Garbage and environmental services company Waste Management (WM -0.03%) is an excellent example of a company that you can buy stock in and sleep well at night. It's a market leader in a straightforward industry. The company is also good to shareholders, paying a dividend that management has increased for the past 18 years and counting.

So why would the stock be a terrible investment today? Unfortunately, a company can be a world-class organization but an awful investment if the price doesn't make sense. Here is why Waste Management's valuation stinks today.

Image Source: Getty Images.

Your trash is someone else's profits

Waste Management serves more than 20 million residential, commercial, and industrial customers across North America. It generates revenue through waste collection services, landfills, recycling, and more. The company made almost $18 billion in revenue in 2021.

You can see below how consistent Waste Management is, generating more revenue and free cash flow each year. Revenue's grown 3% annually on average over the past decade, while earnings per share (EPS) has risen 8% annually thanks to share repurchases.

WM Revenue (TTM) data by YCharts

Waste Management won't blow you away with rapid growth, but the company is a reliable grower that should steadily create wealth for decades. Taking market share from smaller competitors and the occasional acquisition could maintain growth over the long term.

A steep price tag

Over the past year, the stock market has become very volatile. Many nervous investors have flocked to "safe haven" stocks of defensive businesses that can thrive through a potential recession.

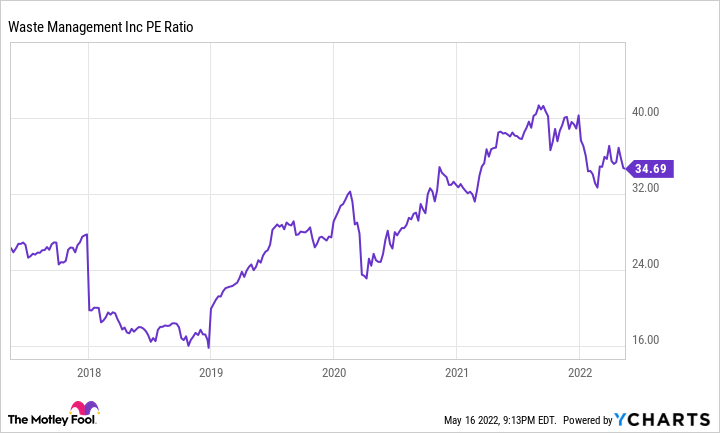

Waste Management's increased demand from investors is pushing the valuation higher. The stock's current price-to-earnings ratio of nearly 35 is twice its median P/E ratio over the past decade (17).

WM PE Ratio data by YCharts

A stock with a higher valuation needs to justify its higher price, or the fundamentals will eventually pull it back down. In other words, does Waste Management deserve to trade at twice its "normal" valuation?

Subpar investment returns looming

Waste Management's growth could pick up; analysts expect EPS to grow 10% per year on average for the near future, a solid uptick from its average over the past decade (7%). Still, I find such an increased valuation hard to swallow.

Investors have two potential scenarios here: First, the company could slowly grow into its premium valuation over time. This could mean a period where Waste Management is "dead money," stagnant while EPS growth catches up to the stock price. Or, the market could quickly correct the valuation; for example, investors could begin flocking out of defensive stocks and returning to growth.

Both scenarios seem likely to disappoint investors. If you ignore valuation, Waste Management's 7% to 10% EPS growth and dividend (its current dividend yield is 1.6%) make the stock a solid investment with the potential for low-double-digit total annual returns. However, the stock's hot valuation means that shares may need to fall as much as 50% from here to have a shot at achieving that.