McDonald's (MCD -0.42%) and Chipotle Mexican Grill (CMG 6.33%) are both experiencing robust revenue growth as the economic reopening gains momentum. The two suffered when governments restricted in-person dining in the earlier stages of the outbreak. As billions of folks have vaccinated against COVID-19, they are unleashing pent-up demand to eat out.

Given their excellent performance, investors might look at McDonald's and Chipotle to determine which is the better stock to buy now. To answer that question, let's look at their results, compare valuations, and pick the better stock to buy.

Chipotle knocks Q2 out of the park

In its most recent quarter, which ended on June 30, Chipotle reported a revenue increase of 17%. Comparable store sales, which only counts stores open for at least 12 months, increased by 10%. Chipotle also added 42 new restaurants in the quarter.

Moreover, Chipotle's earnings per share increased to $9.25, up from $6.60 in the same quarter the year prior. The company said in-restaurant sales jumped by 36%, while digital sales fell to 39% of the overall total. As you might imagine, people are out more often, creating more opportunities to stop by a Chipotle in person. Management says the excellent results will continue through the next quarter, with sales expected to increase close to double digits. The stock was up 14% on the day following the earnings announcement.

McDonald's second quarter was not too shabby

In its second quarter, which ended on June 30, McDonald's revenue decreased by 3%. The company was hampered by a few discrete items impacting comparability. McDonald's sold its operations in Russia, which lowered revenue. Currency price fluctuations were another headwind. Comparable store sales for the Golden Arches were up by 9.7%.

Like Chipotle, McDonald's has been thriving since economic reopening gained momentum. The company's revenue jumped by 21% in 2021. Meanwhile, its earnings per share of $10.04 were by far the highest in its last decade. Also, McDonald's has built a digital sales channel, including orders for delivery, that consumers love.

McDonald's is the better buy right now

CMG Revenue (Annual YoY Growth) data by YCharts.

While McDonald's revenue growth has come back to life since 2021, Chipotle has more consistently expanded the top line over the longer term. It's likely that after the boost in the aftermath of COVID-related lockdowns, McDonald's may sustain healthy revenue growth. Still, it's more likely it will settle into a slower rate after consumer behavior normalizes.

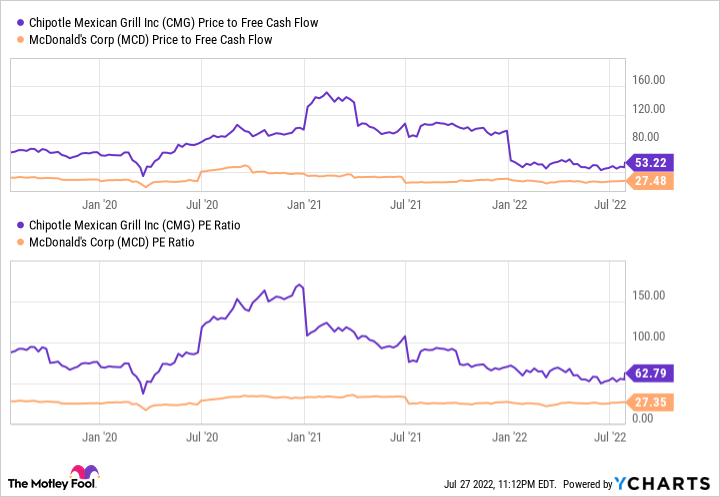

CMG Price to Free Cash Flow data by YCharts.

That said, Chipotle's better top-line prospects are priced into its stock. It's trading at more than twice the premium to McDonald's when measured by the price-to-earnings and price-to-free-cash-flow ratios (see chart above). Therefore, if you had to pick one stock to buy, it should be McDonald's. In my opinion, Chipotle's premium over McDonald's is not justified by its near-term performance.