Streaming giant Netflix (NFLX -0.63%) alluded to an ad-supported product in its first-quarter earnings call, implying a break from the company's historical insistence on subscription billing.

You need eyeballs to make money from advertising, which could be why the battle for streaming rights to live sports is heating up across the industry. Reportedly, Netflix has entered the bidding for streaming rights to Formula One racing, building on industry developments like Amazon's partnership to stream NFL games.

But live sports broadcasting is ruthlessly competitive, and investors should consider whether Netflix can emerge victorious or if live sports may threaten its leadership in streaming.

Live sports cost big dollars

Professional sports are a staple of culture in the United States and worldwide. The leagues are worth billions; the athletes are celebrities; fans spend big on apparel and tickets; and large audiences attract advertisers, fueling the success of this enormous industry.

Media companies continue shelling out record amounts of money for the rights to broadcast sports and advertise to the millions of people who tune in to watch them.

The National Football League (NFL) renewed its media deal in 2021, inking a deal worth $100 billion. This includes the $1 billion Amazon is paying annually to stream Thursday Night Football, which is essentially one game weekly.

Apple just signed a deal to stream Major League Soccer (MLS), a deal worth $2.5 billion over 10 years. Walt Disney pays $1.4 billion annually to put National Basketball Association (NBA) games on ABC and ESPN, and that's likely to increase in a few years.

Netflix is reportedly battling Disney, Comcast, and Amazon for rights to Formula One racing, and a deal could cost the winner more than $100 million annually.

Can Netflix outspend the field?

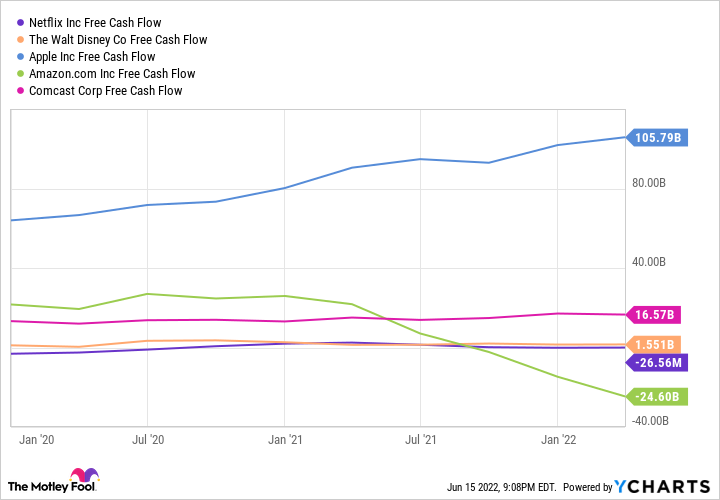

Netflix might find itself as the underdog in the sports field. You can compare Netflix to its streaming rivals below and see it is the smallest fish in the group as far as balance sheets go. Even with $6 billion of cash on hand, it has the smallest war chest at its disposal.

Data by YCharts.

So it's not clear that Netflix is ready for a bidding war of this scale. Beyond its cash on hand, the company is barely free-cash-flow neutral as it is, and its spending habits already stir up some long-term questions about the company. Meanwhile, competitors have legacy businesses that generate billions in free cash flow to support the growth of their streaming libraries.

Data by YCharts.

Perhaps it will land something smaller like the reported Formula One rights, but investors probably shouldn't expect that to make as big a difference as NFL or NBA games would. The average Formula One event drew 934,000 U.S. viewers in 2021, while viewership of Thursday Night Football typically surpasses 14 million each week.

Investor takeaway

The rise of ad-supported streaming is sparking a war for live sports content that Netflix has primarily sat out to this point. The company may have been a first-mover in the industry, but it's starting from behind in this case.

Any additional spending may put financial pressure on a business that doesn't have very much cash profits, and this is amid an existing backdrop of pricing pressure. Netflix is among the most expensive streaming services, and the lack of sports content might not help persuade viewers to pay more.

Ultimately, the streaming landscape seems up in the air right now. The uncertainty likely has to do with Netflix stock falling more than 70% from its high. Maybe investors will eventually look back at these challenges and see what was an opportunity in hindsight. On the other hand, investors must take a leap of faith that doesn't guarantee a happy landing.