and $4.55 billion, representing 11% growth at the midpoint. In addition, non-GAAP (adjusted) earnings will be around $1.44 billion, or a 32% margin. With these predictions, Zoom stock trades for 20.7 times forward earnings.

That's a pretty cheap stock, regardless of the sector.

Management recognizes this and has approved a $1 billion share buyback plan. With more than $5.3 billion in cash and marketable securities, this repurchase plan won't be much of a drain on its financial resources. Additionally, Zoom generated $189 million in free cash flow last quarter, so it can quickly replenish the money it will spend on the repurchases. Zoom could repurchase more than 3% of its total market cap if the company executed its repurchase plan this quarter.

Investor takeaway

These are good reasons to get into the stock, but will the company meet its expectations? Zoom will likely see some customers leave, as there is no reason to have a video conferencing platform if everyone is working in-person. However, most of its customers -- including those with the biggest accounts -- have employees working in multiple locations or are letting their employees work remotely as a flexibility option. These companies won't be able to cut their Zoom subscription as they will still need to accommodate a hybrid work environment.

By purchasing the stock now, you are betting the company will maintain its customers, which is why the market is giving you the stock at a deep discount. However, there is a risk that Zoom will lose many customers and never return to growth mode.

If they didn't know its name, many investors would be enthused to own a stock growing at an 11% pace valued at 21 times forward earnings. However, because it is Zoom Video, it's associated as the chief pandemic stock and is shunned by many investors.

Sentiment cannot ignore business execution forever. If Zoom Video can kick-start its business again with higher growth after its difficult year-over-year comparisons fade, it will become an outstanding stock. I'd use the current market weakness to get in on a tremendous long-term stock with customers that are essentially locked in for life.