Broadcom (AVGO -1.49%) is a chip company that has traditionally thrived on customer relationships. These partnerships have led to innovative products, such as the wi-fi hotspot built into Apple's iPhones and Alphabet's artificial intelligence chip.

Now, Meta Platforms (META 0.60%) will become Broadcom's next billion-dollar customer, according to JPMorgan analyst Harlan Sur. The Facebook parent company reportedly plans to use custom chips made by Broadcom to power its metaverse applications. While this alliance should benefit both companies, the question for investors is: Which metaverse stock holds more potential to drive higher investor returns?

Image source: Getty Images.

Broadcom and Meta

The Broadcom and Meta alliance is the latest example of software and hardware providers entering each other's businesses. However, Broadcom focused exclusively on semiconductors until recently. It thrived on heavy research and development spending, applying this research by employing engineers near major clients to work with its customers to develop custom chips. Now, it hopes to bring its semiconductors into the metaverse through Meta.

Additionally, it entered the software business in 2018 amid a down cycle in the chip business, buying CA Technologies and Symantec's enterprise security business. It also hopes to make software account for nearly have its revenue with a proposed purchase of VMWare.

As for Meta, it built its initial business on software. The company popularized social media with the masses via Facebook and later took over Instagram and WhatsApp. Eventually, it developed a user base of about 2.9 billion daily users across all its platforms.

Still, it has pushed a more hardware-based approach in the metaverse, buying Oculus and trying to integrate its suite of VR goggles. Meta has also partnered with Ray-Ban to develop smart glasses. Though the Broadcom alliance does not put Meta directly in the semiconductor industry, it will take a more active role in working with custom hardware to strengthen its offerings.

How the financials compare

Despite struggles for both stocks lately, they continue to drive significant growth. In its fiscal second quarter (which ended May 2), Broadcom generated $8.1 billion in revenue, a 23% increase versus its year-ago quarter. That outpaces the 19% increase so far for fiscal 2022 and the 15% increase in the last fiscal year.

The Q2 results also led to earnings of almost $2.6 billion, a 73% increase over the same period. The company achieved this growth by limiting the cost of revenue increase and slightly reducing operating expenses.

This appeared to outperform Meta despite a slightly different ending time for the quarter. In the first quarter, Meta's $27.9 billion in revenue rose 7% versus Q1 2021, well below the 37% revenue increase for 2021.

Net income dropped 21% to just under $7.5 billion over the same period. The increase in both cost of revenue and operating expenses dramatically outpaced its revenue growth.

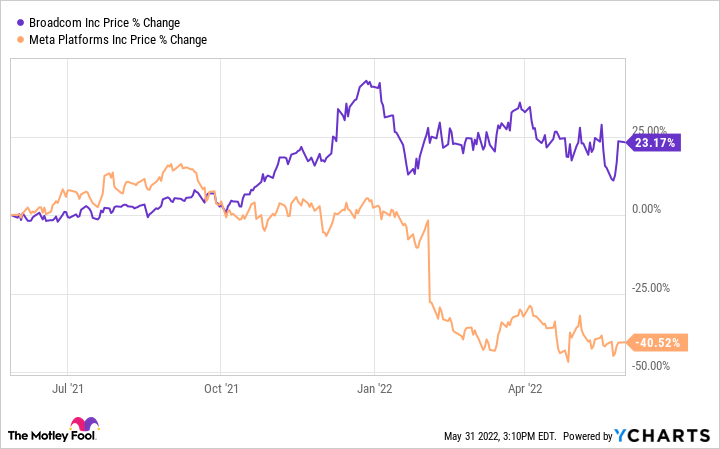

Broadcom's stock also significantly outperformed the Facebook parent. Meta's sagging chart has made many investors wonder whether the stock will rebound anytime soon. Broadcom's gains do not include the company's dividend, which has risen every year since the former Avago Technologies introduced a payout in 2010. Shareholders now receive $16.40 per share annually, a cash yield of about 2.8%.

Still, Meta offers significant advantages. Broadcom supports a price-to-earnings (P/E) ratio of 29 versus 15 for the Facebook parent. Even with Broadcom's more robust performance in recent months, the lower P/E ratio and the aforementioned discount may prompt some buyers to choose Meta. Additionally, its $44 billion in liquidity versus only $9 billion for Broadcom could strengthen the case for the Facebook parent.

Broadcom or Meta?

Although both companies stand a significant chance of profiting from the metaverse in the long term, the path appears more certain with Broadcom. Broadcom's hardware-based deal with Meta is a proven strategy that has succeeded with other companies. Moreover, a history of consistent earnings growth and dividend increases provides a predictable path to outsized growth.

Admittedly, Facebook's cash hoard, ownership of Oculus, and massive user base give it a significant chance to succeed. Nonetheless, it is in the midst of a fundamental transformation. While meeting its goals could lead to higher returns than Broadcom, it cannot guarantee if or how much its strategy will succeed. In other words, Broadcom looks like a safer bet than Meta today