The home improvement industry might be ground zero for investor worries about a potential recession ahead. Mortgage rates are climbing, and demand could slow sharply considering how much spending consumers allocated in that space in the past two years. Other sectors like e-commerce and home furnishings, for example, are going through a painful growth hangover today.

Those risks help explain why Home Depot (HD 2.18%) stock is one of the worst performers in the Dow Jones Industrials index through early September, down about 30% so far in 2022.

Investing isn't about focusing on the next few quarters, though, which will likely be rough for the home improvement leaders. Let's look at whether investors can safely tune out the upcoming volatility when considering buying the stock right now.

Home Depot is a world-class business

Home Depot has all the hallmarks of a business with major, enduring competitive advantages. Its annual sales more than doubled since the last cyclical downturn in the housing market, jumping to $151 billion last year from $66 billion in 2010. Home Depot steadily won market share in an expanding industry over that time.

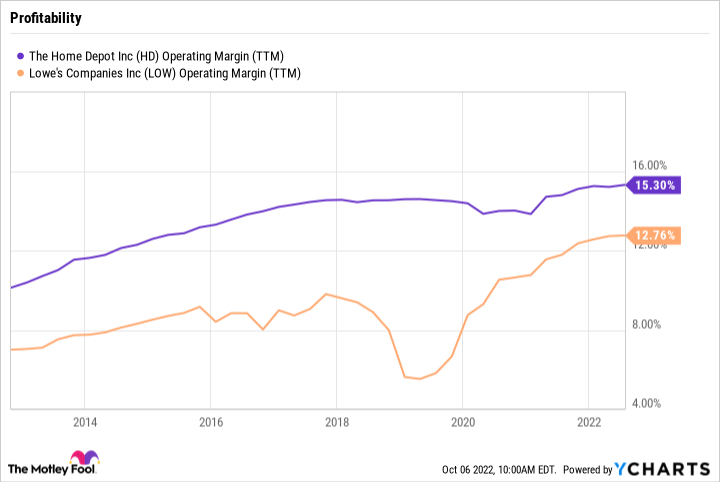

Its financial metrics are just as impressive. Cash flow, return on invested capital, and earnings growth are all stellar. Operating profit margin consistently trounces industry peers, too.

HD Operating Margin (TTM) data by YCharts

That track record should be enough for investors to conclude that Home Depot will almost certainly emerge from any demand slump as a stronger business, just as it has many times before. Yet there's one major risk to that outlook.

An era of rising rates

The problem is that a prolonged period of high or rising interest rates could disrupt Home Depot's momentum in a fundamental way. The housing market might be weak for a while, considering how quickly it expanded in recent years with the help of historically low borrowing costs. Those costs spiked, along with home prices, stressing consumers' budgets.

Home Depot has so far maintained its growth rate through this pressure, in part because much of its business is focused on professional contractors. Lowe's, which caters more to do-it-yourself customers, saw a sharper growth slump. That's a point in Home Depot's favor in protecting against any upcoming slump, but it doesn't mean the market leader will be immune to a wider industry pullback.

Why buy Home Depot stock

The trade-off between risk and reward still seems to favor long-term owners of this stock. While Home Depot might be in for a tough period ahead, it isn't in danger of losing its industry leadership position. Cyclical downturns are a natural part of its business, after all, and it sailed through previous ones in the past.

Assuming a slump does occur, investors can patiently hold the stock while they wait for the inevitable industry rebound. They can choose to reinvest in Home Depot's regularly rising dividends, too.

And, while the short term looks riskier now than it did during the pandemic's early days, Home Depot's stock valuation is also unusually low. An investor can own shares for less than two times annual sales today, which has only been possible a few times over the last decade.

There's always a chance that Home Depot's valuation will sink further. But investors shouldn't let a few percentage points of extra potential gains keep them from owning an excellent business like this.